Get the free Mortgage Brokerage Licence Application - Commission des services ... - fsco gov on

Show details

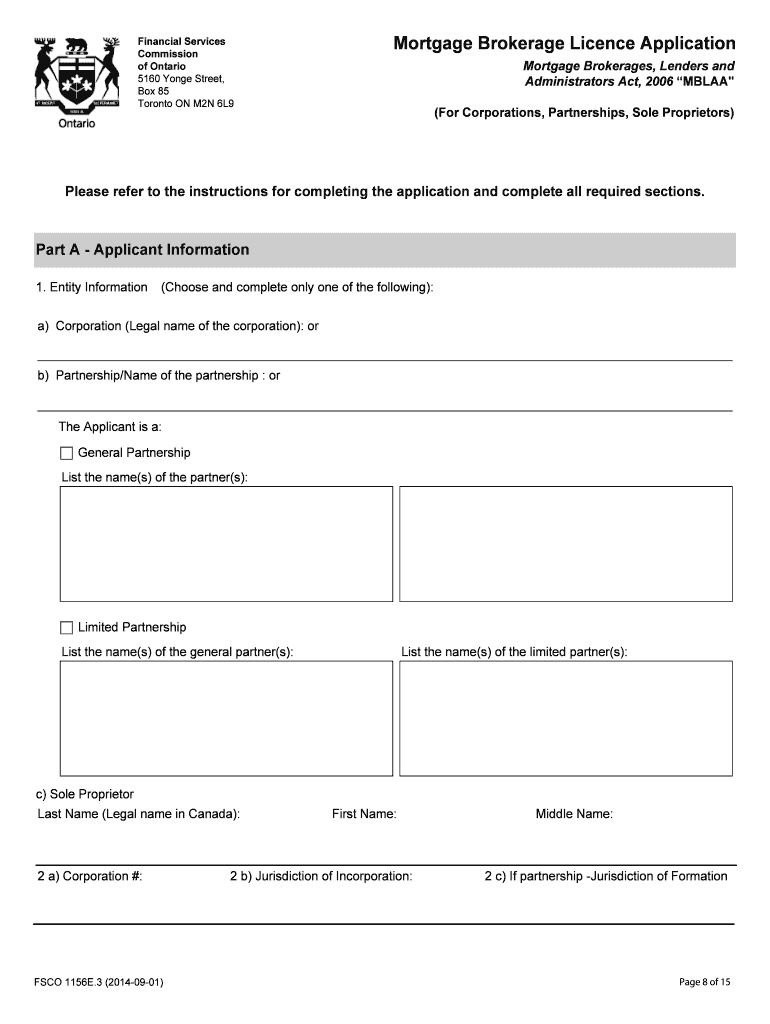

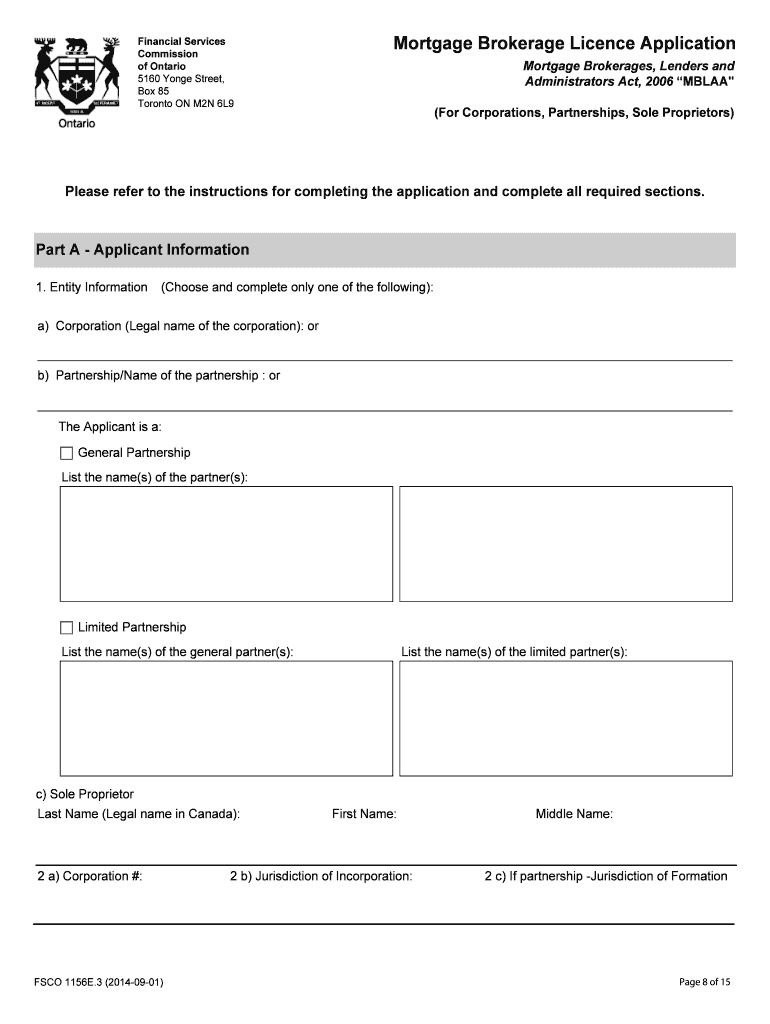

Financial Services Commission of Ontario 5160 Yong Street, Box 85 Toronto ON M2N 6L9 Mortgage Brokerage License Application Mortgage Brokerages, Lenders and Administrators Act, 2006 MBL AA (For Corporations,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage brokerage licence application

Edit your mortgage brokerage licence application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage brokerage licence application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage brokerage licence application online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mortgage brokerage licence application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage brokerage licence application

How to fill out a mortgage brokerage licence application:

01

Gather all necessary documents: Before you begin filling out the application, make sure you have all the required documents ready. This may include identification documents, proof of education or training, financial statements, and any other relevant documents mentioned in the application guidelines.

02

Read and understand the instructions: Carefully go through the instructions provided with the application form. Familiarize yourself with the requirements, deadlines, and any specific guidelines mentioned by the licensing authority. This will help ensure you provide accurate and complete information.

03

Complete personal information: Start by filling in your personal details, such as your name, contact information, Social Security number, and any other required identification information. Double-check for accuracy to avoid any errors.

04

Provide educational and professional background: Include information about your education and any relevant training or certifications you have obtained. Indicate any previous experience in the mortgage industry or related fields. This will help demonstrate your qualifications for obtaining the licence.

05

Disclose criminal background: Typically, licence applications require applicants to disclose any criminal history. Answer truthfully and provide any required documentation, such as court records or police reports, as instructed in the application.

06

Submit financial information: Some licence applications may require you to disclose your financial situation, including details about your assets, liabilities, or income. Fill in this section accurately and provide any necessary supporting documentation.

07

Attach additional documents: As mentioned earlier, there may be additional documents required to support your application, such as proof of insurance coverage, professional references, or business plans. Make sure to include all necessary attachments and organize them as specified in the application guidelines.

08

Review and double-check: Once you have completed the application, take the time to review it carefully. Double-check for any errors, missing information, or inconsistencies. It may be helpful to have someone else review your application as well to ensure its accuracy.

