Get the free PROMISSORY NOTE (Forgivable Loan) - s3.amazonaws.com

Show details

PROMISSORY NOTE (Forgivable Loan) For value received, the undersigned, (Name of Employee), hereinafter called Employee, hereby promises to pay to (Name of Employer), a corporation organized and existing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign promissory note forgivable loan

Edit your promissory note forgivable loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your promissory note forgivable loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing promissory note forgivable loan online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit promissory note forgivable loan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out promissory note forgivable loan

How to fill out a promissory note forgivable loan:

01

Start by gathering all the necessary information: the lender's name and contact information, the borrower's name and contact information, the loan amount, and the repayment terms.

02

Begin filling out the promissory note by clearly stating the names of the lender and borrower at the beginning of the document.

03

Specify the loan amount in both numeric and written form to eliminate any confusion or ambiguity.

04

Clearly outline the repayment terms, including the interest rate (if any), the repayment schedule, and the due dates for each installment.

05

Include any provisions or conditions that apply to the forgivable aspect of the loan. This may include conditions under which the loan will be forgiven, such as if the borrower meets certain criteria or fulfills specific obligations.

06

Provide a detailed description of any collateral or security that the borrower is required to provide for the loan, if applicable.

07

Include clauses regarding late payment penalties or default consequences to protect the interests of both parties.

08

Make sure to include spaces for the signatures of both the lender and the borrower, along with the date of signing.

09

Review the completed promissory note forgivable loan form carefully before signing to ensure accuracy and clarity.

Who needs a promissory note forgivable loan?

01

Small business owners or entrepreneurs who are in need of financial assistance may consider applying for a promissory note forgivable loan. This type of loan can provide them with the necessary funds to start or expand their business, with the possibility of forgiveness under certain conditions.

02

Non-profit organizations or community development projects that require funding to support their initiatives can also benefit from a promissory note forgivable loan. Through this type of loan, they can access the required capital to implement their projects or programs, with the potential for loan forgiveness based on predefined criteria.

03

Individuals or families seeking financial aid for education or housing expenses may also opt for a promissory note forgivable loan. By meeting specific requirements, such as completing a certain number of education or work-related activities, they may be eligible for loan forgiveness, relieving them of the financial burden in the long run.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify promissory note forgivable loan without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your promissory note forgivable loan into a dynamic fillable form that you can manage and eSign from anywhere.

How can I get promissory note forgivable loan?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the promissory note forgivable loan in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How can I fill out promissory note forgivable loan on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your promissory note forgivable loan by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

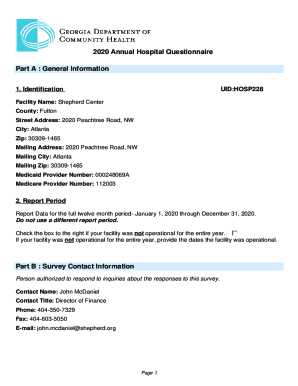

What is promissory note forgivable loan?

A promissory note forgivable loan is a type of loan where a borrower agrees to repay the money, but the lender has the option to forgive the loan under certain conditions.

Who is required to file promissory note forgivable loan?

Individuals or businesses who have entered into a promissory note forgivable loan agreement are required to file the loan documents.

How to fill out promissory note forgivable loan?

To fill out a promissory note forgivable loan, the borrower must include all necessary information such as loan amount, repayment terms, forgiveness conditions, and signatures of both parties.

What is the purpose of promissory note forgivable loan?

The purpose of a promissory note forgivable loan is to provide financial assistance to borrowers while also allowing lenders the option to forgive a portion or all of the loan in the future.

What information must be reported on promissory note forgivable loan?

Information such as loan amount, repayment schedule, forgiveness conditions, interest rate, and signatures of both parties must be reported on a promissory note forgivable loan.

Fill out your promissory note forgivable loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Promissory Note Forgivable Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.