Get the free State Licenses - Bank of England Mortgage

Show details

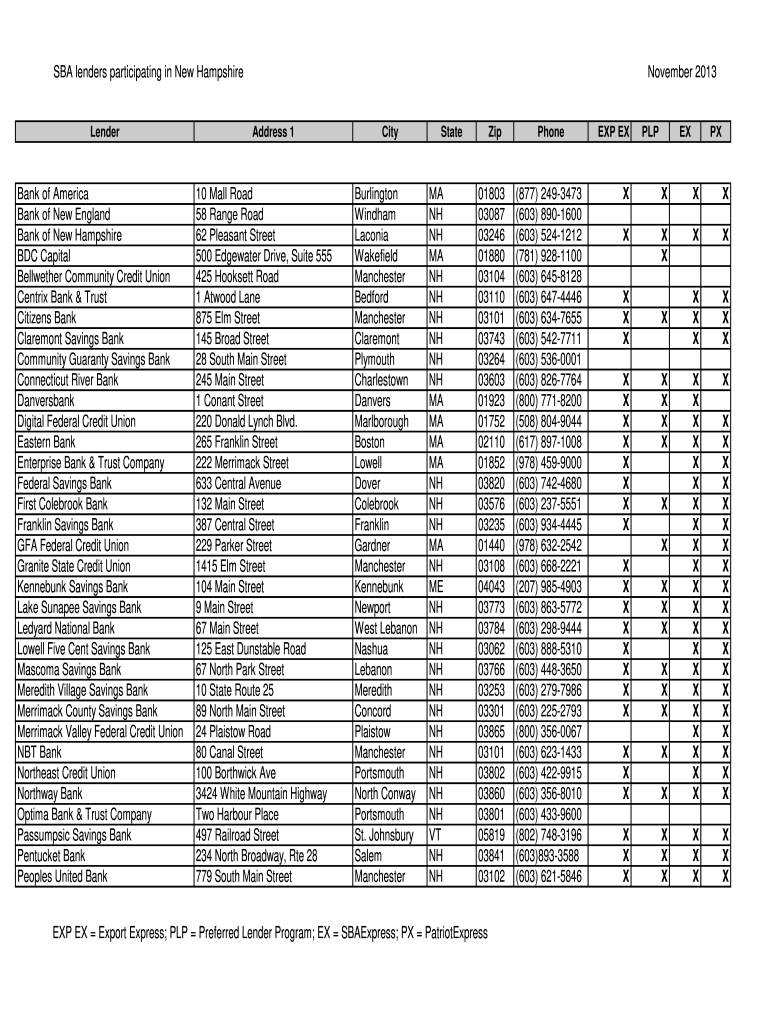

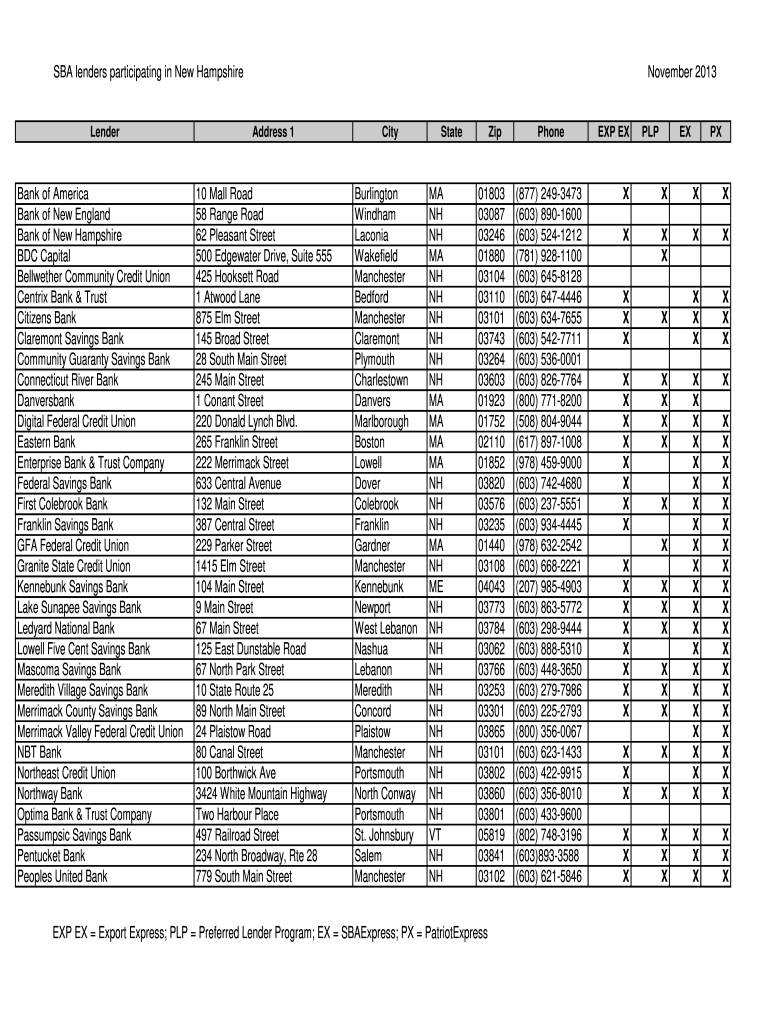

SBA lenders participating in New HampshireLenderBank of America Bank of New England Bank of New Hampshire BDC Capital Bellwether Community Credit Union Centric Bank & Trust Citizens Bank Claremont

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state licenses - bank

Edit your state licenses - bank form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state licenses - bank form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing state licenses - bank online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit state licenses - bank. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state licenses - bank

How to fill out state licenses - bank

01

Research the specific state license requirements for banks in the state you are operating in. Each state may have different requirements, so it is important to understand what documents and information you will need to provide.

02

Gather all the necessary documents and information. This may include financial statements, business plans, proof of capital, criminal background checks for key personnel, and other relevant information.

03

Complete the application form for the state license. Make sure to provide accurate and complete information as requested.

04

Pay the required fees for the application. The fees may vary depending on the state.

05

Submit the completed application and all supporting documents to the appropriate state agency responsible for licensing banks.

06

Wait for the state agency to review and process your application. This may take some time, so be patient.

07

If your application is approved, you will receive your state license. Make sure to comply with any additional requirements or conditions set by the state.

08

Once you have obtained the state license, you can start operating as a bank within that state. Make sure to follow all applicable laws and regulations to maintain your license.

Who needs state licenses - bank?

01

