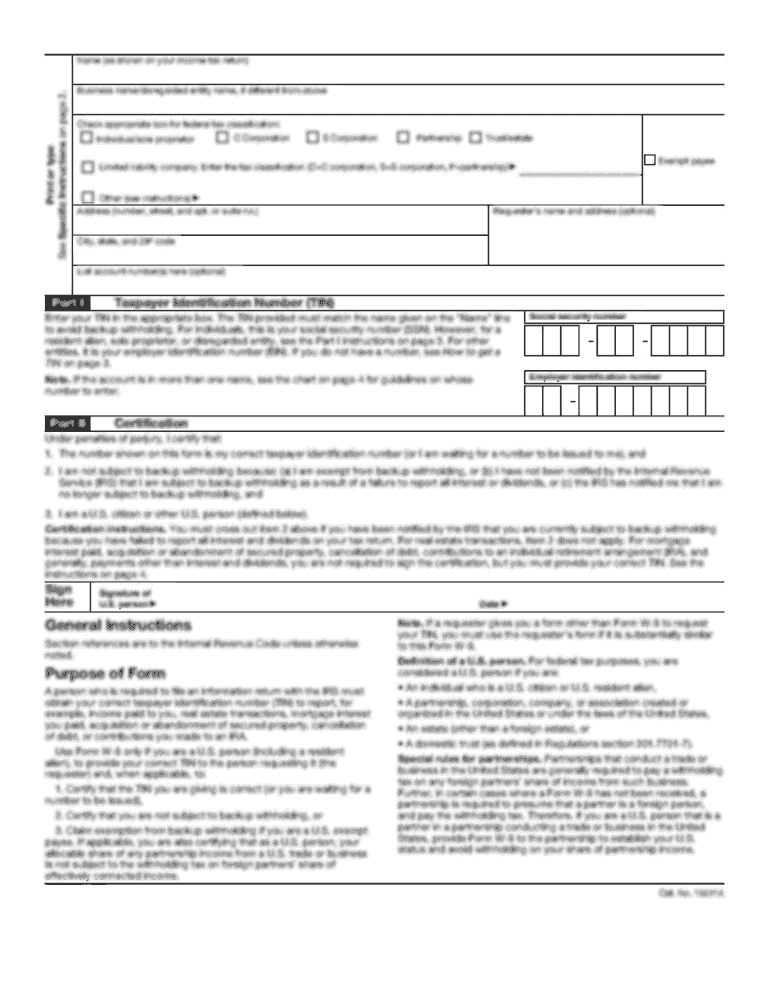

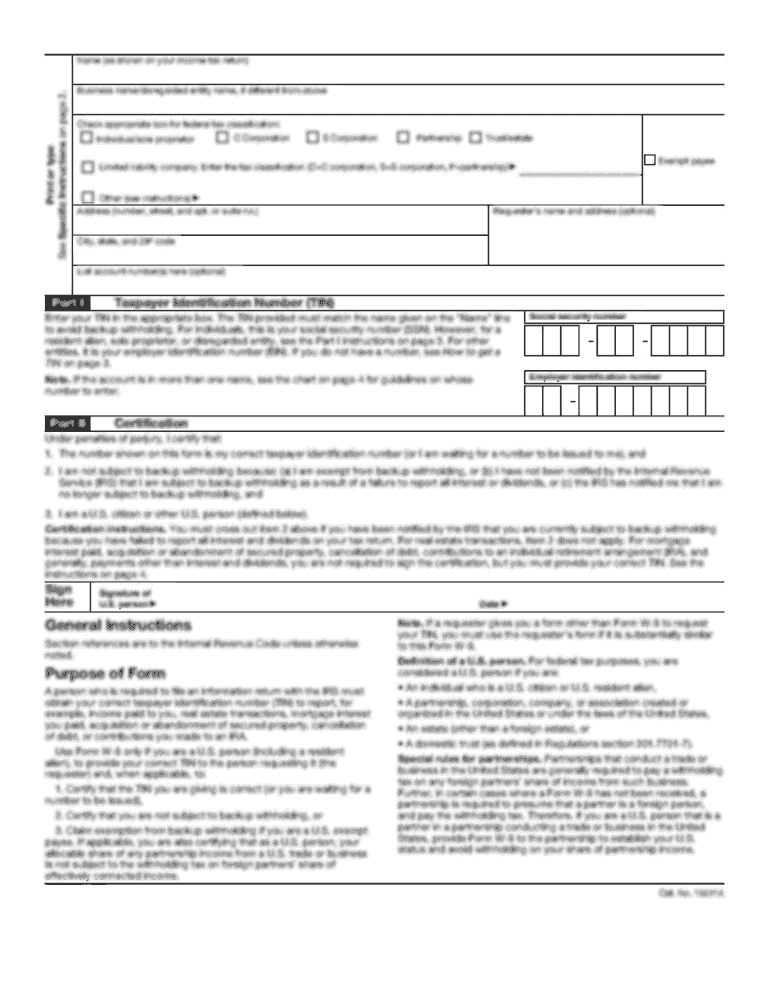

Get the free Medical Professional - Books by Kelly LLC

Show details

Medical and Tax Expenses. ORG13. MEDICAL AND DENTAL EXPENSES. 1 Prescription medications.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign medical professional - books

Edit your medical professional - books form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your medical professional - books form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit medical professional - books online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit medical professional - books. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out medical professional - books

How to fill out medical professional - books:

01

Gather all relevant information: Before filling out the medical professional - books, gather all necessary information such as patient names, dates of visit, medical procedures performed, and any relevant medical codes or billing information.

02

Understand the purpose of each section: Medical professional - books typically have different sections for recording patient demographics, medical history, diagnosis, treatment plans, and billing information. Familiarize yourself with the purpose of each section to accurately fill out the books.

03

Complete patient demographics: Start by recording the patient's full name, date of birth, gender, address, and contact information in the designated section.

04

Document medical history: In the medical history section, record any relevant past medical conditions, surgeries, allergies, or medications taken by the patient. This information helps provide a comprehensive overview of the patient's health.

05

Record diagnosis and treatment: In the diagnosis and treatment section, accurately document the patient's diagnosis based on medical examinations, tests, or consultations. Include the date of diagnosis and any treatment plans recommended or administered.

06

Fill out billing information: The billing section requires recording the details of medical procedures performed, including any codes or descriptions for billing purposes. Note the date, type of service, and any relevant medical codes that apply.

07

Double-check for accuracy: Before finalizing the medical professional - books, review all the information you have entered for accuracy and completeness. Ensure that there are no missing or incorrect details that could compromise the patient's care or billing process.

Who needs medical professional - books?

01

Medical Practices: Medical professional - books are essential for medical practices, such as hospitals, clinics, and private practices. These books assist in maintaining accurate records of patients, diagnoses, treatment plans, and billing information.

02

Health Insurance Companies: Health insurance companies often require medical professional - books to evaluate claims, process reimbursements, and verify the appropriateness of medical procedures performed.

