Get the free Interest - Working Capital

Show details

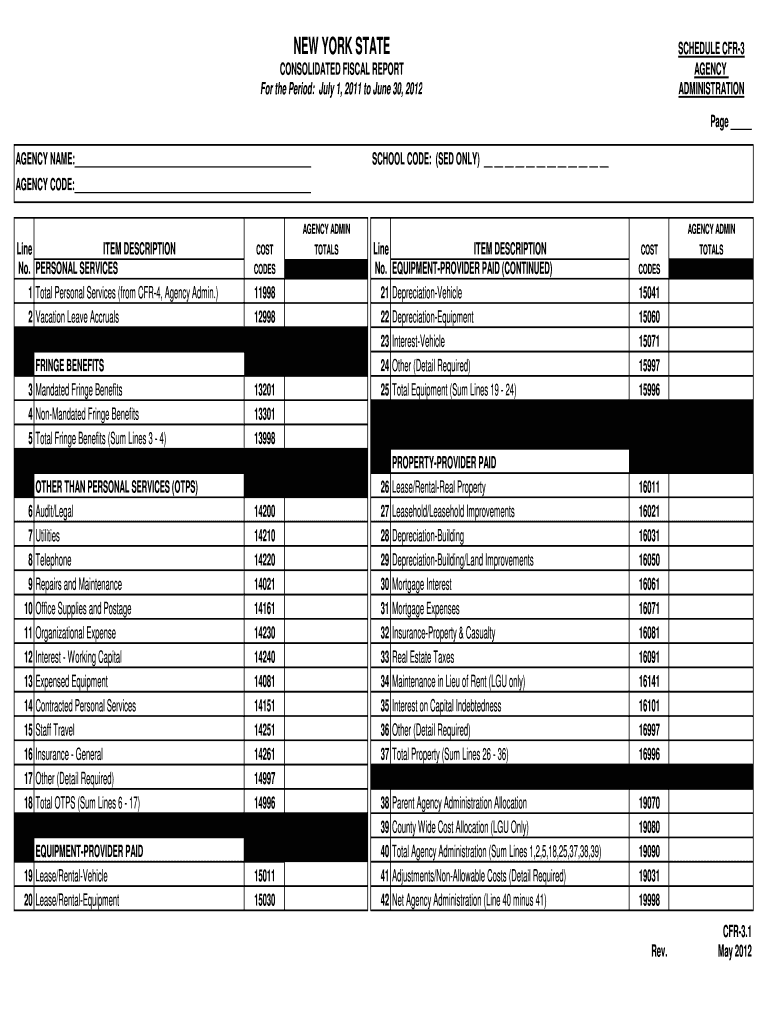

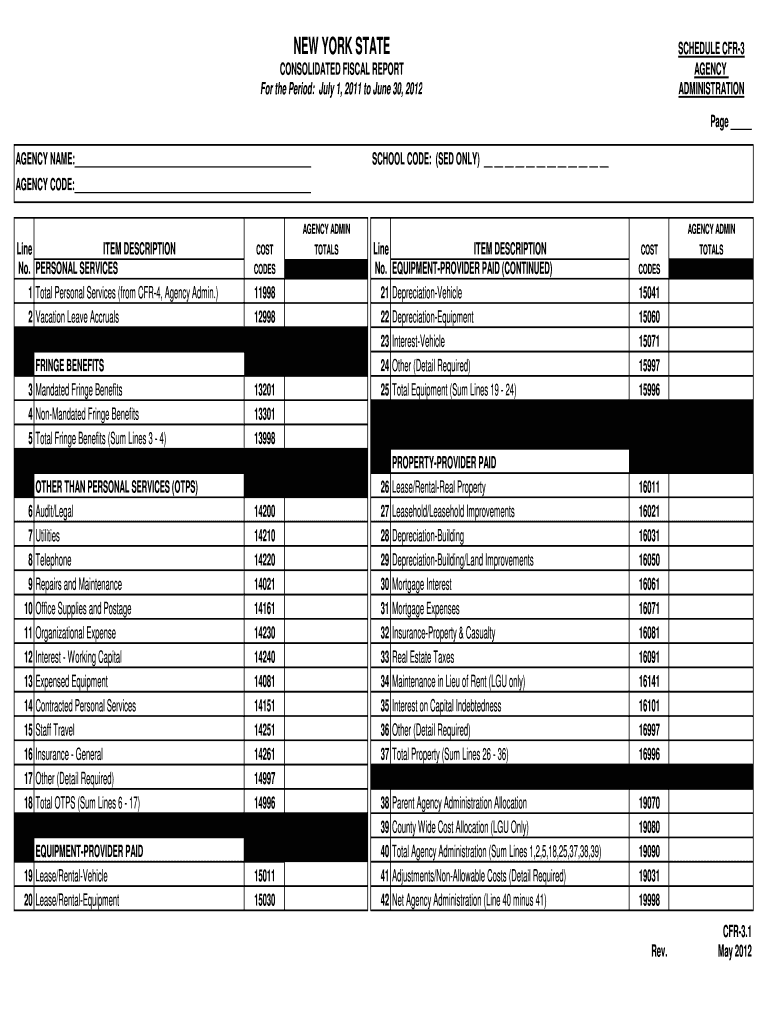

NEW YORK STATESCHEDULE CFR3 AGENCY ADMINISTRATIONCONSOLIDATED FISCAL REPORT For the Period: July 1, 2011, to June 30, 2012Page AGENCY NAME: SCHOOL CODE: (USED ONLY) AGENCY CODE: AGENCY Airline ITEM

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign interest - working capital

Edit your interest - working capital form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your interest - working capital form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing interest - working capital online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit interest - working capital. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out interest - working capital

How to fill out interest - working capital

01

To fill out interest - working capital, follow these steps:

02

Gather all necessary financial information such as current assets, current liabilities, revenue, expenses, and cash flow.

03

Determine the working capital requirement by subtracting current liabilities from current assets.

04

Analyze the cash flow patterns to understand any fluctuations or gaps that need to be addressed.

05

Identify potential sources of working capital financing such as loans, lines of credit, or trade credit.

06

Evaluate the terms and conditions of the available financing options, including interest rates, repayment terms, and collateral requirements.

07

Compare and select the most suitable working capital financing option based on your business needs and financial capabilities.

08

Fill out the necessary application forms and provide all required documentation for the chosen financing option.

09

Review and double-check the completed application before submission.

10

Submit the filled-out interest - working capital application to the respective financial institution or lender.

11

Follow up with the lender if needed and be prepared to provide any additional information or clarifications.

12

Once approved, carefully review the terms and conditions of the working capital financing agreement before accepting it.

13

Use the funds wisely and monitor your working capital closely to ensure it remains optimized and sufficient for your business operations.

Who needs interest - working capital?

01

Interest - working capital is needed by various individuals and businesses, including:

02

- Small and medium-sized enterprises (SMEs) who may face temporary cash flow constraints or need funds for day-to-day operations.

03

- Startups and entrepreneurs who require capital to launch their businesses or sustain initial growth.

04

- Seasonal businesses that experience fluctuations in revenue and need additional funds during slower periods.

05

- Businesses undergoing expansion or significant changes, such as mergers or acquisitions, that require additional working capital.

