Get the free Form PT-102:4/11:Tax on Diesel Motor Fuel:PT102. Cigarette and Unaffixed Stamp Inven...

Show details

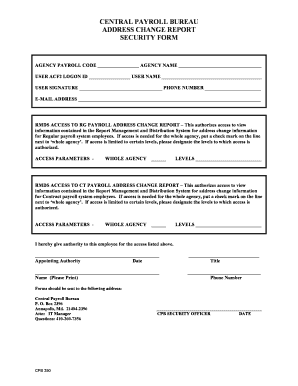

PT-102 (4/11) 0411 New York State Department of Taxation and Finance Tax on Diesel Motor Fuel Tax Law Articles 12-A and 13-A Use this form to report transactions for the month of April 2011. Legal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form pt-102411tax on diesel

Edit your form pt-102411tax on diesel form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form pt-102411tax on diesel form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form pt-102411tax on diesel online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form pt-102411tax on diesel. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form pt-102411tax on diesel

How to fill out form pt-102411tax on diesel?

01

Begin by obtaining the form: The first step in filling out form pt-102411tax on diesel is to ensure that you have the correct form in your possession. You can obtain this form from the relevant tax authority's website or office.

02

Provide necessary personal and business information: The form will require you to enter your personal information, such as your name, address, and social security number. Additionally, you may need to supply details related to your business, such as its name, address, and tax identification number.

03

Report diesel fuel usage: This form is specifically for reporting diesel fuel usage for tax purposes. You will need to accurately record the amount of diesel fuel consumed during the reporting period and provide any supporting documentation, such as fuel invoices or receipts.

04

Calculate tax liability: Once you have reported your diesel fuel usage, the form will guide you through the process of calculating your tax liability. This may involve multiplying the fuel used by the applicable tax rate or following any specific instructions provided on the form.

05

Submit the form: After completing all necessary sections of form pt-102411tax on diesel, ensure that you have signed and dated the form. Depending on the requirements of the tax authority, you may need to submit the form through mail, electronically, or in person at a designated office.

Who needs form pt-102411tax on diesel?

01

Businesses using diesel fuel: Any business that utilizes diesel fuel as part of its operations may need to fill out form pt-102411tax. This applies to a wide range of industries, including transportation, construction, agriculture, and manufacturing.

02

Individuals and entities liable for diesel fuel taxes: In some cases, individuals or entities who are not businesses but are still responsible for paying taxes on diesel fuel usage may need to fill out this form. This could include individuals operating certain types of vehicles or equipment that consume diesel fuel.

03

Compliance with tax regulations: The form is necessary to ensure compliance with tax regulations related to the reporting and payment of taxes on diesel fuel usage. Filling out the form accurately and submitting it within the designated timeline helps individuals and businesses meet their tax obligations and avoid potential penalties or legal issues.

In summary, form pt-102411tax on diesel must be filled out by businesses using diesel fuel, individuals and entities liable for diesel fuel taxes, and those seeking to comply with tax regulations governing the reporting and payment of diesel fuel taxes. Following the step-by-step instructions provided on the form ensures accurate completion and submission.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form pt-102411tax on diesel directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your form pt-102411tax on diesel and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I create an eSignature for the form pt-102411tax on diesel in Gmail?

Create your eSignature using pdfFiller and then eSign your form pt-102411tax on diesel immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Can I edit form pt-102411tax on diesel on an Android device?

The pdfFiller app for Android allows you to edit PDF files like form pt-102411tax on diesel. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your form pt-102411tax on diesel online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Pt-102411tax On Diesel is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.