Get the free Transfer on Death Agreement - Chase Bank

Show details

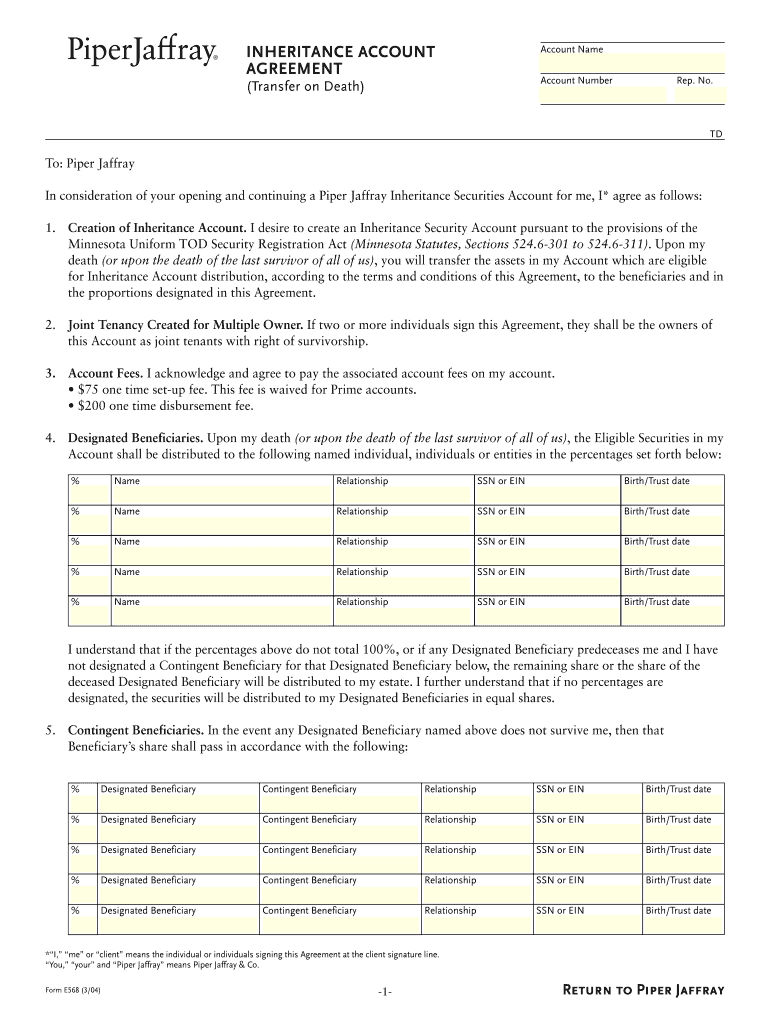

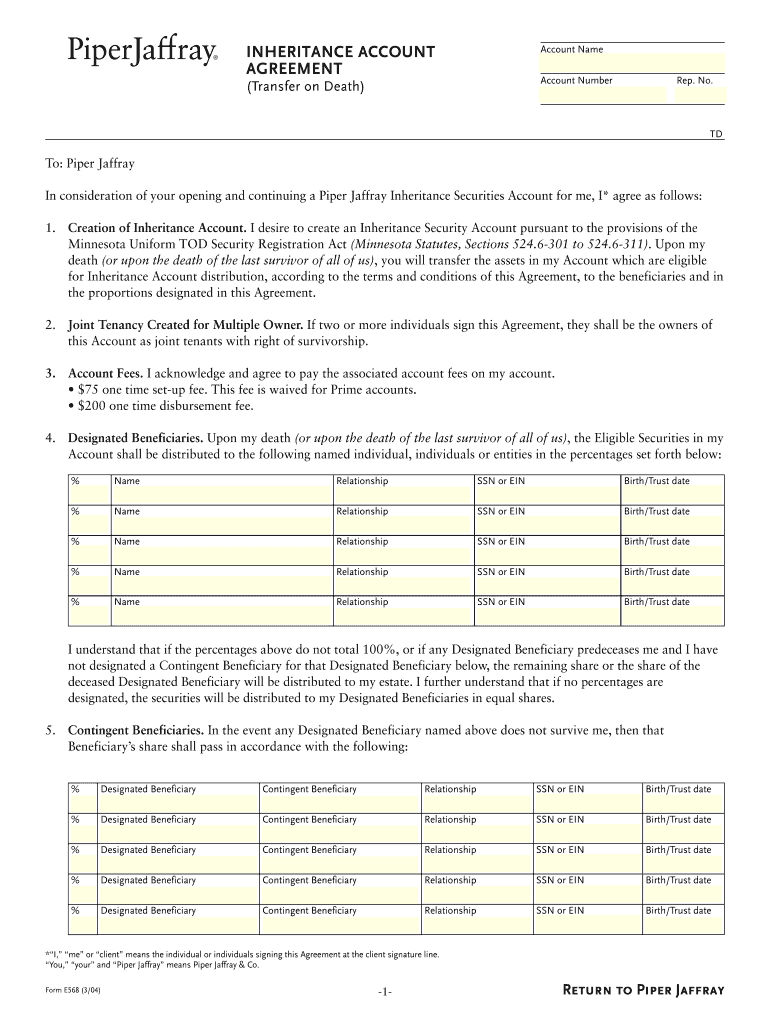

NOTE: THE ATTACHED DISCLOSURE STATEMENT (FORM E569) IS REQUIRED TO ACCOMPANY THE ACCOUNT AGREEMENT.INHERITANCE ACCOUNT

AGREEMENTAccount Name(Transfer on Death)Account NumberComplete online, print,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transfer on death agreement

Edit your transfer on death agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transfer on death agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing transfer on death agreement online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit transfer on death agreement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transfer on death agreement

How to fill out transfer on death agreement

01

To fill out a transfer on death agreement, follow these steps:

02

Obtain the necessary form: Contact the relevant financial institution or consult an attorney to obtain the transfer on death agreement form.

03

Provide personal information: Fill in your full name, address, and contact details as the account owner.

04

Designate beneficiaries: List the full names and contact information of the individuals or organizations who will receive the assets upon your death. Specify their relationship to you, such as spouse, child, or charity.

05

Add contingent beneficiaries: Optionally, indicate alternate beneficiaries to receive the assets if the primary beneficiaries predecease you.

06

Determine percentage allocation: Specify the percentage or fractional share of the assets that each beneficiary will receive.

07

Signature and date: Sign and date the transfer on death agreement, and include any required witnesses or notarization.

08

Submit the form: Return the completed form to the financial institution or file it with the appropriate county or state office, if necessary.

09

It is recommended to consult with an attorney or financial advisor during the process to ensure accuracy and compliance with legal requirements.

Who needs transfer on death agreement?

01

Transfer on death agreements can be beneficial for individuals who want to avoid probate and ensure a smooth transfer of their assets to chosen beneficiaries upon their death.

02

Specifically, the following individuals may consider using transfer on death agreements:

03

- Individuals with valuable financial accounts, such as savings accounts, investment accounts, or retirement accounts.

