Get the free Mutual Fund / Variable Annuity Switch Letter - Providence Christian ...

Show details

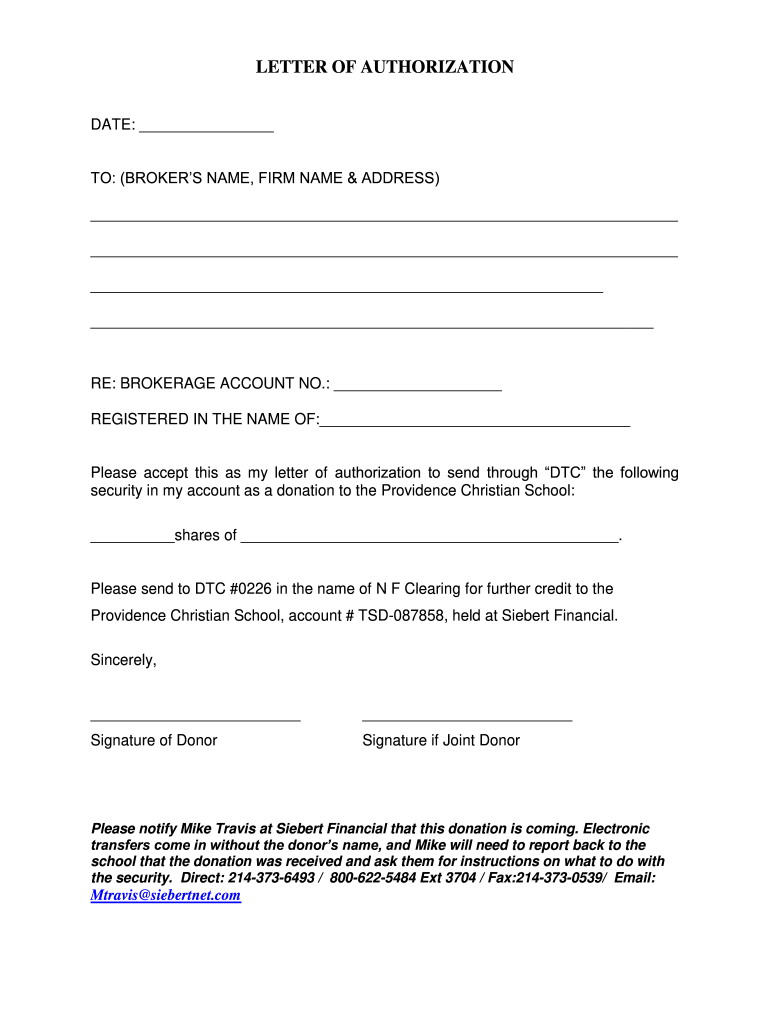

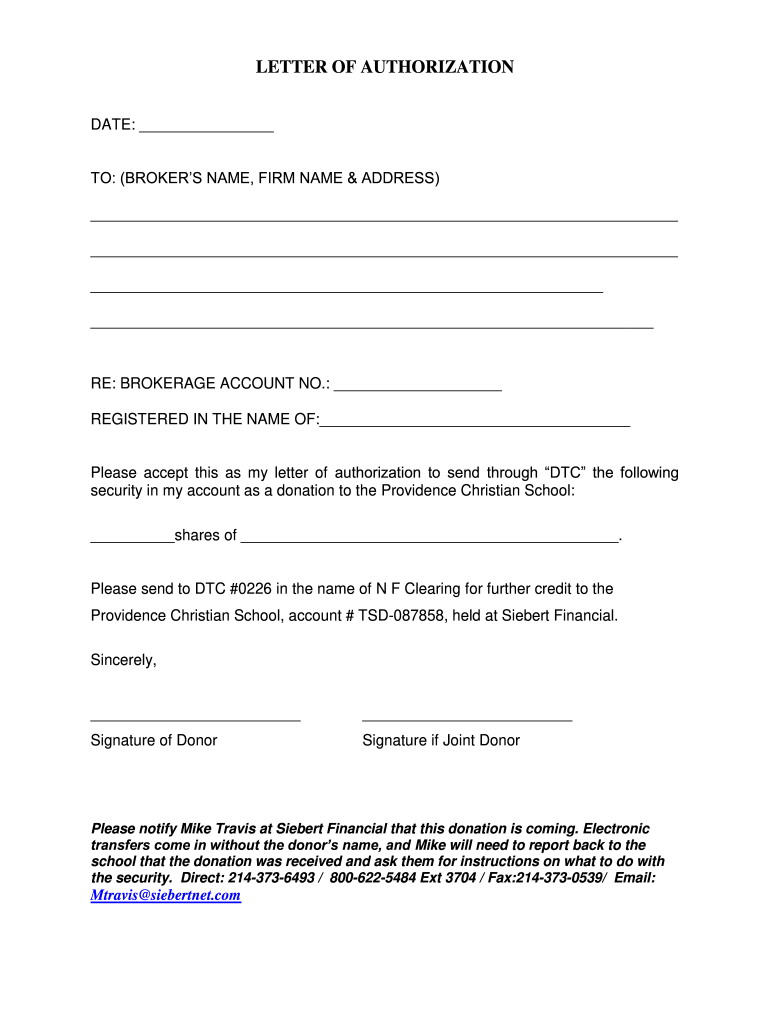

LETTER OF AUTHORIZATION DATE: TO: (BROKERS NAME, FIRM NAME & ADDRESS) RE: BROKERAGE ACCOUNT NO.: REGISTERED IN THE NAME OF: Please accept this as my letter of authorization to send through DTC the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mutual fund variable annuity

Edit your mutual fund variable annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mutual fund variable annuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mutual fund variable annuity online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mutual fund variable annuity. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mutual fund variable annuity

How to fill out mutual fund variable annuity

01

Gather all necessary documents and information, including your personal identification details, financial statements, and investment goals.

02

Research and compare different mutual fund variable annuity options to find the one that suits your needs and preferences.

03

Contact a reputable insurance company or financial advisor to help you understand the terms and conditions of the mutual fund variable annuity and guide you through the application process.

04

Fill out the application form by accurately providing your personal information, investment amount, beneficiary details, and any additional requirements or preferences.

05

Review the completed application form to ensure all the information is correct and complete. Make any necessary corrections or additions.

06

Attach any required documents, such as a copy of your identification, financial statements, or any other requested verification.

07

Sign the application form and submit it along with any required payment or initial investment amount.

08

Wait for the insurance company or financial institution to process your application. This may involve verification checks and underwriting procedures.

09

Once your application is approved, read and understand the terms and conditions of the mutual fund variable annuity contract. Seek clarification if needed.

10

Fund your account by transferring the desired investment amount or setting up a systematic investment plan (SIP) if available.

11

Monitor your mutual fund variable annuity performance regularly and keep track of any changes in market conditions or fund performance.

12

Consult with your financial advisor periodically to assess the suitability of the mutual fund variable annuity and make any necessary adjustments or rebalancing.

13

Understand the fees and charges associated with the mutual fund variable annuity and evaluate whether they are reasonable and justified based on the benefits provided.

Who needs mutual fund variable annuity?

01

Mutual fund variable annuities are suitable for individuals who:

02

- Seek long-term investment growth while also ensuring a steady stream of income in retirement

