RI EXO-APP free printable template

Show details

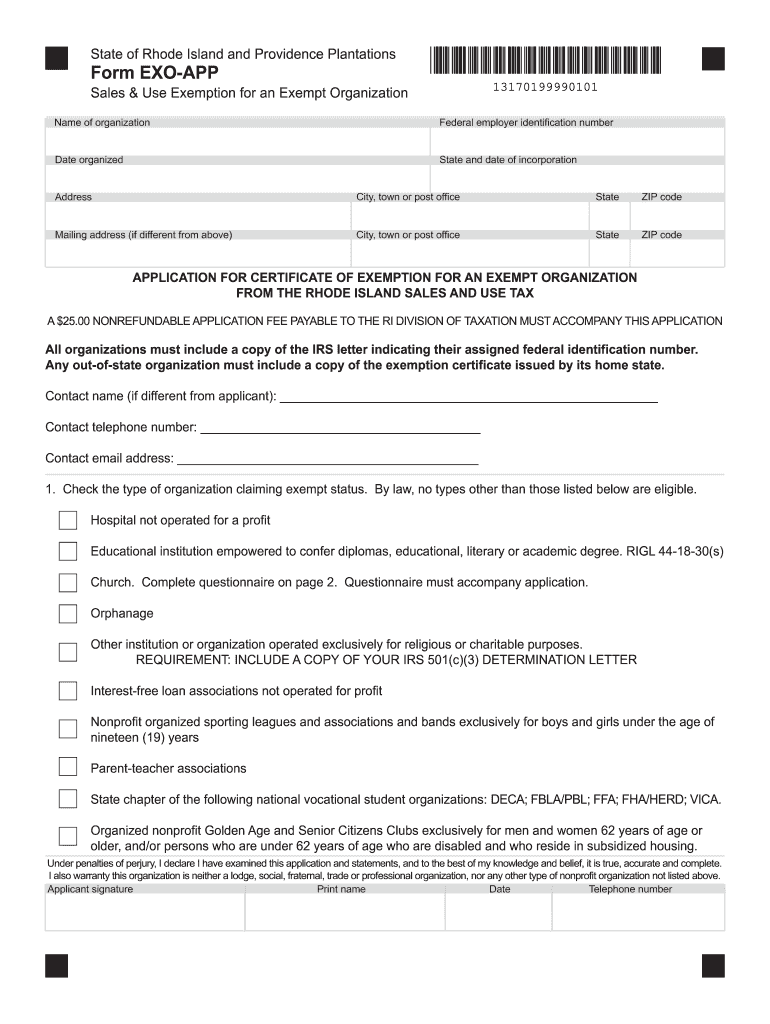

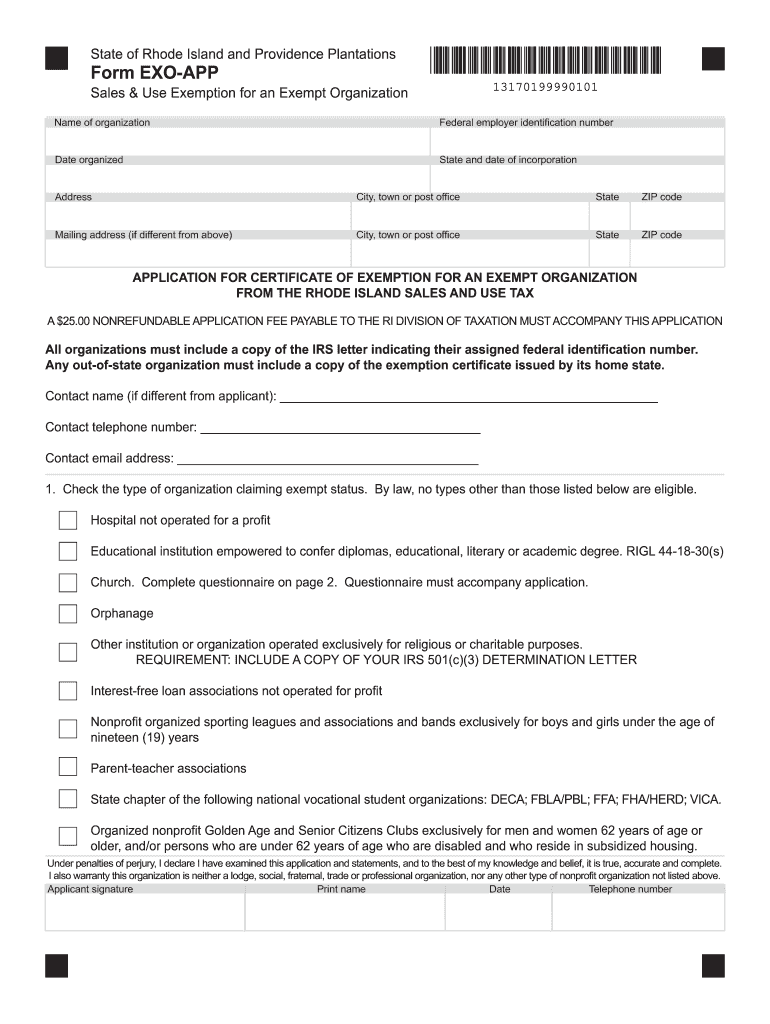

State of Rhode Island and Providence Plantations Form EX-COP 13170199990101 Sales &? Use Exemption for an Exempt Organization Name of organization Federal employer identification number Date organized

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign RI EXO-APP

Edit your RI EXO-APP form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your RI EXO-APP form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing RI EXO-APP online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit RI EXO-APP. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out RI EXO-APP

How to fill out RI EXO-APP

01

Obtain the RI EXO-APP form from the official website or designated office.

02

Read the instructions thoroughly before starting to fill out the form.

03

Fill out your personal information including your name, address, and contact details.

04

Provide any relevant identification numbers or social security numbers as requested.

05

Complete the sections that require specific details about your situation or application purpose.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the application as required.

08

Submit the form either electronically or by mail to the appropriate address.

Who needs RI EXO-APP?

01

Individuals applying for specific benefits or services that require the RI EXO-APP.

02

Residents needing to update their personal information with state services.

03

Residents seeking eligibility for programs administered by the Rhode Island government.

Fill

form

: Try Risk Free

People Also Ask about

What items are tax-exempt in Rhode Island?

What purchases are exempt from the Rhode Island sales tax? Clothing. EXEMPT. Groceries. EXEMPT. Prepared Food. 8% Prescription Drugs. EXEMPT. OTC Drugs. 7%

Who qualifies for homestead exemption Rhode Island?

The Homestead Exemption Application can be applied for by anyone who owns and occupies a residential property (single, two, or three family, also including residential condos) as their primary residence by 12/31, for the subsequent tax bill.

Who qualifies for a homestead exemption in Rhode Island?

The Homestead Exemption Application can be applied for by anyone who owns and occupies a residential property (single, two, or three family, also including residential condos) as their primary residence by 12/31, for the subsequent tax bill.

Is it better to claim 0 or exempt?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

What is exemption for your filing status?

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

What does exempt from certification mean?

Exempt Colors Exempt from certification colors do not require additional batch by batch testing but have also been thoroughly evaluated by the FDA.

