Get the free Independent Accountants Report on Compliance with Requirements Applicable to Its Maj...

Show details

LAKE METROPOLIS LAKE COUNTY SINGLE AUDIT FOR THE YEAR ENDED DECEMBER 31, 2010, LAKE METROPOLIS LAKE COUNTY TABLE OF CONTENTS TITLE PAGE Federal Awards Expenditures Schedule 1 Notes to the Federal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign independent accountants report on

Edit your independent accountants report on form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your independent accountants report on form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing independent accountants report on online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit independent accountants report on. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

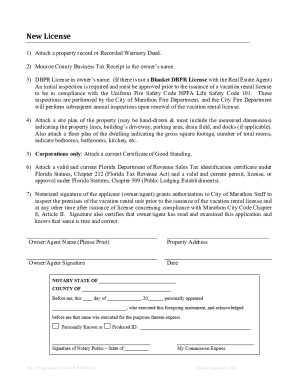

How to fill out independent accountants report on

To fill out an independent accountant's report, follow these steps:

01

Begin by gathering all relevant financial documents, including income statements, balance sheets, and cash flow statements.

02

Review the financial data to ensure accuracy and completeness. Verify that all transactions have been properly recorded and classified.

03

Evaluate the company's internal controls and accounting policies. Assess their effectiveness in preventing and detecting fraud or errors.

04

Perform analytical procedures to identify any unusual trends or anomalies in the financial data. Compare current financial performance with previous periods and industry benchmarks.

05

Conduct substantive testing, such as sampling transactions and verifying supporting documentation. This helps to validate the accuracy and reliability of the financial information.

06

Compile your findings, observations, and conclusions in the independent accountant's report. Clearly state your opinion on whether the financial statements present a true and fair view of the company's financial position and performance.

Regarding who needs an independent accountant's report, it is typically required by various stakeholders, including:

01

Shareholders and potential investors use the report to make informed decisions about investing in the company.

02

Lenders and creditors rely on the report to assess the company's creditworthiness and determine the terms of loans or credit arrangements.

03

Regulatory bodies and government agencies may mandate the submission of an independent accountant's report for compliance purposes.

04

Non-profit organizations often require the report to demonstrate transparency and accountability to their donors and funding sources.

Remember, the need for an independent accountant's report may vary depending on the specific circumstances and regulations applicable to the organization. It is advisable to consult with relevant stakeholders or seek professional advice to determine the specific requirements in each case.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in independent accountants report on without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing independent accountants report on and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How can I fill out independent accountants report on on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your independent accountants report on. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit independent accountants report on on an Android device?

You can make any changes to PDF files, like independent accountants report on, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is independent accountants report on?

The independent accountants report provides an opinion on the financial statements of an entity. It assesses the fairness and accuracy of the financial information presented.

Who is required to file independent accountants report on?

Entities that are subject to financial statement audits, such as publicly traded companies or organizations receiving federal funding, are required to file an independent accountants report.

How to fill out independent accountants report on?

To fill out an independent accountants report, the accountant must conduct a thorough examination of the entity's financial statements, assess internal controls, and perform necessary audit procedures. They then issue an opinion based on their findings.

What is the purpose of independent accountants report on?

The purpose of the independent accountants report is to provide assurance to users of the financial statements that the information presented is reliable, accurate, and in compliance with relevant accounting standards.

What information must be reported on independent accountants report on?

The independent accountants report must include the accountant's opinion on the fairness of the financial statements, a description of the audit scope and procedures performed, and any findings or observations made during the audit process.

Fill out your independent accountants report on online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Independent Accountants Report On is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.