UMD ESSIC AppointmentEmployee Data Collection Form free printable template

Show details

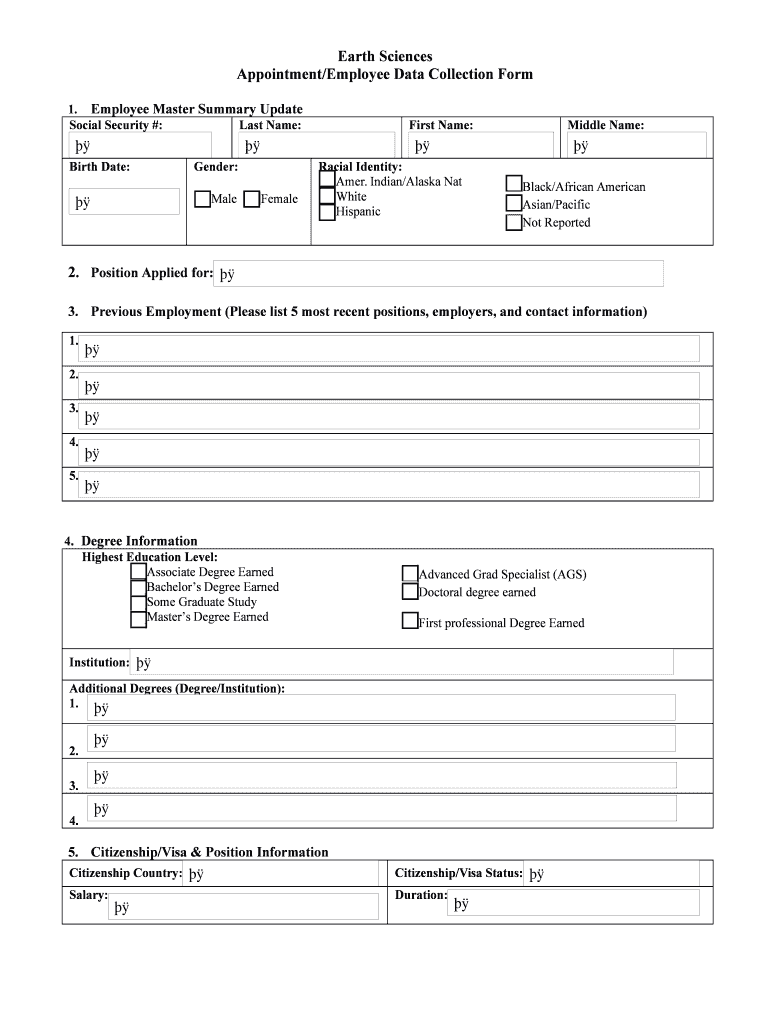

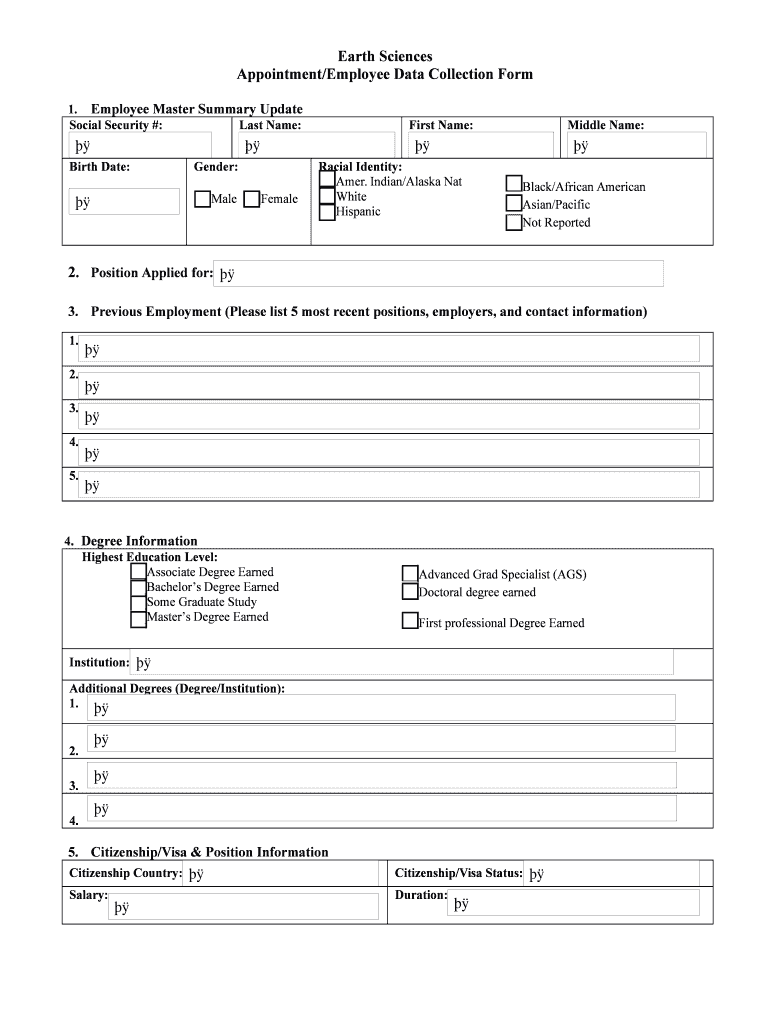

Earth Sciences

Appointment/Employee Data Collection Form

1. Employee Master Summary Update

Social Security #:

Last Name:

Birth Date:Gender:

MaleFemaleFirst Name:

Racial Identity:

Amer. Indian/Alaska

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign az1 to az70 websiiteincome

Edit your az1 to az70 websiiteincome form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your az1 to az70 websiiteincome form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit az1 to az70 websiiteincome online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit az1 to az70 websiiteincome. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out az1 to az70 websiiteincome

How to fill out az1 to az70 websiiteincome

01

To fill out the az1 to az70 websiiteincome, follow these steps:

1. Open the az1 to az70 websiiteincome form on your computer.

02

Provide your personal information such as name, address, and contact details in the designated fields.

03

Enter your website income details from az1 to az70 in the respective fields provided. Make sure to accurately report the income for each website.

04

Include any additional information or details required by the form, such as expenses or deductions related to the website income.

05

Double-check all the information you have entered to ensure accuracy and completeness.

06

Once you are satisfied with the entries, submit the filled-out form either electronically or by mail, as per the instructions provided.

Who needs az1 to az70 websiiteincome?

01

Anyone who generates income from multiple websites can benefit from az1 to az70 websiiteincome. It is specifically designed for individuals or entities who operate and earn income from multiple websites.

02

This form helps in organizing and reporting website income, providing a consolidated view of the earnings from different websites.

03