Should you claim an exemption for yourself?

As you fill out your federal income tax return, even before you report your income, the IRS asks you to list your personal exemptions. It's important not to skip this step — exemptions reduce your taxable income.

What does it mean to fill exempt?

What Does Filing Exempt on a W-4 Mean? Being tax-exempt means you are free from tax liability. You do not need to pay the same tax that other people are paying. You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold.

Is it better to claim 0 or 1 exemptions?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

How do I claim exemptions on my tax form?

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax. NOTE: if you claim EXEMPT you must complete a new W-4 annually in February.

Who qualifies for homestead exemption in RI?

The Homestead Exemption Application can be applied for by anyone who owns and occupies a residential property (single, two, or three family, also including residential condos) as their primary residence by 12/31, for the subsequent tax bill.

How many exemptions should I claim?

If you are single and have one job, or married and filing jointly then claiming one allowance makes the most sense. An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit RI EXO-APP from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including RI EXO-APP, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I edit RI EXO-APP on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing RI EXO-APP.

Can I edit RI EXO-APP on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign RI EXO-APP. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is RI EXO-APP?

RI EXO-APP is a form used in Rhode Island for reporting entities that wish to apply for an exemption from certain tax requirements.

Who is required to file RI EXO-APP?

Entities seeking tax exemption status in Rhode Island are required to file the RI EXO-APP.

How to fill out RI EXO-APP?

To fill out the RI EXO-APP, gather necessary documentation, provide accurate entity information, specify the exemption being requested, and submit the form to the appropriate Rhode Island tax authority.

What is the purpose of RI EXO-APP?

The purpose of the RI EXO-APP is to allow organizations to apply for and obtain exemptions from certain state taxes, facilitating tax relief for qualifying entities.

What information must be reported on RI EXO-APP?

Information that must be reported on RI EXO-APP includes the entity's name, address, federal tax identification number, type of exemption requested, and supporting documentation that justifies the exemption.

Fill out your RI EXO-APP online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

RI EXO-APP is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.