Get the free Investment Option or Allocation Change Form - ABLE United

Show details

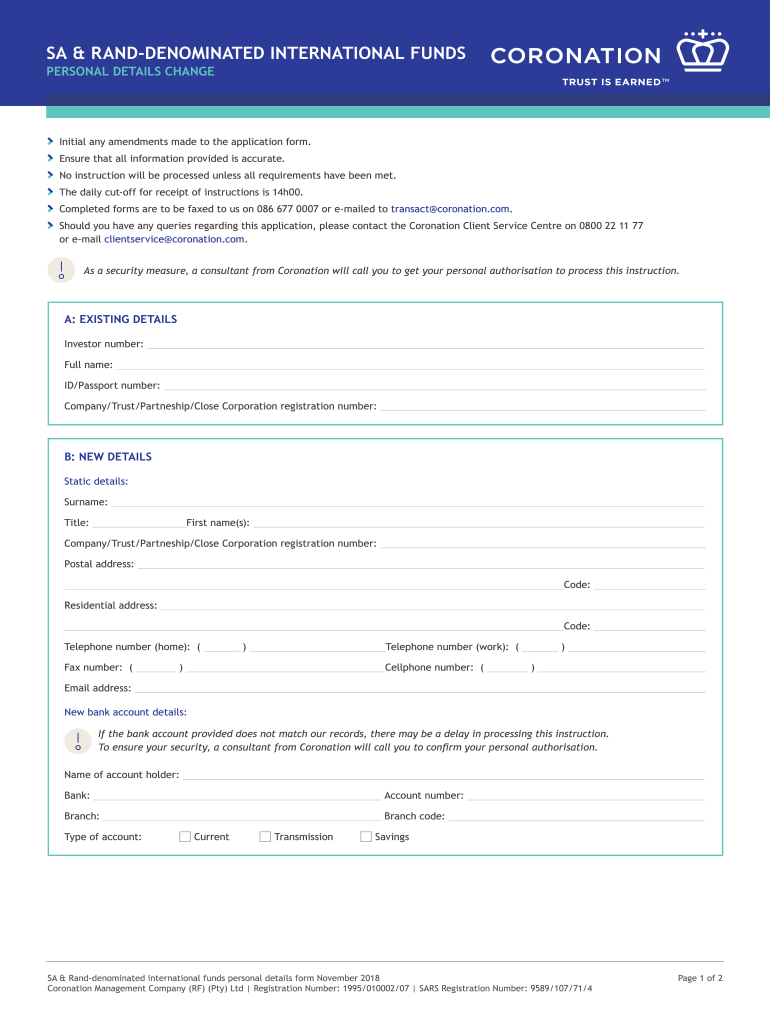

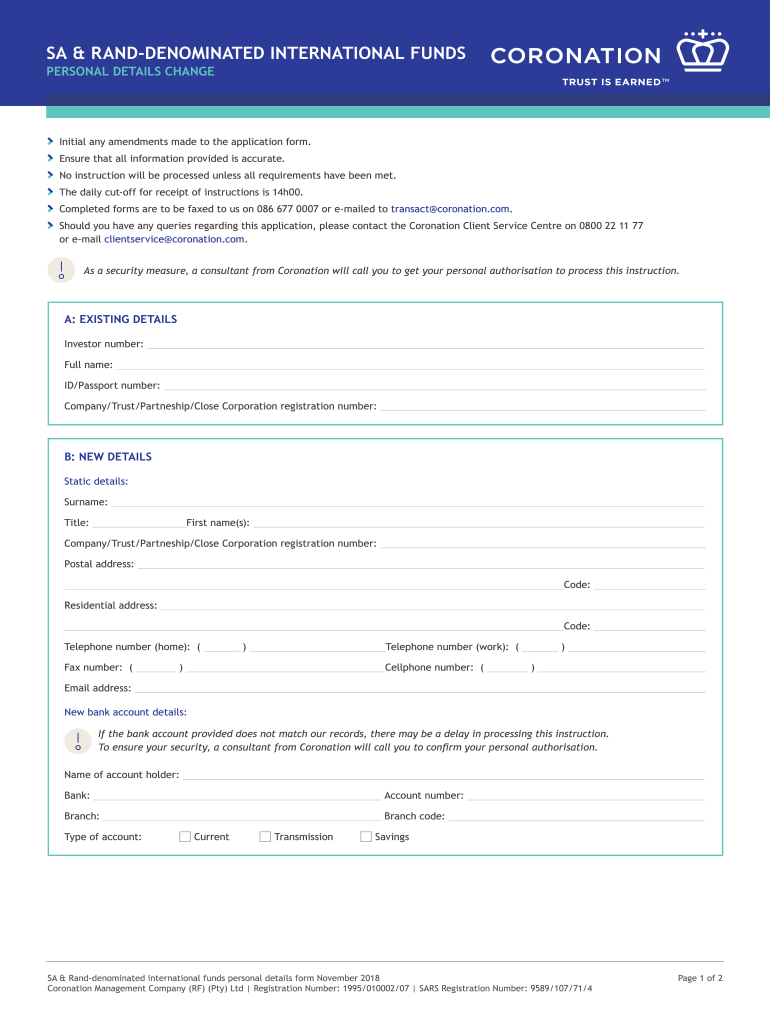

SA & RANDDENOMINATED INTERNATIONAL FUNDS PERSONAL DETAILS CHANGEInitial any amendments made to the application form. Ensure that all information provided is accurate. No instruction will be processed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investment option or allocation

Edit your investment option or allocation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investment option or allocation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit investment option or allocation online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit investment option or allocation. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out investment option or allocation

How to fill out investment option or allocation

01

To fill out investment option or allocation, follow these steps:

02

Start by assessing your financial goals and risk tolerance. Determine how much you can afford to invest and the level of risk you are comfortable with.

03

Research different investment options and understand their potential risks and returns. This can include stocks, bonds, mutual funds, ETFs, real estate, or other assets.

04

Consider diversifying your investment portfolio to reduce risk. Allocate your funds across different assets or sectors to avoid overexposure to a single investment.

05

Set a target allocation for each investment option based on your goals and risk tolerance. This could be expressed as a percentage of your total portfolio.

06

Open an investment account with a reputable financial institution or brokerage firm.

07

Fill out the necessary forms and provide any required information or documentation.

08

Consult with a financial advisor if needed to discuss your investment strategy and get professional advice.

09

Review your investment option or allocation periodically and make adjustments as needed based on market conditions or changes in your financial goals.

10

Stay informed about the performance of your investments and the overall market to make informed decisions.

11

Monitor and rebalance your portfolio periodically to maintain your desired investment allocation.

Who needs investment option or allocation?

01

Investment option or allocation is beneficial for:

02

- Individuals who want to grow their wealth over time.

03

- Investors looking to diversify their portfolio and reduce risk.

04

- Those who have specific financial goals, such as retirement planning or saving for a major purchase.

05

- People who are willing to take on some level of risk for potentially higher returns.

