Get the free About Form 8615, Tax for Certain Children Who Have Unearned ...

Show details

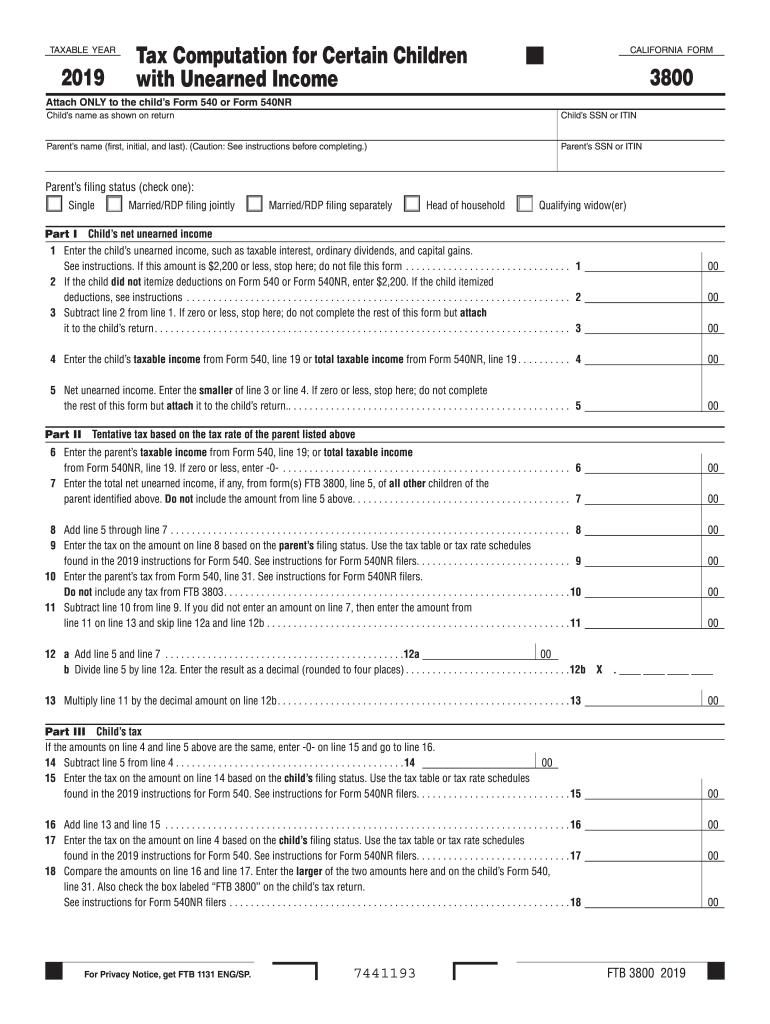

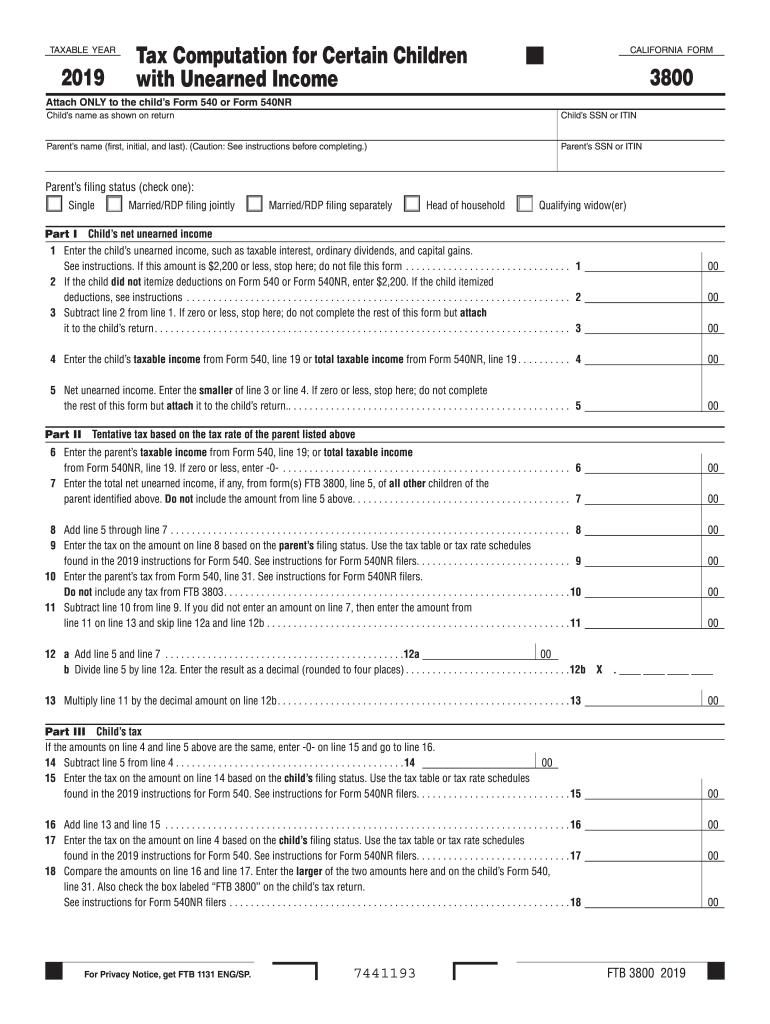

TAXABLE YEAR2019Tax Computation for Certain Children

with Unearned IncomeCALIFORNIA FORM3800Attach ONLY to the children Form 540 or Form 540NR

Child's name as shown on returnChilds SSN or Itinerants

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign about form 8615 tax

Edit your about form 8615 tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your about form 8615 tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing about form 8615 tax online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit about form 8615 tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out about form 8615 tax

How to fill out about form 8615 tax

01

To fill out Form 8615 tax, follow these steps:

02

Gather all the necessary information, including your child's income, your investment income, and any deductions or credits you qualify for.

03

Start by entering your identifying information at the top of the form, such as your name, address, and social security number.

04

Fill out Part I, which includes information about your child's unearned income and any other adjustments.

05

Move on to Part II, where you will calculate your modified adjusted gross income (MAGI). This includes adding up your child's income, your investment income, and any other inclusions.

06

Complete Part III, which calculates the tax on your child's unearned income using the tax rates for trusts and estates.

07

If applicable, fill out Part IV to determine if you qualify for the kiddie tax. This involves comparing your child's unearned income to a threshold amount.

08

Finally, review your completed form for accuracy and attach it to your tax return.

09

Note: It is always a good idea to consult a tax professional or refer to the official IRS instructions for Form 8615 for specific guidance.

Who needs about form 8615 tax?

01

Form 8615 tax is needed by parents or guardians of children who meet certain criteria:

02

- The child has unearned income (such as interest, dividends, or capital gains) that exceeds the specified threshold.

