Get the free Tax deferral techniques for real estate -starker exchanges and more

Show details

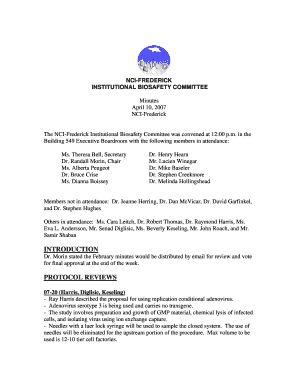

TAX DEFERRAL TECHNIQUES FOR REAL ESTATE STARKER EXCHANGES AND MORE! THURSDAY, OCTOBER 6, 2004 OAK BROOK, ILLINOIS DATES/LOCATIONS: WHAT YOU WILL LEARN: Thursday, October 6, 2004 A like kind exchange

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax deferral techniques for

Edit your tax deferral techniques for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax deferral techniques for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax deferral techniques for online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax deferral techniques for. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax deferral techniques for

How to fill out tax deferral techniques for:

01

Start by understanding the concept of tax deferral. Tax deferral refers to the strategy of delaying the payment of taxes on income or gains until a future date. This allows individuals or businesses to potentially benefit from lower tax rates or maximize investment growth in the meantime.

02

Assess your financial situation and tax goals. Before applying tax deferral techniques, it is essential to evaluate your specific circumstances and reasons for seeking tax deferral. This may include considerations such as retirement planning, investment opportunities, or managing cash flow.

03

Consult with a tax professional or financial advisor. To ensure you navigate the tax deferral process correctly and take advantage of all available options, seek expert advice. They can provide personalized guidance tailored to your specific needs and help you adhere to tax laws and regulations.

04

Identify eligible tax-deferred accounts or investments. There are several avenues to consider for tax deferral, such as individual retirement accounts (IRAs), 401(k)s, or annuities. These accounts allow your contributions or gains to grow tax-free until withdrawal, typically during retirement when you may be subject to a lower tax bracket.

05

Determine the contribution limits and deadlines for specific tax-deferred accounts. Each tax-deferred account has its own rules and limits regarding contributions. Familiarize yourself with these guidelines to ensure you make the most of your tax-deferred options while staying within the set limits.

06

Consider other tax-deferred investment vehicles. Alongside retirement accounts, there are additional investment options that offer tax deferral, such as 1031 exchanges for real estate investors or health savings accounts (HSAs) for medical expenses. Research these alternatives to determine if they align with your financial goals.

Who needs tax deferral techniques for:

01

Small business owners: Tax deferral strategies can be particularly beneficial for entrepreneurs who want to reinvest profits back into their business, defer taxes on capital gains, or optimize retirement savings through tax-advantaged accounts.

02

High-income earners: Individuals with higher incomes may use tax deferral techniques to reduce their current tax liability and potentially benefit from lower tax rates in the future, especially during retirement when income may decrease.

03

Investors and savers: Those who actively invest or save for long-term goals, such as retirement or education expenses, can leverage tax deferral options to maximize growth potential and defer tax payments until withdrawal, potentially resulting in higher overall savings.

In summary, filling out tax deferral techniques involves understanding the concept, assessing your financial situation, seeking professional advice, identifying eligible accounts, adhering to contribution limits, and considering additional tax-deferred investment vehicles. Tax deferral techniques can be beneficial for small business owners, high-income earners, and individuals focused on long-term investing and saving.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax deferral techniques for for eSignature?

When your tax deferral techniques for is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete tax deferral techniques for online?

Filling out and eSigning tax deferral techniques for is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out the tax deferral techniques for form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign tax deferral techniques for. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is tax deferral techniques for?

Tax deferral techniques are used to postpone the payment of taxes on income or investments until a later date, allowing individuals or businesses to potentially reduce their current tax liability.

Who is required to file tax deferral techniques for?

Individuals or businesses who have income or investments that qualify for tax deferral may be required to file tax deferral techniques.

How to fill out tax deferral techniques for?

Tax deferral techniques can typically be filled out using the appropriate tax forms provided by the IRS or other tax authorities, with accurate and detailed information about the income or investments being deferred.

What is the purpose of tax deferral techniques for?

The purpose of tax deferral techniques is to allow individuals or businesses to delay paying taxes on income or investments, potentially resulting in tax savings or providing cash flow benefits.

What information must be reported on tax deferral techniques for?

Tax deferral techniques typically require reporting of detailed information about the income or investments being deferred, including amounts, dates, and other relevant details.

Fill out your tax deferral techniques for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Deferral Techniques For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.