Get the free Download A Return Form - Select Fashion

Show details

Refund/Exchange Instruction 1) Enter the quantity you are returning against the relevant order line on the Returns Note. 2) On the same order line, circle a return reason letter code from those listed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign download a return form

Edit your download a return form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your download a return form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing download a return form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit download a return form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out download a return form

How to fill out and download a return form:

01

Start by accessing the website or platform from which you need to download the return form. This could be a government website, an e-commerce platform, or any other organization that requires you to submit a return form.

02

Locate the section or page where the return form is available for download. This is typically found under a "Forms" or "Downloads" tab. If you are unsure, you can use the search bar on the website to find the specific form you need.

03

Click on the link or button that corresponds to the return form you require. This will usually initiate the download process, and the form will be saved onto your computer or device. Make sure to select the correct form if there are multiple options available.

04

Once the form is downloaded, locate the file on your computer or device. It is often saved in the "Downloads" folder by default, but it may vary depending on your settings. You can use the file explorer or search function if needed.

05

Open the downloaded return form using a compatible program. Most forms are provided in PDF format, so you will need a PDF reader such as Adobe Acrobat Reader to open and fill out the form. If you don't have a PDF reader, you can download one for free from the internet.

06

Carefully read the instructions and guidelines provided on the return form. This will help you understand the specific information required and how to fill out each section correctly. Pay attention to any mandatory fields, special formatting, or additional attachments that may be needed.

07

Start filling out the return form by entering your personal or business information as requested. This may include your name, contact details, tax identification number, and other relevant details. Use the provided fields or boxes to input the required information.

08

Enter the financial or transactional details required for your return. This could include income, expenses, deductions, sales figures, or any other relevant information depending on the purpose of the return form. Ensure the accuracy and completeness of the information provided.

09

If necessary, attach any supporting documents or paperwork that may be required along with the return form. This could include receipts, invoices, proof of income, or any other documents that validate the information provided in the form.

10

Once you have completed all the necessary sections and attached any required documents, review the filled out return form. Double-check for any errors, missing information, or inconsistencies. Make sure that all the provided information is accurate and up to date.

11

After reviewing the form, save a copy of the filled out return form on your computer or device. You can do this by selecting "Save As" or similar options in your PDF reader and choosing a location to save the file.

12

Finally, submit the filled out return form following the instructions provided by the organization or website. This may involve uploading the form directly on the platform, mailing it physically, or any other submission method specified. Make sure to meet any deadlines and keep a copy of the submitted form for your records.

Who needs to download a return form:

01

Individuals or businesses who are required to file tax returns with the government.

02

E-commerce platforms or online marketplaces that require sellers to submit return forms for sales or transactions.

03

Organizations or institutions that request return forms for various purposes, such as claiming refunds, submitting financial reports, or complying with specific regulations.

04

Individuals or businesses involved in specific industries or sectors that have specific return forms related to their activities (e.g., healthcare, real estate, finance).

05

Students or educational institutions that need to submit return forms for financial aid, scholarships, or other academic purposes.

06

Non-profit organizations or charities that require return forms for documenting donations and achieving tax-exempt status.

07

Any other individuals or entities that need to report or provide certain information accurately and officially in a standardized form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit download a return form from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your download a return form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Where do I find download a return form?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the download a return form. Open it immediately and start altering it with sophisticated capabilities.

Can I sign the download a return form electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your download a return form and you'll be done in minutes.

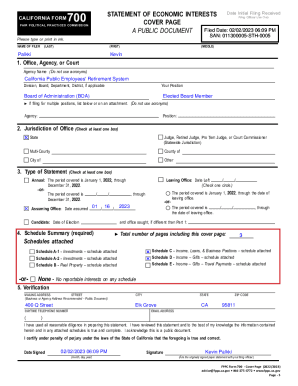

What is download a return form?

Download a return form is a document that taxpayers use to report their income, expenses, and other tax information to the tax authorities.

Who is required to file download a return form?

Individuals and businesses who have earned income during the tax year are required to file a return form.

How to fill out download a return form?

Taxpayers can fill out the return form either manually or electronically, following the instructions provided by the tax authorities.

What is the purpose of download a return form?

The purpose of a return form is to calculate the tax liability of the taxpayer based on their income, deductions, and credits.

What information must be reported on download a return form?

Taxpayers must report their income, expenses, deductions, credits, and any other relevant tax information on the return form.

Fill out your download a return form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Download A Return Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.