Get the free OREGON ACCOUNTING MANUAL - oregon

Show details

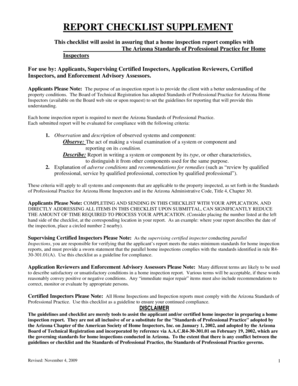

Statewide Policy OREGON ACCOUNTING MANUAL Subject: Accounting and Financial Reporting Number: 45.50.00 Division: Chief Financial Office Effective date: June 11, 2014, Chapter: Payroll Part: Collection

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oregon accounting manual

Edit your oregon accounting manual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oregon accounting manual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing oregon accounting manual online

Follow the steps down below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit oregon accounting manual. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oregon accounting manual

How to fill out Oregon accounting manual:

01

Start by familiarizing yourself with the structure and format of the Oregon accounting manual. Take the time to read through the table of contents and get an overview of the various sections and topics covered.

02

Review any specific instructions or guidelines provided at the beginning of the manual. Pay attention to any updates or revisions that may have been made since your last use of the manual.

03

Begin filling out the manual by addressing each section or topic in order. Follow the instructions provided within each section and provide the necessary information or documentation as required.

04

Take note of any specific formatting or referencing guidelines mentioned in the manual. Ensure that your entries are accurate, clear, and in accordance with the prescribed format.

05

If you encounter any difficulties or have questions while filling out the manual, consult any accompanying documentation or reference materials. You may also consider reaching out to relevant individuals or departments for clarification or guidance.

Who needs the Oregon accounting manual:

01

Accountants: The Oregon accounting manual is particularly useful for accountants and finance professionals who are responsible for managing financial records, preparing financial statements, and ensuring compliance with regulatory requirements.

02

Government agencies: The manual provides guidance and instructions specific to the accounting practices and procedures followed by government agencies in Oregon. It is essential for staff and officials working in these agencies to have a thorough understanding of the manual to accurately record and report financial information.

03

Auditors and reviewers: Auditors and reviewers, whether internal or external, often refer to the Oregon accounting manual to assess the accuracy and compliance of financial records and statements. Being familiar with the manual allows them to effectively evaluate financial processes and identify any areas of concern.

04

Businesses and organizations operating in Oregon: Even if not mandated by law, businesses and organizations operating in Oregon can benefit from using the Oregon accounting manual as a reference and guide for maintaining accurate financial records and following best accounting practices.

05

Students and learners: Individuals studying accounting or interested in learning about governmental accounting practices can use the Oregon accounting manual as a valuable educational resource. It provides insights into the unique accounting requirements and procedures specific to the state of Oregon.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is oregon accounting manual?

Oregon Accounting Manual is a comprehensive guide that outlines the accounting policies and procedures for entities in Oregon.

Who is required to file oregon accounting manual?

Entities in Oregon, including government agencies, non-profit organizations, and businesses, are required to file the Oregon Accounting Manual.

How to fill out oregon accounting manual?

The Oregon Accounting Manual can be filled out by following the guidelines provided in the manual, which include instructions on reporting financial information, completing forms, and submitting required documentation.

What is the purpose of oregon accounting manual?

The purpose of the Oregon Accounting Manual is to ensure consistency in accounting practices across entities in Oregon and to provide a standard framework for financial reporting.

What information must be reported on oregon accounting manual?

The Oregon Accounting Manual requires entities to report financial information such as revenues, expenses, assets, liabilities, and fund balances.

How can I manage my oregon accounting manual directly from Gmail?

oregon accounting manual and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I modify oregon accounting manual without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your oregon accounting manual into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send oregon accounting manual to be eSigned by others?

oregon accounting manual is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Fill out your oregon accounting manual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oregon Accounting Manual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.