Get the free APR vs Interest Rate - Difference and ComparisonDiffen

Show details

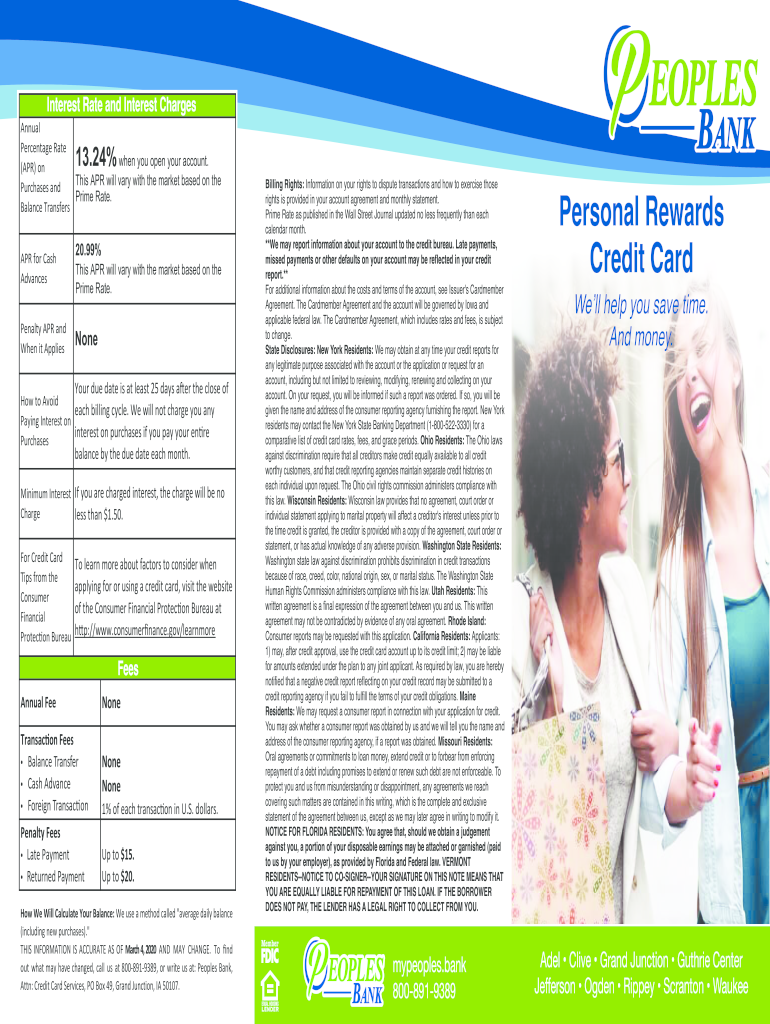

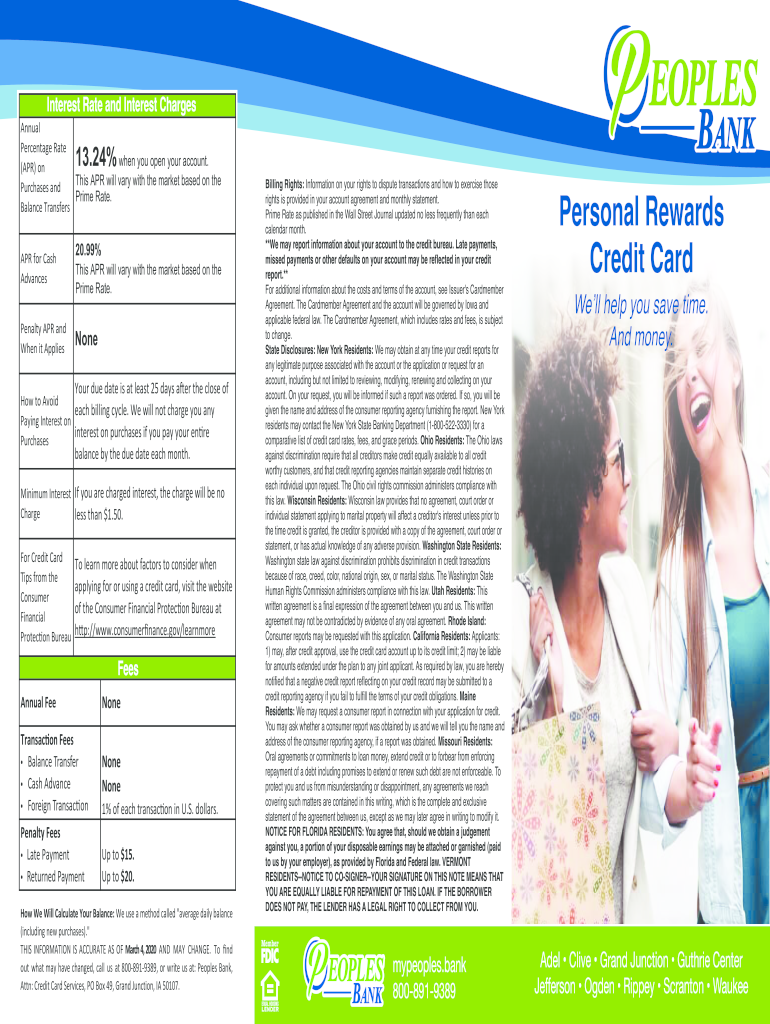

Interest Rate and Interest ChargesAnnual

Percentage Rate

when you open your account.

(APR) on

This

APR

will

vary

with the market based on the

Purchases and

Prime Rate.

Balance Transfers13.24%APR for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign apr vs interest rate

Edit your apr vs interest rate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your apr vs interest rate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing apr vs interest rate online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit apr vs interest rate. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out apr vs interest rate

How to fill out apr vs interest rate

01

To fill out APR vs Interest Rate, follow these steps:

1. Understand the difference between APR and interest rate. The APR (Annual Percentage Rate) is the annual cost of borrowing, including fees and other charges. The interest rate, on the other hand, is the percentage of the loan amount that you pay as interest each year.

02

Gather all the necessary information. This includes the loan amount, the term of the loan, any additional fees or charges, and the interest rate.

03

Calculate the APR. Use an online APR calculator or a spreadsheet to input the loan details and compute the APR.

04

Fill out the APR vs Interest Rate form. This form usually requires you to input the loan amount, the term, the interest rate, and any additional fees. Make sure to accurately fill in all the details.

05

Review and double-check the form. Ensure that all the information is correctly entered and that the calculated APR matches your calculations.

06

Submit the form. If you are applying for a loan or comparing different loan offers, submit the APR vs Interest Rate form along with other required documents.

07

Keep a record. It is always wise to keep a copy of the filled-out form and any other related documentation for future reference.

Who needs apr vs interest rate?

01

APR vs Interest Rate is important for anyone seeking a loan or credit. It is beneficial for:

02

- Borrowers: They can compare different loan options more accurately by considering both the APR and interest rate. APR provides a better understanding of the overall cost of borrowing, including fees and charges.

03

- Lenders: They can use APR vs Interest Rate to communicate the total cost of borrowing to the borrowers. It helps in providing transparency and ensuring informed decision-making.