It is useful for individuals, freelancers, small business owners, or anyone else who earns income through various websites and needs to report it for taxation or other purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the az1 to az70 websiiteincome electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your az1 to az70 websiiteincome in seconds.

Can I create an electronic signature for signing my az1 to az70 websiiteincome in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your az1 to az70 websiiteincome right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit az1 to az70 websiiteincome straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing az1 to az70 websiiteincome.

What is az1 to az70 websiiteincome?

Az1 to az70 website income refers to a set of tax forms or reports related to income generated from websites or online activities. These forms are used for reporting various income streams associated with web-based platforms.

Who is required to file az1 to az70 websiiteincome?

Individuals and businesses that generate income through websites, including e-commerce stores, affiliate marketing, and blogging, are required to file az1 to az70 website income based on their revenue thresholds and local tax regulations.

How to fill out az1 to az70 websiiteincome?

To fill out az1 to az70 website income, gather all income data from your online activities, complete the required forms with accurate financial information, ensure all sections are filled out clearly, and submit the forms to the appropriate tax authority.

What is the purpose of az1 to az70 websiiteincome?

The purpose of az1 to az70 website income forms is to ensure that individuals and businesses correctly report and pay taxes on income earned through their online ventures, thus contributing to the tax system.

What information must be reported on az1 to az70 websiiteincome?

Information that must be reported on az1 to az70 website income includes total income earned, sources of income, expenses related to website operation, and any deductions that may apply.

Fill out your az1 to az70 websiiteincome online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

az1 To az70 Websiiteincome is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.