DoL WH-4 2018-2026 free printable template

Show details

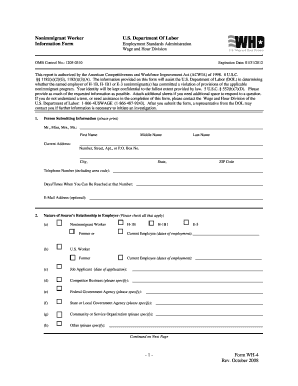

U.S. Department of LaborNonimmigrant Worker Information Firmware and Hour Division OMB NO: 12050310 Expires: 10/31/2021This report is authorized by certain Immigration and Nationality Act provisions.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign how to wh 4 form

Edit your DoL WH-4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your DoL WH-4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing DoL WH-4 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit DoL WH-4. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DoL WH-4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out DoL WH-4

How to fill out DoL WH-4

01

Download the DoL WH-4 form from the official Department of Labor website.

02

Fill in the employer's name and address at the top of the form.

03

Enter the employee's name and address in the designated fields.

04

Specify the employment period for which the form is being submitted.

05

Provide information about the wages and hours worked by the employee during that period.

06

Indicate any deductions or adjustments that apply.

07

Review the completed form for accuracy.

08

Sign and date the form at the bottom.

Who needs DoL WH-4?

01

Employers who are required to report employee wages and hours for compliance with labor laws.

02

Employees seeking to clarify wage issues or claims related to unpaid wages.

03

State workforce agencies or labor departments that need wage information for processing claims.

Fill

form

: Try Risk Free

People Also Ask about

What is a wh 4 form for indiana?

WH-4 Indiana State Tax Withholding Form (pdf) - All employees should complete Form WH-4 to ensure that the correct State income tax is withheld from your pay. Depending on the county in which you reside, you may have also have county tax withheld from your pay.

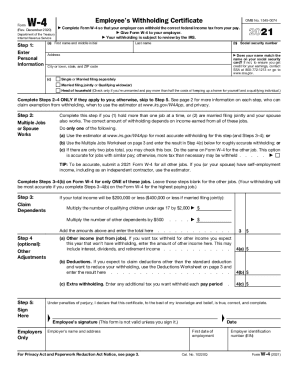

What is the W4 form?

A W-4 is the IRS document that you complete for your employer to determine how much should be withheld from your paycheck for federal income taxes. Accurately completing your W-4 can help you avoid overpaying your taxes throughout the year, or even owing a large balance at tax time.

Who fills out a W-4 and why?

Key Takeaways. Employees fill out a W-4 form to inform employers how much tax to withhold from their paychecks. The amount withheld is based on filing status, dependents, anticipated tax credits, and deductions. If the form is filled out incorrectly, you may not pay enough income tax throughout the year.

What is Form W-4 exemption from withholding?

What Does Filing Exempt on a W-4 Mean? When you file as exempt from withholding with your employer for federal tax withholding, you don't make any federal income tax payments during the year. (A taxpayer is still subject to FICA tax.)

What is a W-4 form and what is its purpose?

Form W-4 tells you, as the employer, the employee's filing status, multiple jobs adjustments, amount of credits, amount of other income, amount of deductions, and any additional amount to withhold from each paycheck to use to compute the amount of federal income tax to deduct and withhold from the employee's pay.

What is a W-4 form used for simple?

The W-4 Form is an IRS form that you complete to let your employer know how much money to withhold from your paycheck for federal taxes. Accurately completing your W-4 can help you prevent having a big balance due at tax time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit DoL WH-4 on an iOS device?

Create, edit, and share DoL WH-4 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete DoL WH-4 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your DoL WH-4. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit DoL WH-4 on an Android device?

You can make any changes to PDF files, like DoL WH-4, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is DoL WH-4?

DoL WH-4 is a form used by employers to report information related to the payment of overtime wages and to help ensure compliance with labor laws.

Who is required to file DoL WH-4?

Employers who are subject to the Fair Labor Standards Act (FLSA) and who have employees covered by the Act are required to file the DoL WH-4 form.

How to fill out DoL WH-4?

To fill out DoL WH-4, employers need to provide details such as the employer's name and address, employee's name and work details, hours worked, and compensation information. Ensure that all sections are completed accurately.

What is the purpose of DoL WH-4?

The purpose of DoL WH-4 is to document compliance with wage regulations, particularly focusing on overtime pay, and to provide a clear record for both employers and employees.

What information must be reported on DoL WH-4?

Information that must be reported on DoL WH-4 includes the employer's and employee's identification details, total hours worked, wage rates, and calculation of overtime pay.

Fill out your DoL WH-4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

DoL WH-4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.