03

Regulatory Bodies: Regulatory bodies, such as healthcare authorities or government agencies, may request medical professional - books for audits, compliance checks, or investigations to ensure that medical practices adhere to legal and ethical standards.

04

Medical Researchers and Educators: Medical professional - books serve as valuable resources for medical researchers and educators who analyze patient data, track healthcare trends, or use real-life cases for educational purposes.

05

Patients: While patients may not directly need medical professional - books, they benefit from the accurate and complete records maintained in these books. Patients can access their medical history, treatment plans, and billing information when needed for personal records, second opinions, or legal purposes.

Overall, medical professional - books are crucial for various stakeholders involved in healthcare delivery, reimbursement processes, regulatory compliance, and medical research or education.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit medical professional - books on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing medical professional - books, you can start right away.

How can I fill out medical professional - books on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your medical professional - books, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I complete medical professional - books on an Android device?

Use the pdfFiller mobile app and complete your medical professional - books and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is medical professional - books?

Medical professional - books refer to the financial records and logs maintained by medical professionals to track their income, expenses, and other financial transactions related to their practice.

Who is required to file medical professional - books?

Medical professionals such as doctors, nurses, dentists, and other healthcare providers are required to maintain and file their medical professional - books.

How to fill out medical professional - books?

Medical professional - books can be filled out by recording all sources of income, expenses, and other financial transactions related to the medical practice in a systematic and organized manner.

What is the purpose of medical professional - books?

The purpose of medical professional - books is to track the financial performance of the medical practice, monitor cash flow, and maintain accurate records for tax and regulatory compliance.

What information must be reported on medical professional - books?

Information such as income from services, expenses for supplies and equipment, patient billing records, insurance payments, and other financial transactions must be reported on medical professional - books.

Fill out your medical professional - books online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Medical Professional - Books is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.