04

- Financial Advisors: They can guide their clients in choosing the most suitable loan option by analyzing and explaining the APR vs Interest Rate.

05

- Regulators: They can monitor and regulate the lending industry and ensure fair practices by evaluating APR vs Interest Rate.

06

- Researchers: They can study the impact of APR vs Interest Rate on borrowing behavior, financial markets, and economic indicators.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my apr vs interest rate directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your apr vs interest rate and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I edit apr vs interest rate on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing apr vs interest rate, you can start right away.

How do I edit apr vs interest rate on an Android device?

The pdfFiller app for Android allows you to edit PDF files like apr vs interest rate. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is apr vs interest rate?

APR (Annual Percentage Rate) includes the interest rate plus any fees or other costs, providing a more comprehensive measure of the cost of borrowing over a year, while the interest rate is simply the cost of borrowing principal without additional fees.

Who is required to file apr vs interest rate?

Individuals and businesses that borrow money or are involved in financing transactions must typically disclose both the APR and the interest rate to provide clarity on the costs associated with their loans.

How to fill out apr vs interest rate?

To fill out APR vs interest rate forms, gather all relevant financial information about the loan, including the loan amount, term, interest rate, and any fees. Then, compute the APR according to provided formulas and report both values accurately on the required form.

What is the purpose of apr vs interest rate?

The purpose of comparing APR and interest rate is to provide borrowers with clear information about the total cost of a loan, allowing them to make informed decisions when comparing different loan offers.

What information must be reported on apr vs interest rate?

The information that must be reported includes the principal amount of the loan, the interest rate, the APR, the total fees or costs associated with the loan, the financing term, and any other charges that may affect the cost of borrowing.

Fill out your apr vs interest rate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Apr Vs Interest Rate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.