03

- The child's unearned income includes dividends and interest that are greater than $2,200 (for tax year 2021).

04

- The child is under 18 years old, or is between 18 and 24 years old and a full-time student.

05

- The child's earned income does not exceed half of their own support for the year.

06

If these criteria apply to your situation, you will need to fill out Form 8615 tax when filing your federal income tax return.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send about form 8615 tax for eSignature?

When you're ready to share your about form 8615 tax, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for the about form 8615 tax in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your about form 8615 tax in seconds.

Can I create an eSignature for the about form 8615 tax in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your about form 8615 tax and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is about form 8615 tax?

Form 8615 is used to calculate the tax for certain children who have unearned income over a specific threshold, commonly referred to as the 'kiddie tax.'

Who is required to file about form 8615 tax?

Form 8615 must be filed by children who are younger than 19 at the end of the tax year or under 24 if they are full-time students, and who have unearned income exceeding the annual threshold.

How to fill out about form 8615 tax?

To fill out Form 8615, you need to provide information such as the child's name, Social Security number, unearned income, and the parent's taxable income. It is advisable to refer to the IRS instructions for detailed guidance.

What is the purpose of about form 8615 tax?

The purpose of Form 8615 is to ensure that unearned income of children is taxed at the parent's tax rate, rather than at the usually lower rate that applies to minors' income.

What information must be reported on about form 8615 tax?

Form 8615 requires reporting of the child's unearned income, the parent's taxable income, and the child's tax liability calculated based on those figures.

Fill out your about form 8615 tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

About Form 8615 Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.