Get the free Use of Credit Card City Court - in

Show details

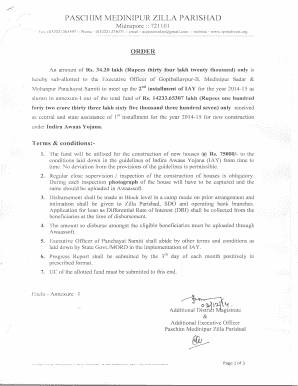

B41673STATE BOARD OF ACCOUNTS

302 West Washington Street

Room E418

INDIANAPOLIS, INDIANA 462042769AUDIT REPORT

OF

CITY COURT

CITY OF GARY

LAKE COUNTY, INDIANA

January 1, 2011, to December 31, 2011FILED

01/17/2013TABLE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign use of credit card

Edit your use of credit card form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your use of credit card form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing use of credit card online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit use of credit card. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out use of credit card

How to fill out use of credit card:

01

Gather all necessary information: Before filling out the credit card application, make sure you have all the required information on hand. This may include your personal details, contact information, employment information, and financial information.

02

Choose the right credit card: Research and compare different credit card options to find the one that suits your needs. Consider factors such as interest rates, reward programs, annual fees, and credit limits.

03

Read the application form carefully: Carefully read through the credit card application form to understand all the terms and conditions, fees, and responsibilities associated with the card. Pay attention to the fine print to avoid any surprises later.

04

Provide accurate information: Fill out the application form with accurate and up-to-date information. Ensure that the details you provide match your identification documents and financial records.

05

Understand the credit card terms: Familiarize yourself with the terms of use for the credit card, including the interest rates, payment due dates, grace periods, and penalty fees. This will help you make informed decisions about using the card responsibly.

06

Complete the necessary documentation: Some credit card applications may require additional documentation, such as proof of income or identification. Make sure you have all the required documents ready and attached to the application form.

07

Double-check before submission: Before submitting the application, review all the information you have entered to ensure accuracy. This will help avoid any delays or complications in the approval process.

Who needs use of credit card:

01

Individuals who want to build credit history: Using a credit card responsibly can help individuals establish and build their credit history, which is essential for future loans, mortgages, or other financial endeavors.

02

Frequent travelers: Credit cards often offer travel rewards, such as airline miles or hotel points. This makes them a convenient payment option for individuals who frequently travel and want to earn rewards or enjoy travel-related benefits.

03

Online shoppers: Using a credit card for online purchases provides an added layer of security. Credit cards often offer fraud protection and the ability to dispute charges, making them a safer choice for online transactions.

04

Emergency situations: Having a credit card can provide a financial safety net in case of emergencies. It enables individuals to cover unexpected expenses or handle temporary financial setbacks.

05

Convenience and flexibility: Credit cards offer convenience and flexibility when it comes to making purchases. They can be used for daily expenses, shopping, dining out, and various other transactions without the need for carrying large amounts of cash.

Note: It is important to remember that credit cards should be used responsibly, and individuals should only spend what they can afford to pay off in a timely manner to avoid accumulating debt.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is use of credit card?

The use of a credit card allows individuals to make purchases on credit, which is essentially borrowing money from the credit card issuer.

Who is required to file use of credit card?

Individuals who have used a credit card for purchases or transactions are required to report and document their credit card usage.

How to fill out use of credit card?

To fill out the use of a credit card, individuals need to provide details of their credit card transactions including dates, amounts, and merchants.

What is the purpose of use of credit card?

The purpose of reporting the use of a credit card is to track expenses, monitor spending habits, and manage financial records.

What information must be reported on use of credit card?

Information such as transaction dates, amounts, merchants, and any additional fees or charges must be reported on the use of a credit card.

How can I modify use of credit card without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your use of credit card into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send use of credit card to be eSigned by others?

use of credit card is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out use of credit card using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign use of credit card and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your use of credit card online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Use Of Credit Card is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.