04

- Property owners who want to transfer real estate to specific individuals or organizations.

05

- Parents or guardians who want to pass on assets to their children or other dependents.

06

- Individuals who want to provide for a charitable cause or organization after their passing.

07

It is recommended to consult with an attorney or financial advisor for personalized advice on whether a transfer on death agreement is suitable for your individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in transfer on death agreement?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your transfer on death agreement to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How can I edit transfer on death agreement on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing transfer on death agreement right away.

How do I complete transfer on death agreement on an Android device?

Complete transfer on death agreement and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is transfer on death agreement?

A transfer on death agreement is a legal document that allows an individual to designate beneficiaries to receive their assets or property upon their death, bypassing the probate process.

Who is required to file transfer on death agreement?

Generally, individuals who own real estate or specific assets and wish to transfer them directly to beneficiaries upon their death must file a transfer on death agreement.

How to fill out transfer on death agreement?

To fill out a transfer on death agreement, an individual must provide their personal information, the details of the asset or property, and the names and contact information of the designated beneficiaries. It is recommended to have the document notarized.

What is the purpose of transfer on death agreement?

The purpose of a transfer on death agreement is to ensure a smooth transfer of assets to beneficiaries upon the death of the owner, while avoiding the often lengthy and costly probate process.

What information must be reported on transfer on death agreement?

The information that must be reported includes the owner's name, the description of the property or assets being transferred, the names and addresses of the beneficiaries, and the date of the agreement.

Fill out your transfer on death agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transfer On Death Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.