Get the free Work Opportunity Tax Credit (WOTC) - Department of Labor ...

Show details

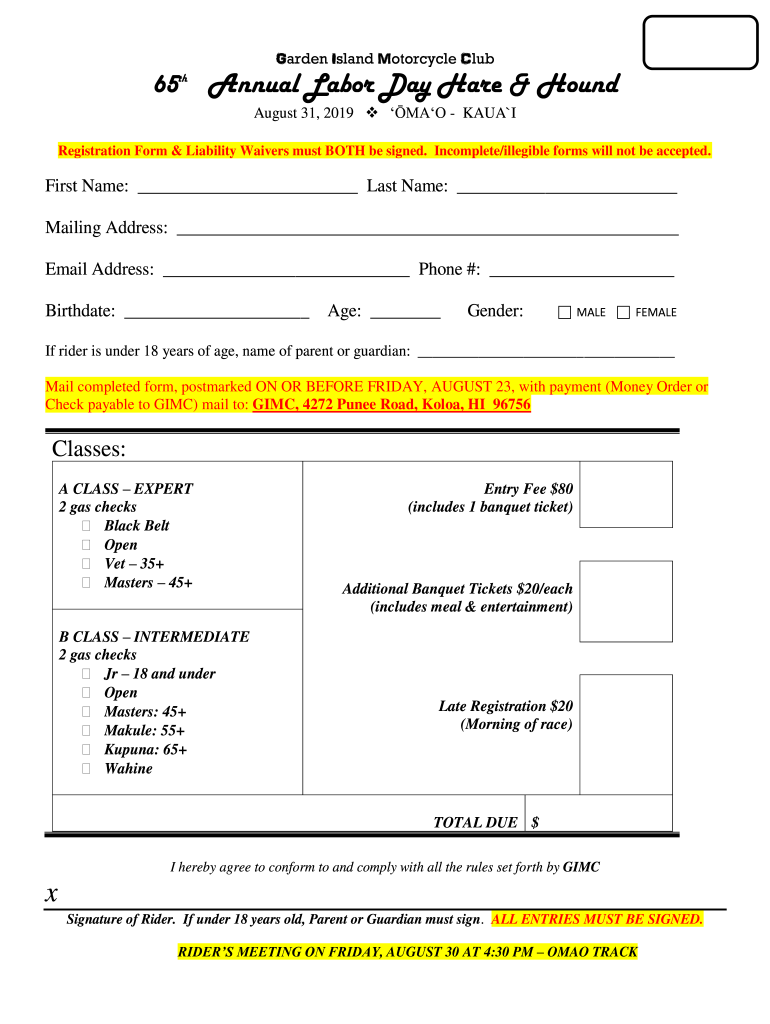

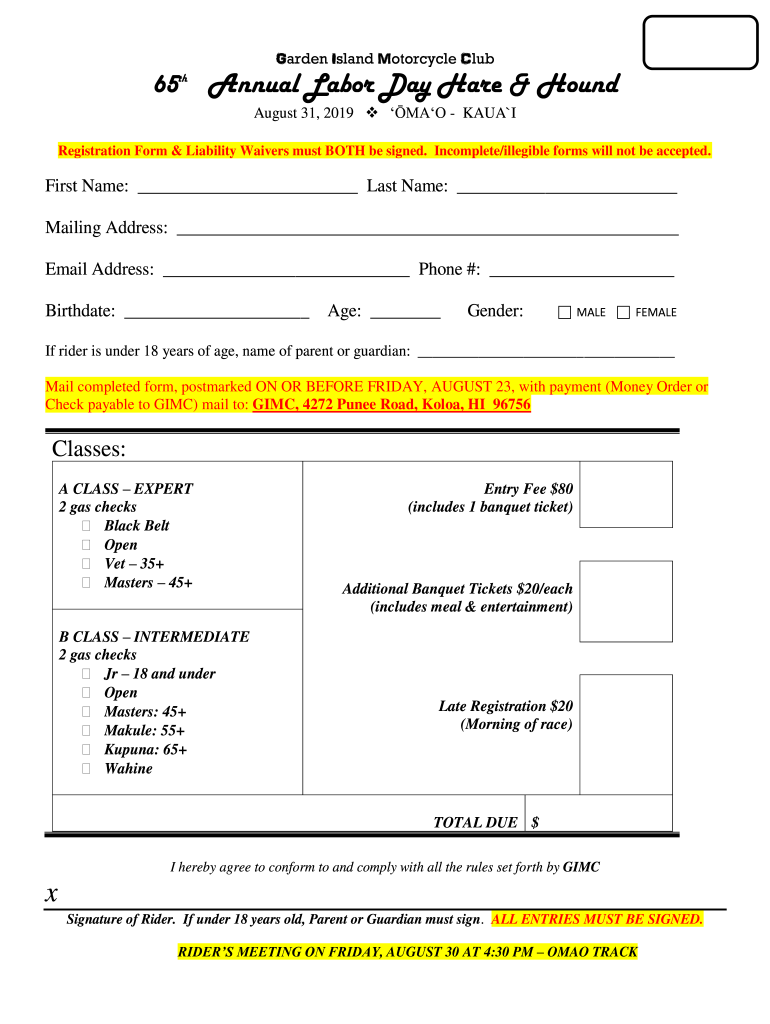

Garden Island Motorcycle Club65thAnnual Labor Day Hare & Hound August 31, 2019, MAO KAUAI Registration Form & Liability Waivers must BOTH be signed. Incomplete/illegible forms will not be accepted.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign work opportunity tax credit

Edit your work opportunity tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your work opportunity tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit work opportunity tax credit online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit work opportunity tax credit. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out work opportunity tax credit

How to fill out work opportunity tax credit

01

Obtain the necessary forms to apply for the Work Opportunity Tax Credit (WOTC). These forms can be obtained from the Internal Revenue Service (IRS) website or by contacting your local IRS office.

02

Gather the required information about the employee for whom you are applying for the credit. This includes their name, social security number, start date of employment, and information about their eligibility for one of the targeted groups specified by the WOTC program.

03

Complete the appropriate forms based on the eligibility of the employee. There are different forms for different targeted groups, so make sure to choose the correct one. Instructions for completing each form can be found on the IRS website or within the form itself.

04

Submit the completed forms to the appropriate government agency. The specific agency depends on the targeted group and your location, so check the instructions provided with the forms to determine where to submit them.

05

Keep a copy of the forms for your records. It is important to maintain documentation of your application in case of any future audits or inquiries by the IRS.

06

Follow up with the appropriate government agency to track the progress of your application and ensure that it is being processed.

07

If approved, you will receive a notification and be eligible for the Work Opportunity Tax Credit. Make sure to accurately track and document the number of hours worked by the employee in order to calculate the credit when filing your tax return.

Who needs work opportunity tax credit?

01

Various employers can benefit from the Work Opportunity Tax Credit (WOTC). It is designed to encourage the employment of individuals who may face barriers to employment, such as

