NY LS 48 2015 free printable template

Show details

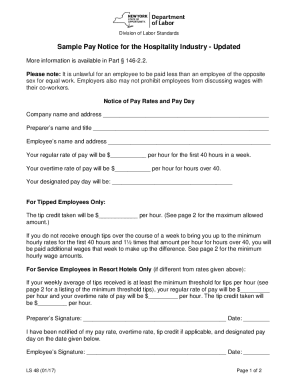

New York State Department of Labor Division of Labor Standards Sample Pay Notice for the Hospitality Industry Updated The sample pay notice below is updated to reflect the Minimum Wage increase on

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY LS 48

Edit your NY LS 48 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY LS 48 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY LS 48 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NY LS 48. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY LS 48 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY LS 48

How to fill out NY LS 48

01

Obtain the NY LS 48 form from the New York State Division of Licensing Services website.

02

Fill in your personal information in the designated fields (name, address, contact information).

03

Provide details about your education and qualifications relevant to the license you are applying for.

04

Include your employment history, detailing relevant positions and responsibilities.

05

If applicable, disclose any prior licenses, certifications, or permits you hold.

06

Answer any questions related to criminal history or past disciplinary actions honestly.

07

Review the form for completeness and accuracy before submission.

08

Submit the completed NY LS 48 form along with any required fees to the appropriate licensing authority.

Who needs NY LS 48?

01

Individuals seeking to obtain or renew a specific professional license in New York.

02

Applicants for licenses that require proof of qualifications, education, or employment history.

03

Those who have previously held a license and need to provide documentation for renewal.

Fill

form

: Try Risk Free

People Also Ask about

What is a wage theft prevention notice for compensation change?

The notice must be in the language the employer normally uses to communicate employment-related information to the employee. When do employers need to provide this notice to employees? At the time of hire and within 7 days of a change if the change is not listed on the employee's pay stub for the following pay period.

What can be deducted from final pay?

No deductions are allowed against an employee's final paycheck, even if the employee has consented to it. California law states that a worker's unpaid wages are due and payable to the employee immediately after their discharge. [7] This final paycheck has to be free from any deductions or setoffs.

What is the penalty for wage notice in NY?

What is the penalty for violating the NY Wage Theft Prevention Act? Employers who violate the NY Wage Theft Prevention Act face multiple penalties and punishments. Employers must provide written pay notices and pay stubs to employees. If they do not, they may have to pay a penalty of up to $10,000 per employee.

What is the Labor Code 195.1 in NY?

Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law Notice for Hourly Rate Employees LS 54 is a blank work agreement that contains all of the fields that employers must include to notify each employee in writing of conditions of employment at time of commitment to hire.

What is Section 195.1 of the New York State Labor law?

Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law Notice for Exempt Employees LS 59 is a blank work agreement that contains all of the fields that employers must include to notify each employee in writing of conditions of employment at time of commitment to hire.

What is Section 195.6 of the New York State Labor law?

N.Y. Labor Law, § 195(6) requires employers to provide written notice to discharged employees, stating the effective date of termination. The notice must also provide the exact date that any employee benefits, such as health, accident, and life insurance, will cease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find NY LS 48?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific NY LS 48 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I edit NY LS 48 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share NY LS 48 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I edit NY LS 48 on an Android device?

You can make any changes to PDF files, like NY LS 48, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is NY LS 48?

NY LS 48 is a form used in New York State for reporting and filing certain local taxes, including the local job creation credit and other local incentives.

Who is required to file NY LS 48?

Businesses that qualify for local tax incentives or credits and are required to report their eligibility must file NY LS 48.

How to fill out NY LS 48?

To fill out NY LS 48, gather the necessary business information, complete the sections relating to tax credits or incentives, and ensure all data is accurate before submitting to the relevant tax authority.

What is the purpose of NY LS 48?

The purpose of NY LS 48 is to provide a standardized method for businesses to report local tax incentives and ensure compliance with tax regulations in New York State.

What information must be reported on NY LS 48?

The information that must be reported on NY LS 48 includes the business's identification details, the specific tax credits or incentives being claimed, and any relevant financial information pertaining to the local tax incentives.

Fill out your NY LS 48 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY LS 48 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.