Get the free Sage Fixed Assets Depreciation User Guide

Show details

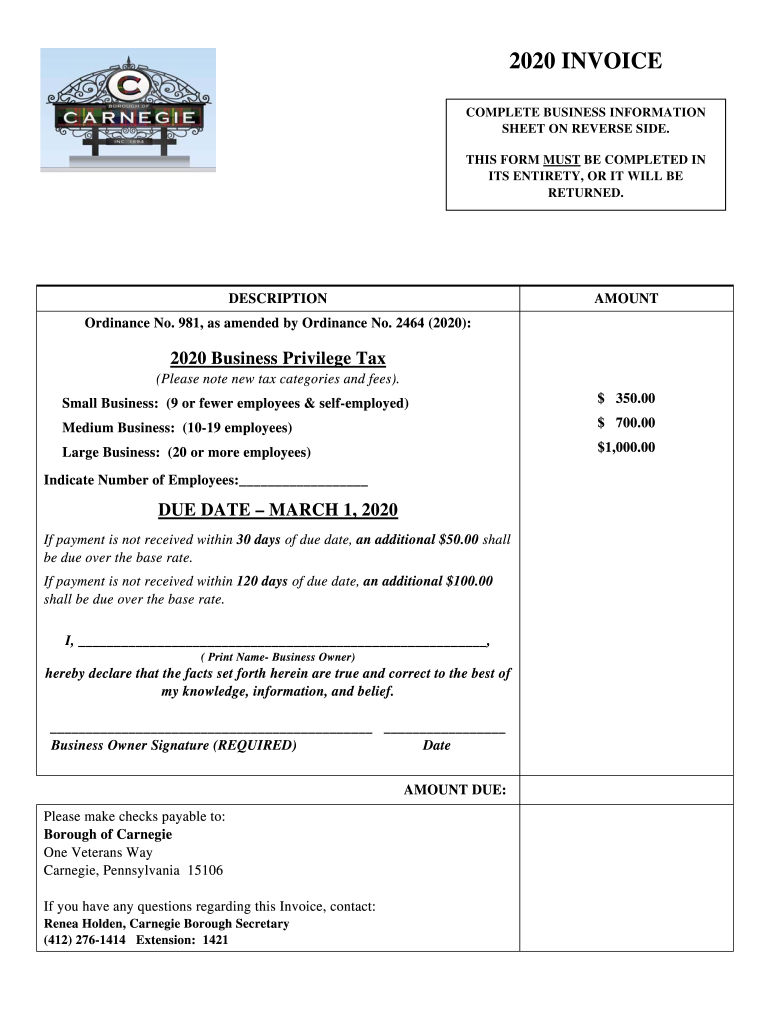

2020 INVOICE COMPLETE BUSINESS INFORMATION SHEET ON REVERSE SIDE. THIS FORM MUST BE COMPLETED IN ITS ENTIRETY, OR IT WILL BE RETURNED.DESCRIPTIONAMOUNTOrdinance No. 981, as amended by Ordinance No.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sage fixed assets depreciation

Edit your sage fixed assets depreciation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sage fixed assets depreciation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sage fixed assets depreciation online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sage fixed assets depreciation. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sage fixed assets depreciation

How to fill out sage fixed assets depreciation

01

To fill out Sage Fixed Assets Depreciation, follow these steps:

02

Open the Sage Fixed Assets Depreciation software.

03

Navigate to the 'Depreciation' module.

04

Click on the 'Add Asset' button to add a new asset.

05

Enter the required information for the asset, such as the asset name, purchase date, cost, and useful life.

06

Select the appropriate depreciation method from the available options (e.g., straight-line, declining balance).

07

Set up any additional parameters or rules for the depreciation, if needed.

08

Save the asset details.

09

Repeat steps 3 to 7 for each asset you want to include in the depreciation schedule.

10

Once all assets are added, generate the depreciation schedule by running the appropriate report or process.

11

Review the generated depreciation schedule to ensure accuracy.

12

Use the depreciation schedule for accounting and reporting purposes.

13

Periodically update and adjust the depreciation schedule as necessary.

Who needs sage fixed assets depreciation?

01

Sage Fixed Assets Depreciation is primarily used by businesses and organizations that have a need to track and manage fixed assets.

02

This includes companies of all sizes and industries that own physical assets, such as buildings, vehicles, machinery, equipment, furniture, and fixtures.

03

Additionally, accountants, financial analysts, and other finance professionals who are responsible for asset management and depreciation calculations may also need Sage Fixed Assets Depreciation.

04

Having a proper system for calculating and managing depreciation can help organizations accurately report financial statements, comply with tax regulations, track asset value changes over time, and make informed decisions related to asset purchases, repairs, or disposals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete sage fixed assets depreciation online?

pdfFiller has made it simple to fill out and eSign sage fixed assets depreciation. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit sage fixed assets depreciation online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your sage fixed assets depreciation to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for signing my sage fixed assets depreciation in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your sage fixed assets depreciation and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is sage fixed assets depreciation?

Sage fixed assets depreciation refers to the method of allocating the cost of tangible assets over their useful lives in accounting software provided by Sage. This process helps businesses track the decrease in value of their fixed assets over time.

Who is required to file sage fixed assets depreciation?

Businesses that own fixed assets and wish to accurately report their financial position for tax and accounting purposes are required to file sage fixed assets depreciation. This typically includes companies of all sizes and various industries.

How to fill out sage fixed assets depreciation?

To fill out sage fixed assets depreciation, users must input details such as the asset description, acquisition cost, purchase date, useful life, and appropriate depreciation method in the Sage software. The software will then calculate the depreciation expense based on the provided data.

What is the purpose of sage fixed assets depreciation?

The purpose of sage fixed assets depreciation is to systematically reduce the book value of an asset over time, reflecting its usage and aging. This helps in presenting an accurate financial picture, managing asset values, and complying with tax regulations.

What information must be reported on sage fixed assets depreciation?

Information that must be reported on sage fixed assets depreciation includes the asset's identification, description, cost, acquisition date, useful life, disposal date (if applicable), and the depreciation expense for each period.

Fill out your sage fixed assets depreciation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sage Fixed Assets Depreciation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.