03

- Are comfortable with market fluctuations and understand the potential risks involved

04

- Have a higher risk tolerance and are willing to invest in equities or other market-based instruments

05

- Want to take advantage of tax-deferred growth and potentially lower tax rates in retirement

06

- Want the flexibility to choose from a variety of investment options offered by the annuity provider

07

- Are looking for a financial product that combines investment growth potential with insurance protection

08

- Have the financial means to afford the initial investment and ongoing fees associated with mutual fund variable annuities

09

- Have a solid understanding of their financial goals and the role of variable annuities within their overall investment and retirement plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mutual fund variable annuity in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign mutual fund variable annuity and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I get mutual fund variable annuity?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific mutual fund variable annuity and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I fill out mutual fund variable annuity using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign mutual fund variable annuity. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is mutual fund variable annuity?

A mutual fund variable annuity is a type of investment product that combines features of mutual funds and insurance contracts. It allows investors to allocate their premiums into various mutual fund sub-accounts, with the potential for investment growth and the added benefit of a death benefit.

Who is required to file mutual fund variable annuity?

Typically, insurance companies that issue variable annuities are required to file documentation related to these products. Additionally, investors may need to file certain tax documents if they hold variable annuities.

How to fill out mutual fund variable annuity?

To fill out mutual fund variable annuity forms, individuals typically need to provide personal information, select investment allocations, and indicate payout preferences. It is advisable to consult with a financial advisor or the issuing insurance company for specific instructions.

What is the purpose of mutual fund variable annuity?

The primary purpose of a mutual fund variable annuity is to provide individuals with a long-term investment vehicle that offers tax-deferred growth potential, alongside a source of retirement income and a death benefit.

What information must be reported on mutual fund variable annuity?

Information that must be reported typically includes the investment allocations, account performance, any distributions or withdrawals, and any tax implications resulting from the annuity.

Fill out your mutual fund variable annuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mutual Fund Variable Annuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.