02

- Long-term unemployment recipients

03

- Temporary Assistance for Needy Families (TANF) recipients

04

- Veterans

05

- Ex-felons

06

- Supplemental Nutrition Assistance Program (SNAP) recipients

07

- Designated community residents

08

- Vocational rehabilitation referrals

09

- Supplemental Security Income (SSI) recipients

10

- Summer youth employees

11

By offering tax incentives, the WOTC aims to incentivize employers to hire individuals from these target groups. This provides opportunities for the targeted individuals to gain employment and develop their skills, while also providing financial benefits to the employers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit work opportunity tax credit from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your work opportunity tax credit into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I make edits in work opportunity tax credit without leaving Chrome?

work opportunity tax credit can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for the work opportunity tax credit in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your work opportunity tax credit and you'll be done in minutes.

What is work opportunity tax credit?

The Work Opportunity Tax Credit (WOTC) is a federal tax credit that is available to employers for hiring individuals from certain target groups who face significant barriers to employment.

Who is required to file work opportunity tax credit?

Employers who hire eligible employees from qualified target groups are required to file for the Work Opportunity Tax Credit to claim the tax benefits associated with these hires.

How to fill out work opportunity tax credit?

To fill out the Work Opportunity Tax Credit form, employers need to complete IRS Form 8850 and submit it to their state workforce agency along with any required documentation about the employee and their eligibility.

What is the purpose of work opportunity tax credit?

The purpose of the Work Opportunity Tax Credit is to incentivize employers to hire individuals who face significant obstacles to employment, thereby promoting job creation and reducing unemployment.

What information must be reported on work opportunity tax credit?

Employers must report information such as the employee's name, Social Security number, and the target group the employee belongs to, along with any qualifying details pertaining to the hiring process and eligibility.

Fill out your work opportunity tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Work Opportunity Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.