Get the free CLAIM FOR REFUND OF TAX PAYMENTS BEFORE THE HEARING - acgov

Show details

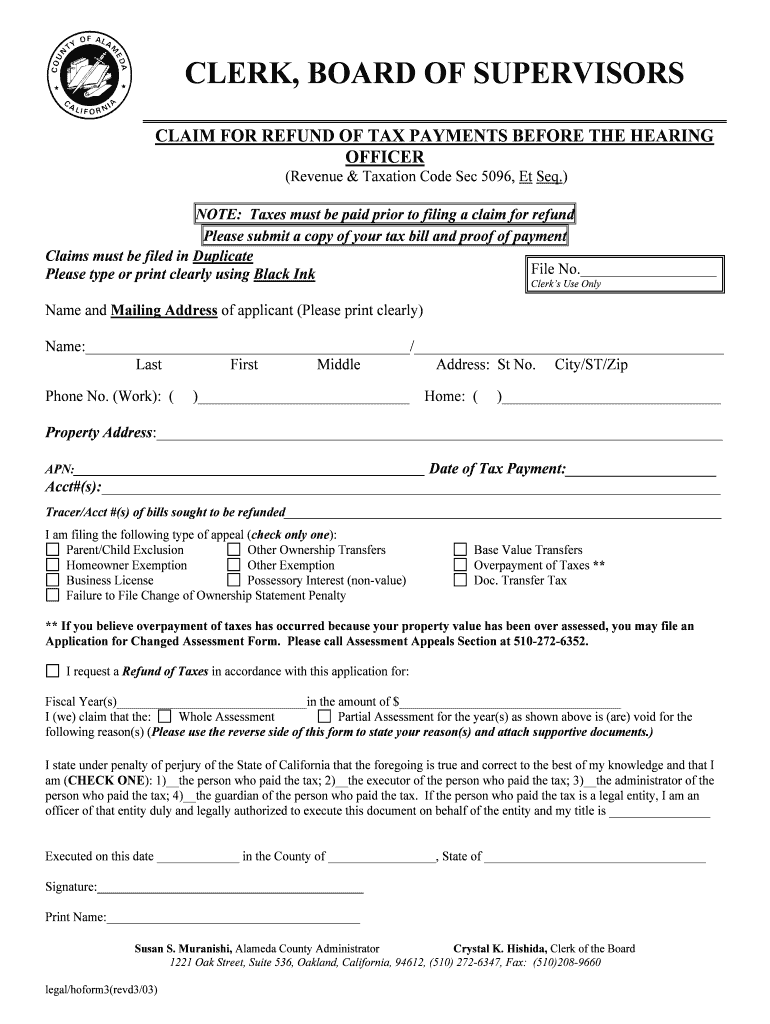

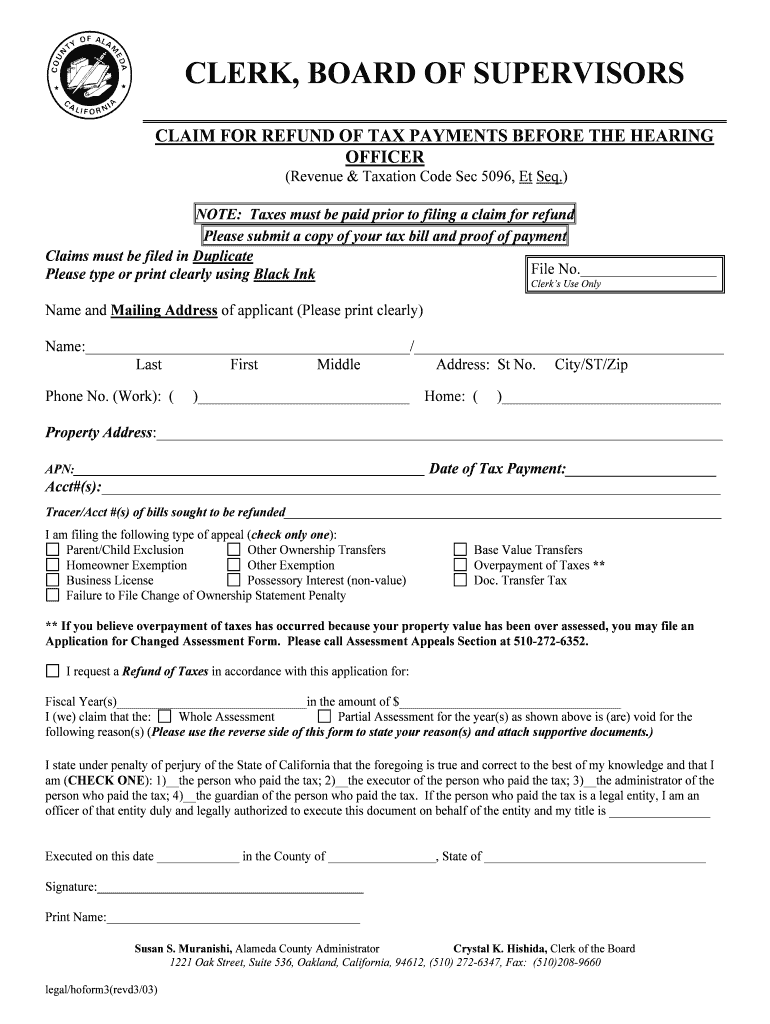

CLERK, BOARD OF SUPERVISORS CLAIM FOR REFUND OF TAX PAYMENTS BEFORE THE HEARING OFFICER (Revenue & Taxation Code Sec 5096, Et Seq.) NOTE: Taxes must be paid prior to filing a claim for refund Please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for refund of

Edit your claim for refund of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for refund of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit claim for refund of online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit claim for refund of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for refund of

Point by point, here's how to fill out a claim for a refund:

01

Gather necessary information: Before starting the claim process, gather all the relevant information such as receipts, invoices, or any supporting documentation that proves the purchase or transaction in question. This information will be required to substantiate your claim.

02

Contact the appropriate party: Identify the party from whom you need to claim the refund. It could be a retailer, service provider, or a specific department within an organization. Find their contact information and reach out to them either through a phone call, email, or in-person visit, depending on the preferred method of communication provided.

03

Understand refund policies and procedures: Familiarize yourself with the refund policies and procedures of the party you're claiming the refund from. This information is usually available on their website, documentation, or can be obtained by contacting their customer support. This knowledge will help you accurately complete the claim form and meet all requirements.

04

Obtain a claim form: The party you're claiming the refund from may provide a specific claim form that you need to fill out. Request this form, ensuring that you have all the necessary sections to complete.

05

Provide accurate information: Fill out the claim form with accurate and factual information. Make sure to include details such as your full name, contact information, date of purchase or transaction, specific item or service for which the refund is being claimed, and any supporting evidence you have.

06

Attach supporting documentation: Remember to attach copies of all the supporting documentation you gathered in step 1. This may include receipts, invoices, warranties, agreements, or any other evidence that supports your claim.

07

