Get the free Life Suitability, Best Interest and Summary Disclosure Form

Show details

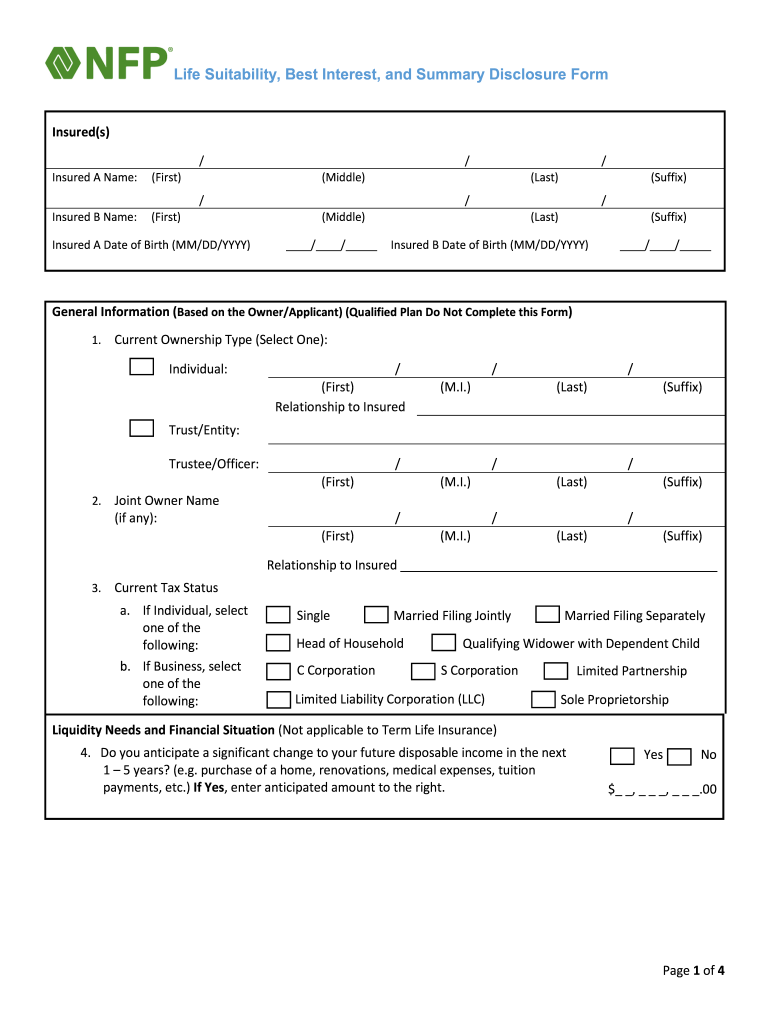

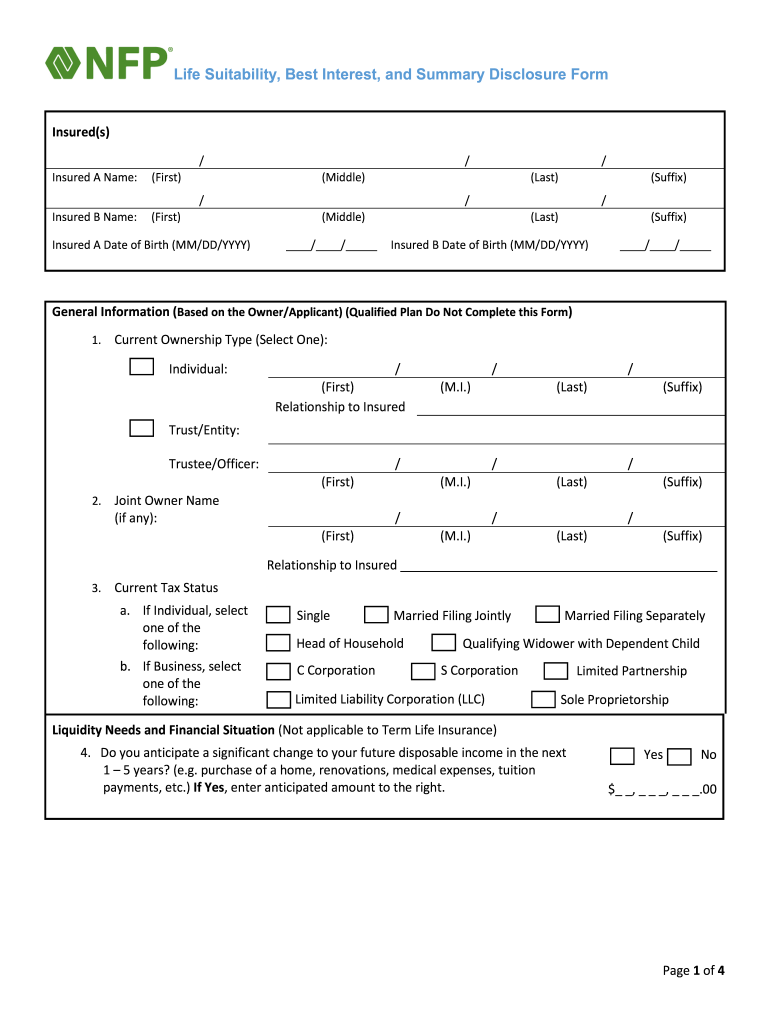

Life Suitability, Best Interest, and Summary Disclosure Form Insured(s) Insured A Name:(First)Insured B Name:(First)/ /Insured A Date of Birth (MM/DD/YYY)/(Middle) / / (Last)/(Middle)/(Suffix)/(Last)Insured

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life suitability best interest

Edit your life suitability best interest form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life suitability best interest form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing life suitability best interest online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit life suitability best interest. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life suitability best interest

How to fill out life suitability best interest

01

To fill out life suitability best interest, follow these steps:

02

Start by gathering all necessary information about the individual for whom the suitability assessment is being conducted.

03

Review the individual's personal and financial circumstances, including their age, health condition, income, liabilities, and financial goals.

04

Evaluate their existing life insurance coverage, if any, and determine its adequacy based on their needs.

05

Identify the individual's risk tolerance, investment knowledge, and understanding of life insurance products.

06

Assess the individual's future financial obligations, such as mortgage, education expenses, or dependent care.

07

Consider any special circumstances or needs, such as business-related insurance requirements or estate planning.

08

Compare different life insurance products available in the market and determine which one suits the individual's needs and budget.

09

Discuss the findings and recommendations with the individual, addressing any questions or concerns they may have.

10

Document the entire suitability assessment process, including the information gathered, analysis conducted, and recommendations provided.

11

Keep the completed life suitability best interest form in the individual's file for recordkeeping and compliance purposes.

Who needs life suitability best interest?

01

Life suitability best interest is needed by:

02

- Individuals who are considering purchasing a life insurance policy.

03

- Financial advisors or insurance professionals who are advising clients on life insurance options.

04

