Get the free NET INTEREST INCOME AFTER

Show details

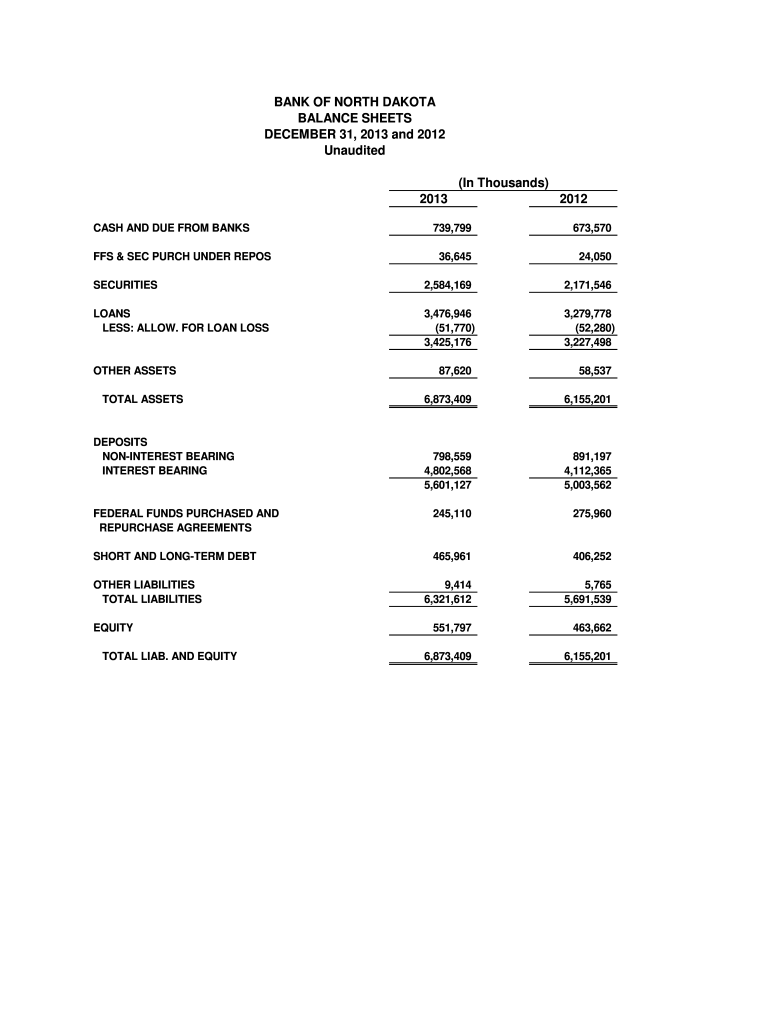

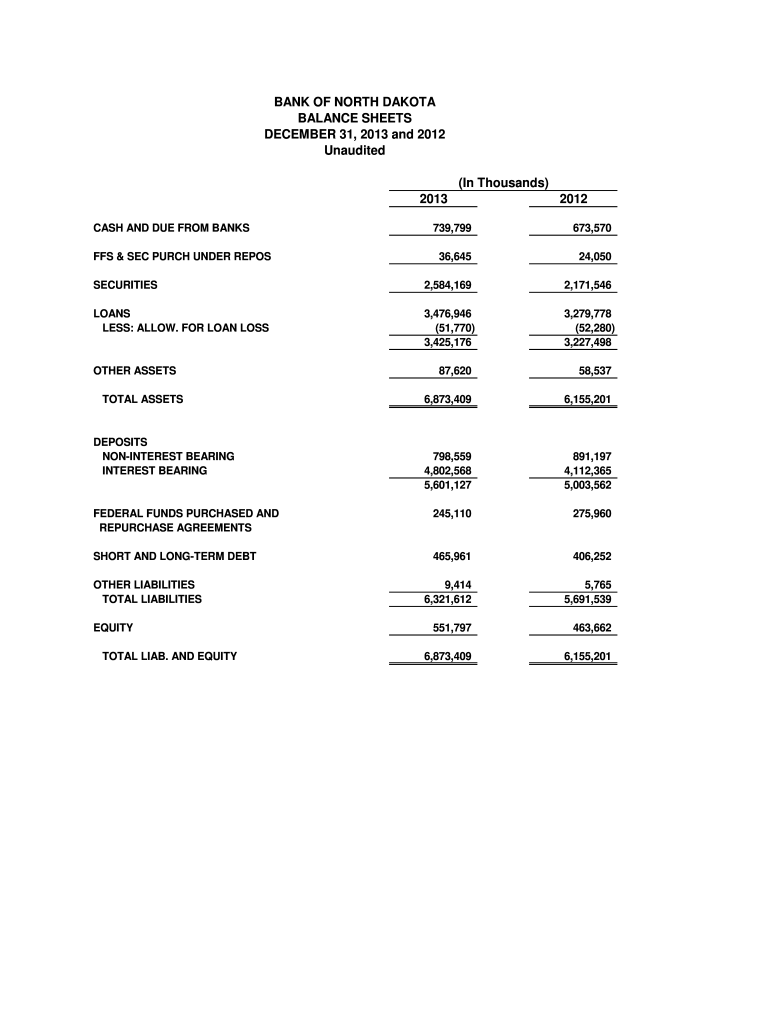

BANK OF NORTH DAKOTA BALANCE SHEETS DECEMBER 31, 2013, and 2012 Unaudited (In Thousands) 2013 CASH AND DUE FROM BANKS2012739,799673,57036,64524,050SECURITIES2,584,1692,171,546LOANS LESS: ALLOW. FOR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign net interest income after

Edit your net interest income after form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your net interest income after form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing net interest income after online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit net interest income after. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out net interest income after

How to fill out net interest income after

01

To fill out net interest income after, follow these steps:

02

Gather all the necessary financial data related to interest income and interest expense.

03

Calculate the total interest income earned during a specified period, such as a fiscal year or a quarter. This includes any interest received from loans, investments, or other interest-bearing assets.

04

Calculate the total interest expense incurred during the same specified period. This includes any interest paid on borrowings, deposits, or other interest-bearing liabilities.

05

Subtract the total interest expense from the total interest income to get the net interest income.

06

Record the net interest income in the appropriate financial statement or report, such as the income statement or the statement of comprehensive income.

07

Review and validate the calculations to ensure accuracy.

08

Update the net interest income figures regularly to reflect changes in interest rates, loan portfolios, or other relevant factors.

09

Use the net interest income figures for analysis, performance evaluation, and reporting purposes.

Who needs net interest income after?

01

Net interest income after is relevant to various individuals and entities, including:

02

- Banks and financial institutions, as it is a key measure of their profitability and the effectiveness of their interest rate management.

03

- Investors and analysts, who use it to assess the financial health and performance of banks and other companies in the financial sector.

04

