Get the free Occupational Tax LicensingMorgan County, GA - Official ...

Show details

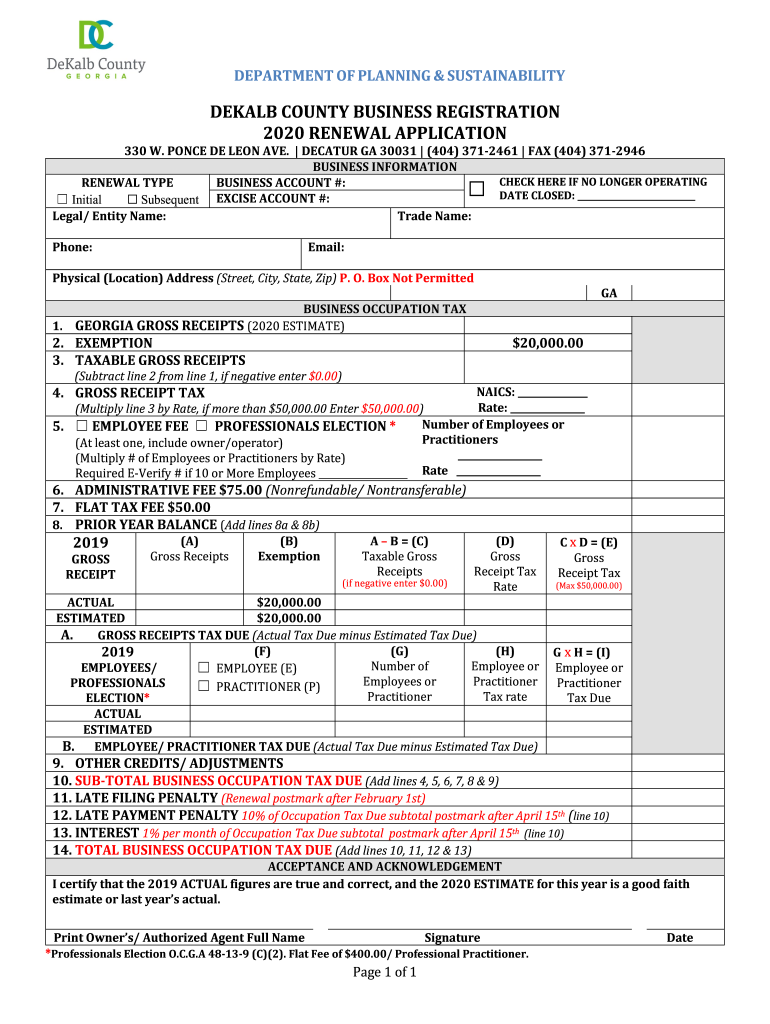

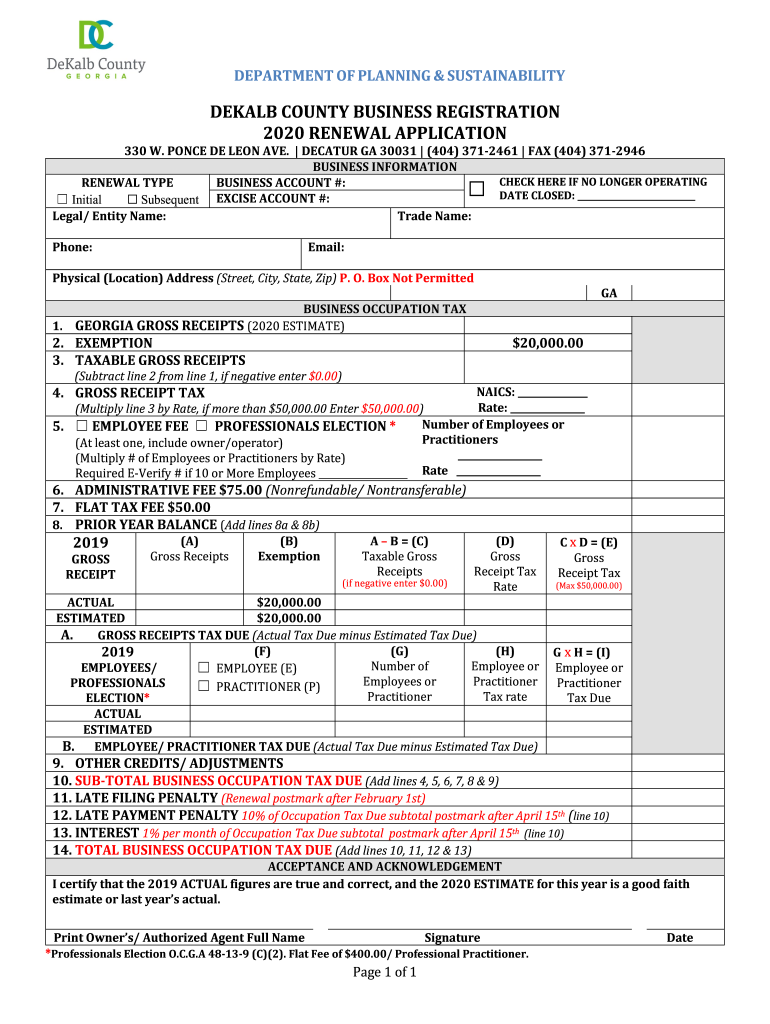

DEPARTMENT OF PLANNING & SUSTAINABILITYDEKALB COUNTY BUSINESS REGISTRATION 2020 RENEWAL APPLICATION330 W. PONCE DE LEON AVE. DECATUR GA 30031 (404) 3712461 FAX (404) 3712946 BUSINESS INFORMATION CHECK

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign occupational tax licensingmorgan county

Edit your occupational tax licensingmorgan county form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your occupational tax licensingmorgan county form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit occupational tax licensingmorgan county online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit occupational tax licensingmorgan county. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out occupational tax licensingmorgan county

How to fill out occupational tax licensingmorgan county

01

To fill out the occupational tax licensing for Morgan County, follow these steps:

02

Obtain the necessary forms from the County's official website or from the local tax office.

03

Fill in the personal information section accurately, including your name, contact details, and business information.

04

Provide details about the type of business you intend to operate and its location.

05

Specify the nature of your business activities and the estimated gross receipts or revenue.

06

Attach any supporting documents or certificates required by the County, such as a certificate of insurance or a professional license.

07

Calculate the occupational tax owed based on the applicable rates and fee schedule provided by the County.

08

Submit the completed forms along with any required fees to the designated office or mailing address.

09

Await confirmation from the County regarding the approval and issuance of your occupational tax license.

10

Display the license prominently at your place of business as required by law.

11

Ensure timely renewal of your occupational tax license as per the County's regulations.

Who needs occupational tax licensingmorgan county?

01

Anyone who intends to engage in business activities within Morgan County is required to obtain an occupational tax license.

02

This applies to both individuals and entities, including sole proprietors, partnerships, corporations, and LLCs.

03

Whether you operate a physical storefront, provide professional services, or conduct online commerce, you must comply with the occupational tax licensing requirements.

04

Failure to obtain and maintain the license may result in penalties, fines, or legal consequences.

05

