Get the free COUNCIL TAX Payment by direct debit BUSINESS RATES Payment ...

Show details

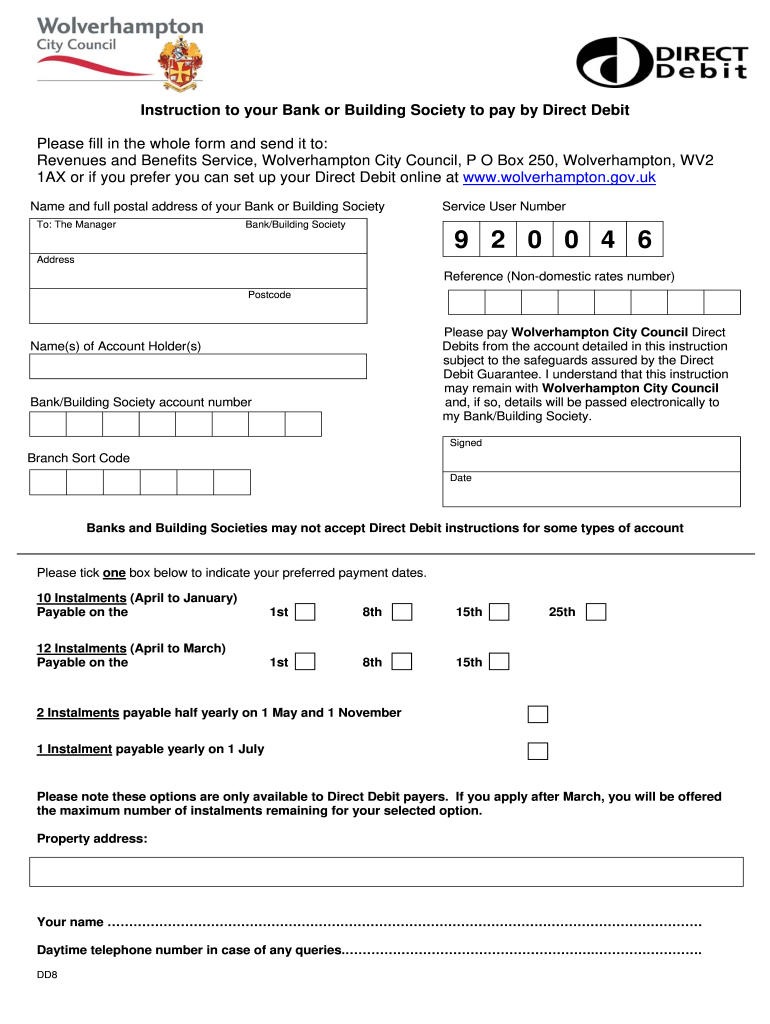

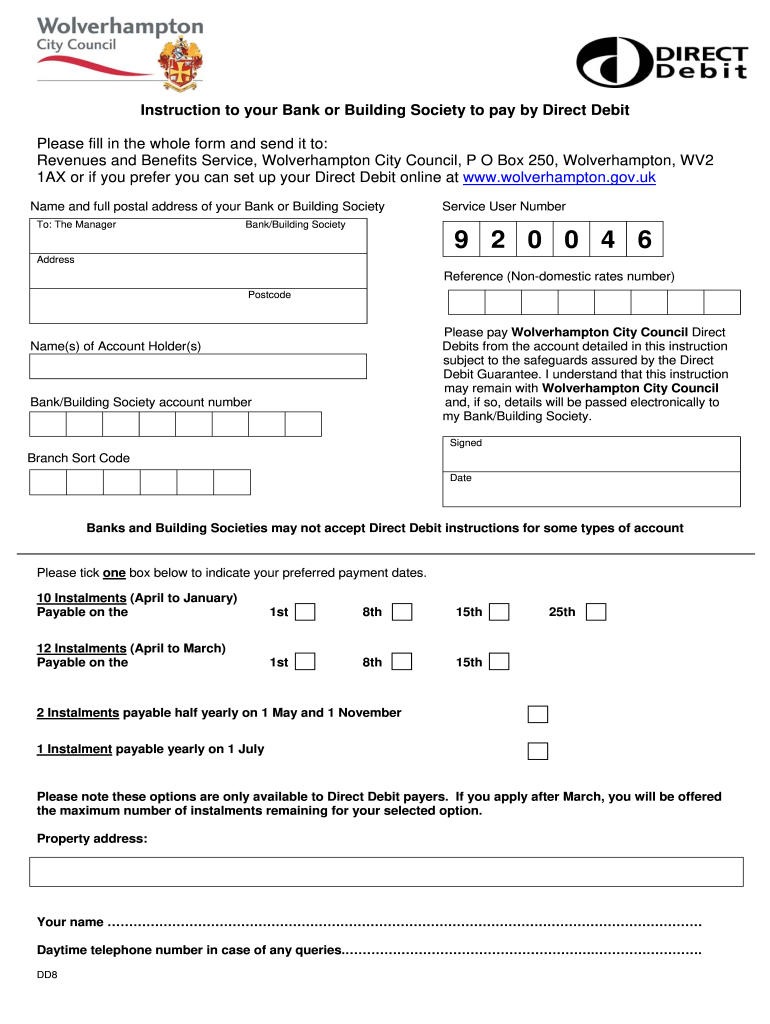

Instruction to your Bank or Building Society to pay by Direct Debit

Please fill in the whole form and send it to:

Revenues and Benefits Service, Wolverhampton City Council, P O Box 250, Wolverhampton,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign council tax payment by

Edit your council tax payment by form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your council tax payment by form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing council tax payment by online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit council tax payment by. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out council tax payment by

How to fill out council tax payment by

01

To fill out council tax payment, follow these steps:

02

Obtain the council tax bill from your local council.

03

Read the bill thoroughly to understand the amount due, payment dates, and payment methods accepted.

04

Choose a preferred payment method, such as online banking, direct debit, or payment by phone.

05

If paying through online banking, log in to your bank's website and navigate to the bill payment section.

06

Add the council tax account details as provided on the bill, including the account number and sort code.

07

Enter the amount you wish to pay and select the appropriate payment date.

08

Confirm the payment details and authorize the payment.

09

Make sure to keep a record of the transaction for future reference.

10

If paying by direct debit, contact your bank or set up the payment through their online banking platform.

11

Provide the council tax account details and specify the payment frequency according to the bill.

12

Ensure that sufficient funds are available in your bank account on the specified payment dates.

13

Monitor your bank statements to ensure the payments are being processed correctly.

14

If paying by phone, use the payment hotline number provided on the council tax bill.

15

Follow the automated instructions or speak to a customer service representative to make the payment.

16

Provide the necessary account and payment details when prompted.

17

Obtain a confirmation or reference number for the payment.

18