- Regulatory authorities and government agencies, as it helps them monitor and regulate the banking and financial industry.

05

- Researchers and academics, who study the impact of interest rates and banking activities on the economy.

06

- Business owners and managers, who analyze net interest income after to make informed decisions regarding borrowing, investing, and financial planning.

07

- Individuals and households, as it can affect the interest earned on their savings, loans, and other financial transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get net interest income after?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the net interest income after in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I fill out the net interest income after form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign net interest income after and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit net interest income after on an iOS device?

Create, modify, and share net interest income after using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is net interest income after?

Net interest income after refers to the income earned by a financial institution after subtracting interest expenses from interest income. It is a key measure of a bank's profitability.

Who is required to file net interest income after?

Financial institutions, such as banks and credit unions, are required to file net interest income after as part of their financial reporting and regulatory compliance.

How to fill out net interest income after?

To fill out net interest income after, organizations must calculate the total interest income earned and subtract the total interest expenses incurred. This information is then reported in the financial statements.

What is the purpose of net interest income after?

The purpose of net interest income after is to provide insight into a financial institution's profitability and efficiency in managing its interest-earning assets and interest-bearing liabilities.

What information must be reported on net interest income after?

Net interest income after must report total interest income, total interest expenses, and the resulting net interest income figure.

Fill out your net interest income after online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Net Interest Income After is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.