Get the free Ten Year Savings Plan Application - Metfriendly

Show details

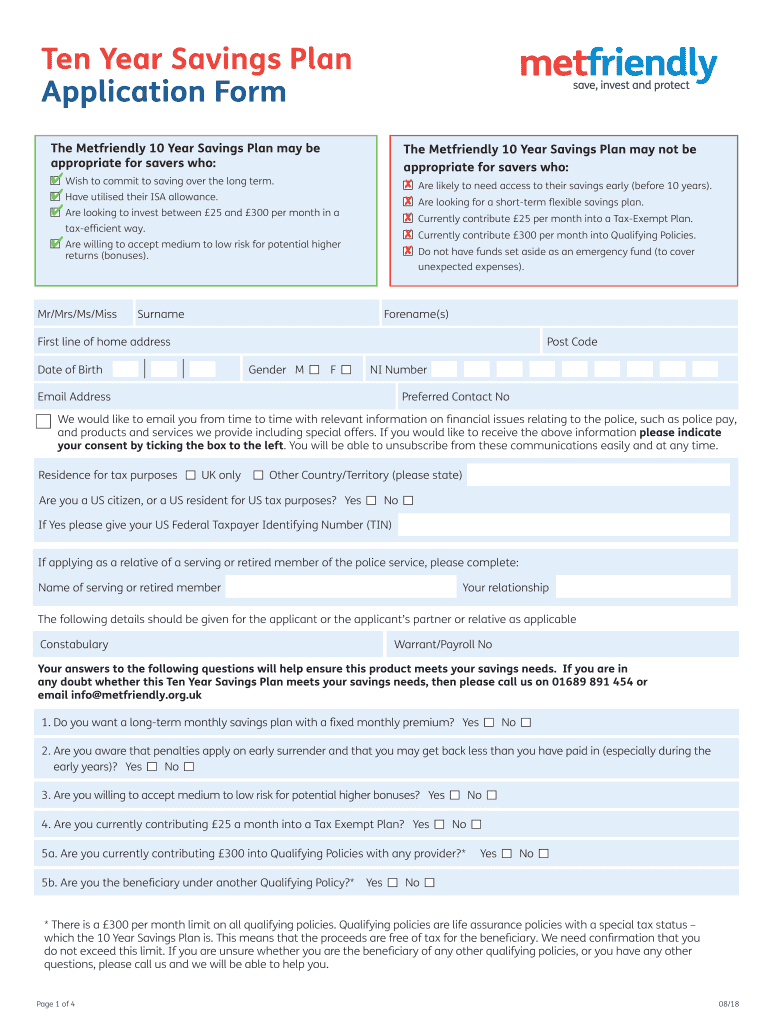

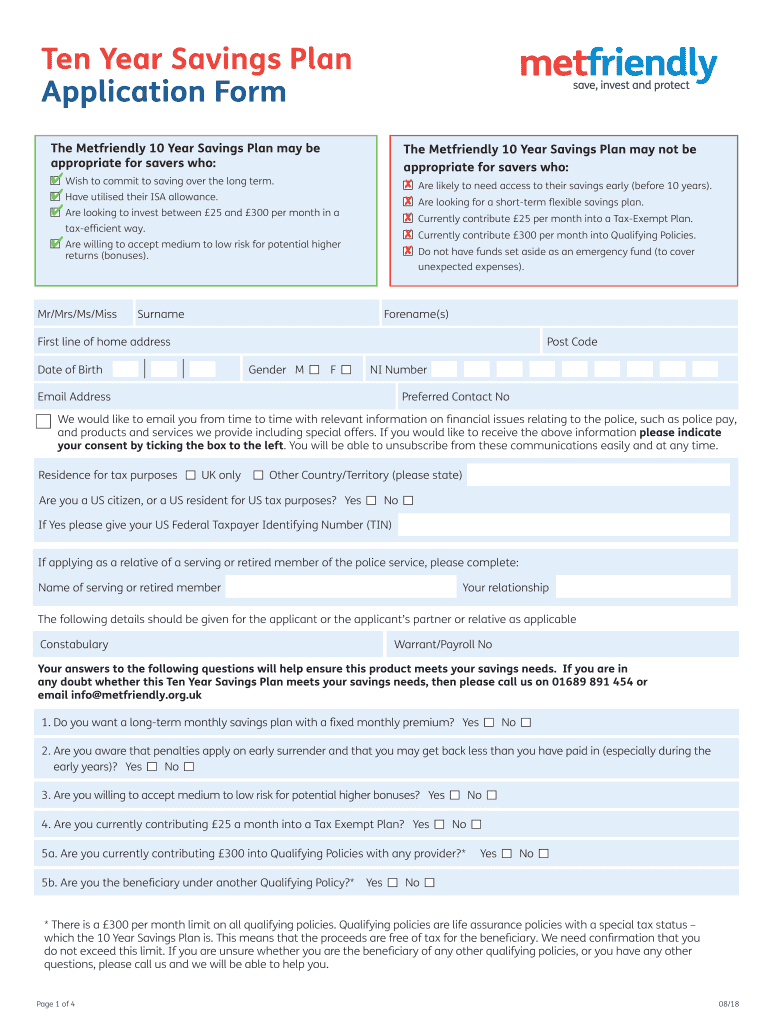

Ten Year Savings Plan Application Form The Met friendly 10 Year Savings Plan may be appropriate for savers who:The Met friendly 10 Year Savings Plan may not be appropriate for savers who:4 Wish to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ten year savings plan

Edit your ten year savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ten year savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ten year savings plan online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ten year savings plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ten year savings plan

How to fill out ten year savings plan

01

Step 1: Determine your financial goals for the next ten years. This could include saving for a down payment on a house, planning for retirement, or saving for a child's education.

02

Step 2: Calculate your current income and expenses to understand how much you can save each month. Consider cutting back on unnecessary expenses to increase your savings.

03

Step 3: Research different savings options such as savings accounts, mutual funds, or individual retirement accounts (IRAs). Compare interest rates, fees, and accessibility to find the best option for your needs.

04

Step 4: Set a realistic savings target for each year. Divide your total savings goal by ten to determine how much you need to save annually.

05

Step 5: Create a budget to track your income and expenses. This will help you stay on track with your savings plan and identify areas where you can save more.

06

Step 6: Automate your savings by setting up automatic transfers from your checking account to your chosen savings account. This will ensure consistent savings without having to manually transfer funds each month.

07

Step 7: Periodically review and adjust your savings plan. Life circumstances and financial goals may change over time, so it's important to reassess and make necessary adjustments.

08

Step 8: Stay disciplined and committed to your savings plan. Avoid dipping into your savings unless it's for planned expenses or emergencies.

09

Step 9: Monitor your progress regularly. Track how close you are to reaching your savings goals and celebrate small victories along the way.

10

Step 10: Seek professional advice if needed. A financial advisor can provide guidance and expertise to help you optimize your savings plan.

11

Remember, consistency and patience are key when filling out a ten year savings plan. Stay focused on your goals and make saving a priority!

Who needs ten year savings plan?

01

Anyone who wants to achieve specific financial goals in the next ten years can benefit from a ten year savings plan.