06

- Companies facing unexpected expenses or financial challenges that require immediate funding.

07

- Individuals or organizations looking to invest in short-term opportunities with the aim of generating returns.

08

- Any entity that wants to maintain a healthy cash flow and ensure smooth operations by having sufficient working capital.

09

Interest - working capital plays a crucial role in supporting the financial stability and growth of these entities by providing necessary funds to cover operational expenses, manage inventory, meet short-term liabilities, and seize growth opportunities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit interest - working capital from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including interest - working capital, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in interest - working capital?

The editing procedure is simple with pdfFiller. Open your interest - working capital in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out interest - working capital on an Android device?

Use the pdfFiller mobile app to complete your interest - working capital on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is interest - working capital?

Interest on working capital refers to the cost incurred by a business for borrowing funds needed to cover short-term operational expenses. It is the charge for using borrowed money to ensure smooth business operations.

Who is required to file interest - working capital?

Businesses that borrow funds specifically for working capital purposes are typically required to file interest - working capital. This includes small businesses, corporations, and partnerships that utilize loans or credit lines to finance their day-to-day operations.

How to fill out interest - working capital?

To fill out interest - working capital, businesses must provide detailed information about their borrowings, including the amount borrowed, the interest rate, terms of the loan, and how the funds were used for working capital purposes. Ensure all calculations of interest expense are accurate and properly documented.

What is the purpose of interest - working capital?

The purpose of interest - working capital is to track and report the cost of financing day-to-day operations through borrowing. It helps businesses understand their financial obligations and assists in budgeting and financial planning.

What information must be reported on interest - working capital?

Information that must be reported includes the total amount of working capital borrowed, interest rates, the purpose of the funds, the duration of the loans, payment schedules, and the total interest paid during the reporting period.

Fill out your interest - working capital online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Interest - Working Capital is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.