Get the free Tax Increment Reinvestment Zone - Economic Development

Show details

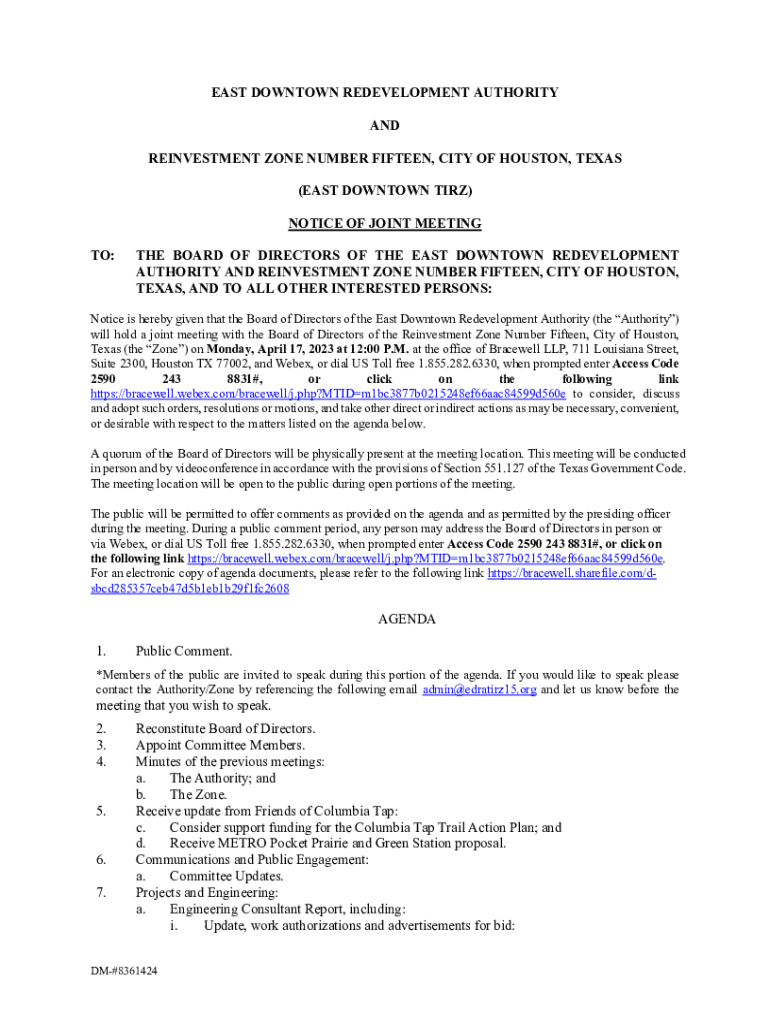

EAST DOWNTOWN REDEVELOPMENT AUTHORITY AND REINVESTMENT ZONE NUMBER FIFTEEN, CITY OF HOUSTON, TEXAS (EAST DOWNTOWN TIRE) NOTICE OF JOINT MEETING TO:THE BOARD OF DIRECTORS OF THE EAST DOWNTOWN REDEVELOPMENT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax increment reinvestment zone

Edit your tax increment reinvestment zone form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax increment reinvestment zone form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax increment reinvestment zone online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax increment reinvestment zone. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax increment reinvestment zone

How to fill out tax increment reinvestment zone:

01

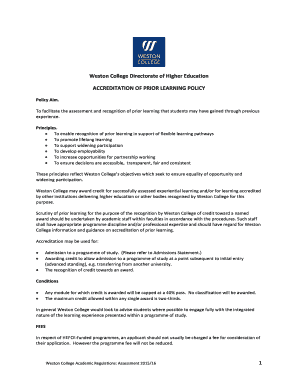

Research the requirements: Start by familiarizing yourself with the specific guidelines and requirements for filling out a tax increment reinvestment zone. Each zone may have its own set of rules and regulations, so it is important to understand what is expected.

02

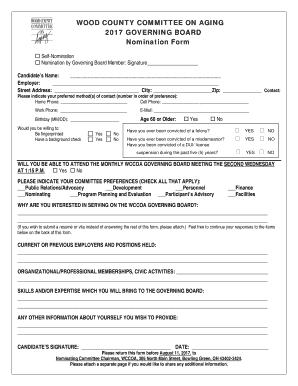

Gather necessary documents: Collect all the necessary documents that need to be filled out for the tax increment reinvestment zone application. This may include forms, financial statements, project plans, and any other required paperwork.

03

Complete the application form: Fill out the application form accurately and completely. Pay close attention to any instructions or guidelines provided. Be sure to provide all the required information and double-check for any errors or missing details.

04

Append supporting documents: Attach any supporting documents that are required along with the application form. This may include copies of financial statements, project plans, property ownership documentation, or any other relevant paperwork.

05

Review and proofread: Before submitting the application, review all the filled-out forms and supporting documents to ensure accuracy. Proofread for any spelling or grammatical errors, and verify that all the information provided is correct and up to date.

06

Submit the application: Once you are confident that all the necessary information has been provided and the application is complete, submit it to the appropriate authority responsible for the tax increment reinvestment zone. Follow any specified submission guidelines and deadlines.

07

Follow up and stay informed: After submitting the application, stay informed about the progress of your application. If necessary, follow up with the relevant authority to inquire about the status and any additional steps or documentation required.

Who needs tax increment reinvestment zone:

01

Municipalities: Local governments often establish tax increment reinvestment zones to promote economic development, revitalize areas, and attract investment.

02

Developers and businesses: Developers and businesses may be interested in tax increment reinvestment zones to take advantage of financial incentives and benefits provided by these zones for their projects or operations.

03

Property owners: Property owners within a tax increment reinvestment zone may benefit from property value appreciation and the increase in economic activity resulting from the zone's development initiatives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete tax increment reinvestment zone online?

Filling out and eSigning tax increment reinvestment zone is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the tax increment reinvestment zone electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your tax increment reinvestment zone and you'll be done in minutes.

How can I edit tax increment reinvestment zone on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing tax increment reinvestment zone, you can start right away.

What is tax increment reinvestment zone?

A tax increment reinvestment zone is a designated area where property tax revenues are set aside and reinvested in the zone for economic development purposes.

Who is required to file tax increment reinvestment zone?

Local governments or redevelopment authorities are typically required to file tax increment reinvestment zones.

How to fill out tax increment reinvestment zone?

To fill out a tax increment reinvestment zone, one must provide detailed information about the zone's boundaries, tax increment financing plan, and anticipated projects.

What is the purpose of tax increment reinvestment zone?

The purpose of a tax increment reinvestment zone is to stimulate economic development, infrastructure improvements, and job creation within a designated area.

What information must be reported on tax increment reinvestment zone?

Information about the zone's boundaries, tax increment financing plan, anticipated projects, and financial projections must be reported on a tax increment reinvestment zone.

Fill out your tax increment reinvestment zone online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Increment Reinvestment Zone is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.