NM RPD-41373 2017 free printable template

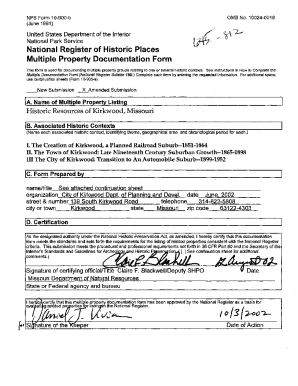

Show details

RPD41373

Rev. 07/28/2017×447480200×New Mexico Taxation and Revenue Departmentalization for Refund of Tax

Withheld From Walkthrough EntitiesWhen To Use this Form: Use this form to apply for a refund

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM RPD-41373

Edit your NM RPD-41373 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM RPD-41373 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NM RPD-41373 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NM RPD-41373. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM RPD-41373 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM RPD-41373

How to fill out NM RPD-41373

01

Obtain NM RPD-41373 form from the New Mexico Taxation and Revenue Department website.

02

Provide your full name and address in the designated fields.

03

Enter the correct tax period for which the form is being filled out.

04

Specify the type of taxpayer you are (individual, corporation, etc.) in the appropriate section.

05

Complete the financial information section, ensuring all figures are accurate and consistent.

06

Review the form for any errors or omissions.

07

Sign and date the form at the bottom.

08

Submit the completed form as per the instructions provided, either online or by mail.

Who needs NM RPD-41373?

01

Individuals or businesses filing a tax return in New Mexico.

02

Taxpayers claiming specific tax credits or exemptions.

03

Those who need to report business income or obligations in New Mexico.

04

Representatives preparing tax documents on behalf of a taxpayer.

Fill

form

: Try Risk Free

People Also Ask about

What is the pass-through withholding rate in New Mexico?

The State of New Mexico requires pass-through entities (which may be a state law partnership or a limited liability company taxed as a partnership) to withhold tax at 5.9% on earnings of non-resident partners or members if the owner's distributive share of net income is over $100 in a year.

Do I need to file New Mexico tax return?

Who is required to file? New Mexico's law says every person who meets both of the following conditions must file Form PIT-1, New Mexico Personal Income Tax Return: Every person who is a New Mexico resident or has income from New Mexico sources. Every person who is required to file a federal income tax return.

How much should I withhold for New Mexico state taxes?

Head of Household Tax Withholding Table If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $9,700$0.00Over $9,700 but not over $17,700$0.00 plus 1.7% of excess over $9,700Over $17,700 but not over $25,700$136.00 plus 3.2% of excess over $17,7007 more rows • Mar 30, 2022

What is the form 41367 in New Mexico?

What is New Mexico RPD 41367? The pass-through entity must file and pay the tax using form RPD-41367, Annual Withholding of Net Income From a Pass-Through Entity Detail Report. Form RPD-41367 can be filed and paid electronically on the Departments web file services page or through a third-party software.

Does New Mexico have a withholding form?

(New Mexico does not have a state equivalent of the federal W-4 form. Employees should complete a copy of the federal W- 4 for New Mexico, writing "For New Mexico State Withholding Only" across the top in prominent letters.

What is a RPD 41359 form?

Annual statements of withholding should not be submitted to the Department, but must be submitted to the taxpayer using form RPD-41359, Annual Statement of Pass-Through Entity Withholding, or 1099-Misc.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NM RPD-41373 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including NM RPD-41373, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I get NM RPD-41373?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the NM RPD-41373 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an eSignature for the NM RPD-41373 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your NM RPD-41373 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is NM RPD-41373?

NM RPD-41373 is a tax form used in New Mexico for reporting certain tax-related information, typically concerning gross receipts or compensating taxes.

Who is required to file NM RPD-41373?

Businesses and individuals who engage in activities that generate gross receipts or are liable for compensating taxes in New Mexico are required to file this form.

How to fill out NM RPD-41373?

To fill out NM RPD-41373, gather your gross receipts and other relevant tax information, follow the instructions provided on the form to accurately report your amounts, and ensure you include all necessary signatures before submission.

What is the purpose of NM RPD-41373?

The purpose of NM RPD-41373 is to report and remit owed taxes on gross receipts or compensating taxes, ensuring compliance with New Mexico tax laws.

What information must be reported on NM RPD-41373?

Information required on NM RPD-41373 includes total gross receipts, deductions, taxable amounts, and any applicable credits or adjustments.

Fill out your NM RPD-41373 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM RPD-41373 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.