Banks or financial institutions planning to operate within a specific state need state licenses. Each state has its own regulations and requirements for licensing banks. Therefore, any entity that wants to provide banking services such as accepting deposits, offering loans, processing payments, and maintaining financial accounts must obtain a state license. The specific criteria for who needs a state license may vary depending on the state laws and regulations. It is important to consult with legal experts or regulatory agencies to determine if a state license is required for a specific banking operation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get state licenses - bank?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the state licenses - bank in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I execute state licenses - bank online?

With pdfFiller, you may easily complete and sign state licenses - bank online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How can I edit state licenses - bank on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing state licenses - bank.

What is state licenses - bank?

State licenses for banks are permissions granted by state regulatory authorities that allow banks to operate within a specific state. These licenses ensure that banks comply with state laws and regulations.

Who is required to file state licenses - bank?

All banks and financial institutions operating within a state are required to file for state licenses. This includes both established banks and new entities seeking to offer banking services.

How to fill out state licenses - bank?

To fill out state licenses for banks, applicants must complete the designated application form provided by the state regulatory agency, provide necessary documentation, such as financial statements and proof of capital, and pay any required fees.

What is the purpose of state licenses - bank?

The purpose of state licenses for banks is to ensure that they operate in accordance with state laws, provide a regulatory framework for consumer protection, and maintain the stability and integrity of the banking system within the state.

What information must be reported on state licenses - bank?

The information that must be reported on state licenses for banks typically includes the bank's legal name, physical address, contact information, ownership structure, financial condition, and any other details required by the state regulatory authority.

Fill out your state licenses - bank online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Licenses - Bank is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.