Remember to pay council tax on time to avoid penalties and late fees.

Who needs council tax payment by?

01

Council tax payment is required by anyone who owns or rents a residential property in the UK.

02

This includes homeowners, tenants, and occupiers of domestic premises.

03

Whether you own the property or are living in it as a tenant, you are responsible for paying council tax.

04

The payment amount may vary based on factors such as the property valuation band and local council rates.

05

It is essential to pay council tax to contribute to the funding of local services, such as rubbish collection, street maintenance, and public amenities.

06

Failure to pay council tax can result in legal action, including court orders and potential debt recovery measures.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute council tax payment by online?

Easy online council tax payment by completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I edit council tax payment by on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing council tax payment by.

How do I edit council tax payment by on an Android device?

With the pdfFiller Android app, you can edit, sign, and share council tax payment by on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is council tax payment by?

Council tax payment is the amount paid by residents to their local government for local services and facilities.

Who is required to file council tax payment by?

Anyone who occupies a residential property in the UK is required to file and pay council tax.

How to fill out council tax payment by?

To fill out council tax payment, you need to complete the council tax registration form provided by your local council, ensuring that all information regarding your property and occupants is accurately stated.

What is the purpose of council tax payment by?

The purpose of council tax payment is to fund local services such as waste collection, road maintenance, and emergency services.

What information must be reported on council tax payment by?

The information that must be reported includes your name, property address, type of property, number of occupants, and any exemptions or discounts that may apply.

Fill out your council tax payment by online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Council Tax Payment By is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.