It is advisable to consult the specific regulations and guidelines provided by Morgan County for further clarity and accurate determination of who needs an occupational tax license.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the occupational tax licensingmorgan county in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your occupational tax licensingmorgan county right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out occupational tax licensingmorgan county using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign occupational tax licensingmorgan county and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete occupational tax licensingmorgan county on an Android device?

Complete occupational tax licensingmorgan county and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is occupational tax licensing Morgan County?

Occupational tax licensing in Morgan County refers to the process through which individuals and businesses obtain licenses to operate legally within the county. This licensing typically involves paying an occupational tax, which is a form of local tax levied on the practice of certain professions or business activities.

Who is required to file occupational tax licensing Morgan County?

Individuals and businesses engaged in specific occupations or trade activities within Morgan County are required to file for an occupational tax license. This includes self-employed individuals, freelancers, and business entities operating within the geographical boundaries of Morgan County.

How to fill out occupational tax licensing Morgan County?

To fill out the occupational tax licensing application in Morgan County, applicants must obtain the necessary forms from the county's local government website or office. The form typically requires personal information, business details, and the nature of the work being performed. After completing the form, it should be submitted along with any required fees to the appropriate county office.

What is the purpose of occupational tax licensing Morgan County?

The purpose of occupational tax licensing in Morgan County is to regulate and monitor business activities, ensure compliance with local laws and regulations, provide a means for the collection of taxes, and promote public safety. It also helps the county maintain an up-to-date record of businesses operating within its jurisdiction.

What information must be reported on occupational tax licensing Morgan County?

Applicants must report detailed information including their name, business name, contact information, type of business or profession, physical business address, and relevant identification numbers (such as Social Security number or Employer Identification Number). Additional documentation may also be required depending on the type of business.

Fill out your occupational tax licensingmorgan county online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Occupational Tax Licensingmorgan County is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.