- Insurance companies or underwriters who need to assess the suitability of potential policyholders.

05

- Regulators or authorities responsible for overseeing the life insurance industry and ensuring consumer protection.

06

- Any party involved in evaluating the appropriateness of life insurance recommendations or decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send life suitability best interest for eSignature?

When your life suitability best interest is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I sign the life suitability best interest electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your life suitability best interest in seconds.

How do I edit life suitability best interest straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing life suitability best interest.

What is life suitability best interest?

Life suitability best interest refers to the legal obligation of financial professionals to act in the best interests of their clients when recommending life insurance products. This includes assessing the customer's needs, financial situation, and objectives to ensure appropriate product recommendations.

Who is required to file life suitability best interest?

Insurance agents and financial advisors who recommend life insurance products are required to file life suitability best interest documentation as part of regulatory compliance.

How to fill out life suitability best interest?

To fill out the life suitability best interest form, gather necessary client information, including financial status, insurance needs, and objectives. Complete the form by documenting the rationale behind product recommendations and ensure both the advisor and client sign it.

What is the purpose of life suitability best interest?

The purpose of life suitability best interest is to protect consumers by ensuring that financial professionals prioritize their clients' needs and financial goals when recommending insurance products, thus enhancing transparency and trust in the financial services industry.

What information must be reported on life suitability best interest?

Information that must be reported includes the client's financial profile, insurance needs analysis, product recommendations, justification for those recommendations, and signatures from both the advisor and the client.

Fill out your life suitability best interest online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Suitability Best Interest is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.