06

- Anyone looking to make their money work for them by generating passive income or capital appreciation.

07

- Individuals seeking to protect their assets against inflation and preserve purchasing power.

08

- Those who want to take advantage of tax benefits offered through certain investment options.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit investment option or allocation from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including investment option or allocation, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in investment option or allocation?

With pdfFiller, the editing process is straightforward. Open your investment option or allocation in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out investment option or allocation on an Android device?

Complete investment option or allocation and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is investment option or allocation?

Investment option or allocation refers to the specific choices or distribution of assets that an investor selects within a financial account or portfolio, determining how funds are invested among different assets, such as stocks, bonds, or mutual funds.

Who is required to file investment option or allocation?

Individuals or organizations that have investment accounts or funds that require reporting of asset allocation, such as retirement accounts or certain brokerage accounts, are typically required to file investment option or allocation.

How to fill out investment option or allocation?

To fill out an investment option or allocation, the filer typically needs to provide details regarding their investment choices, including the types of assets selected, the percentage allocated to each option, and any relevant account information. This may be done through a specific form provided by financial institutions or regulatory bodies.

What is the purpose of investment option or allocation?

The purpose of investment option or allocation is to allow investors to specify how their investment funds are distributed among different options, thereby aligning their investments with their financial goals, risk tolerance, and investment strategies.

What information must be reported on investment option or allocation?

Typically, the information that must be reported includes the types of investment options selected, the amount or percentage allocated to each option, account identification details, and any changes made to the investment allocation during the reporting period.

Fill out your investment option or allocation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investment Option Or Allocation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.