09

Submit the application: Once you are confident that the application is complete and accurate, follow the instructions regarding submission. This may involve mailing it to the licensing authority or submitting it electronically through an online portal. Make sure to meet any deadlines and include any required fees.

Who needs a mortgage brokerage licence application?

Individuals or businesses seeking to engage in mortgage brokerage activities typically require a mortgage brokerage licence application. This includes mortgage brokers, mortgage agents, and mortgage brokerage firms. The licensing process aims to ensure that those involved in the mortgage industry are qualified and meet certain standards, protecting consumers and maintaining the integrity of the industry. The specific requirements for obtaining a mortgage brokerage licence may vary from jurisdiction to jurisdiction. It is essential to research the regulations and licensing requirements set forth by the local regulatory authority to determine if a licence application is necessary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify mortgage brokerage licence application without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your mortgage brokerage licence application into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit mortgage brokerage licence application online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your mortgage brokerage licence application to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for signing my mortgage brokerage licence application in Gmail?

Create your eSignature using pdfFiller and then eSign your mortgage brokerage licence application immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is mortgage brokerage licence application?

A mortgage brokerage licence application is a formal request to obtain a licence to operate a mortgage brokerage business.

Who is required to file mortgage brokerage licence application?

Individuals or companies looking to operate a mortgage brokerage business are required to file a mortgage brokerage licence application.

How to fill out mortgage brokerage licence application?

To fill out a mortgage brokerage licence application, applicants must provide detailed information about their business, financial status, and background.

What is the purpose of mortgage brokerage licence application?

The purpose of a mortgage brokerage licence application is to ensure that individuals or companies meet the necessary requirements to operate a mortgage brokerage business.

What information must be reported on mortgage brokerage licence application?

Information such as business details, financial statements, background checks, and proof of compliance with regulations must be reported on a mortgage brokerage licence application.

Fill out your mortgage brokerage licence application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Brokerage Licence Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.