Be clear and concise: When explaining the reason for the refund, be clear and concise in your description. Include relevant details about what went wrong, why you believe a refund is necessary, and any attempts you have made to resolve the issue informally.

08

Review and submit the claim form: Take the time to carefully review the completed claim form, ensuring that all sections are accurately filled out and all necessary documentation is attached. Double-check for any errors or omissions. Once satisfied, submit the claim form through the specified method, such as mail, email, or an online portal.

Who needs a claim for a refund?

Anyone who has made a purchase or transaction and is not satisfied with the product, service, or outcome may need to submit a claim for a refund. This could include consumers who received faulty or damaged goods, experienced poor service, or did not receive the product or service as promised. It is important to review the refund policies and procedures of the specific organization involved to determine if a claim is necessary and the appropriate steps to take.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify claim for refund of without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your claim for refund of into a dynamic fillable form that you can manage and eSign from anywhere.

How do I make changes in claim for refund of?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your claim for refund of and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for the claim for refund of in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your claim for refund of in seconds.

What is claim for refund of?

Claim for refund of is for requesting a return of overpaid taxes or erroneous payments.

Who is required to file claim for refund of?

Individuals or entities who believe they have overpaid taxes or made erroneous payments are required to file a claim for refund.

How to fill out claim for refund of?

To fill out a claim for refund, you typically need to provide your personal or business information, details of the overpayment or erroneous payment, and supporting documentation.

What is the purpose of claim for refund of?

The purpose of a claim for refund is to request the return of overpaid taxes or erroneous payments.

What information must be reported on claim for refund of?

Information such as your personal or business details, details of the overpayment or erroneous payment, and any supporting documentation must be reported on a claim for refund.

Fill out your claim for refund of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Refund Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.