02

Individuals who are planning for major life events such as buying a house, starting a family, or retiring may find a ten year savings plan useful.

03

Students who are saving for their higher education expenses can also benefit from a ten year savings plan.

04

Entrepreneurs or individuals interested in starting their own business may need a ten year savings plan to accumulate startup funds.

05

Those who want to have a secure financial future and build wealth over time can benefit greatly from a ten year savings plan.

06

Having a ten year savings plan provides structure and discipline in managing one's finances, making it suitable for almost anyone who wants to achieve long-term financial stability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ten year savings plan online?

pdfFiller has made it easy to fill out and sign ten year savings plan. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit ten year savings plan straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing ten year savings plan, you can start right away.

How do I edit ten year savings plan on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share ten year savings plan on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is ten year savings plan?

A ten year savings plan is a financial strategy designed to help individuals or families accumulate savings over a period of ten years, typically for specific goals such as retirement, education, or major purchases.

Who is required to file ten year savings plan?

Individuals or entities that set up a ten year savings plan to save for specific long-term financial goals are typically required to file any necessary documentation related to the plan, depending on the financial institution or regulatory requirements.

How to fill out ten year savings plan?

To fill out a ten year savings plan, one typically needs to provide personal information, define financial goals, choose savings instruments, and set a contribution schedule. It may also require filling out specific forms provided by financial institutions.

What is the purpose of ten year savings plan?

The purpose of a ten year savings plan is to enable individuals to systematically save and grow their funds over a decade to achieve significant financial goals, thereby promoting financial discipline and long-term planning.

What information must be reported on ten year savings plan?

Information that must be reported on a ten year savings plan generally includes account details, contribution amounts, projected growth, financial goals, and any changes to the plan over time.

Fill out your ten year savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ten Year Savings Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.