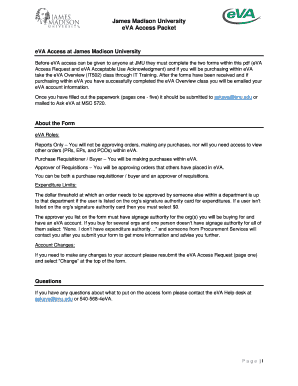

Get the free CONSUMER FINANCIAL PROTECTION - nycbar

Show details

CITY BAR CENTER FOR CLE CONSUMER FINANCIAL PROTECTION AFTER DODD-FRANK: THE NEW LEGISLATION S ENHANCED ENFORCEMENT STRUCTURE AGENDA 9:00-9:50 Introduction and Background The Dual Banking System Non-banks

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer financial protection

Edit your consumer financial protection form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer financial protection form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consumer financial protection online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit consumer financial protection. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer financial protection

How to Fill Out Consumer Financial Protection:

01

Gather all relevant documents and information: Start by collecting any paperwork or documentation related to your financial activities, such as bank statements, credit card statements, loan agreements, and any other relevant records. Also, make sure to gather your personal identification information and proof of address.

02

Identify the consumer financial protection form: Determine the specific form that needs to be filled out for consumer financial protection. This could vary based on your country or jurisdiction. Research and locate the appropriate form for your situation.

03

Read the instructions carefully: Before filling out the form, thoroughly go through the instructions provided. Make sure you understand the purpose of the form, the required information, and any specific guidelines or constraints mentioned.

04

Provide accurate and complete information: Once you have a clear understanding of the form and its requirements, start filling it out. Ensure that all the information you provide is accurate, complete, and up to date. Double-check the form for any errors or missing details before submitting it.

05

Include supporting documentation if required: Some consumer financial protection forms may require you to attach supporting documentation to substantiate your claims or provide evidence of any fraudulent or unfair practices. Make copies of these documents and include them with the form if necessary.

06

Review and proofread the filled-out form: Before finalizing the form, carefully review each section to ensure that you have answered all the questions accurately and appropriately. Proofread for any spelling or grammatical errors that could affect the clarity or credibility of your submission.

07

Seek professional assistance if needed: If you're uncertain about any aspect of the form or feel overwhelmed by the process, consider reaching out to a consumer protection agency or consulting with a financial advisor. They can provide guidance and support to ensure that you complete the form correctly.

Who Needs Consumer Financial Protection?

01

Individuals facing financial challenges: Consumer financial protection is essential for individuals who are struggling with debt, facing predatory lending practices, dealing with abusive debt collectors, or experiencing any other financial difficulties. It aims to safeguard their rights and provide recourse against unfair or deceptive financial practices.

02

Borrowers and consumers: Borrowers and consumers who engage in financial transactions, such as taking out loans, using credit cards, or signing up for financial services, benefit from consumer financial protection. It helps ensure transparency, fairness, and accountability in the financial industry, protecting them from fraudulent schemes or exploitative practices.

03

Small business owners and entrepreneurs: Consumer financial protection is not limited to individual consumers; it also extends to small business owners and entrepreneurs who interact with financial institutions. It helps protect them from predatory lending, deceptive marketing, and unfair business practices that could harm their financial stability and growth.

Overall, consumer financial protection is necessary for anyone engaging in financial transactions to safeguard their rights, promote fair and ethical practices, and provide a mechanism for addressing potential grievances or disputes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is consumer financial protection?

Consumer financial protection focuses on safeguarding consumers from unfair, deceptive, or abusive practices by financial institutions.

Who is required to file consumer financial protection?

Financial institutions such as banks, credit unions, and lending companies are required to file consumer financial protection reports.

How to fill out consumer financial protection?

Consumer financial protection reports can be filled out online through the designated regulatory agency's website.

What is the purpose of consumer financial protection?

The purpose of consumer financial protection is to ensure that consumers are treated fairly and transparently by financial institutions.

What information must be reported on consumer financial protection?

Information such as interest rates, fees, terms and conditions, and any complaints received from consumers must be reported on consumer financial protection.

Can I create an electronic signature for the consumer financial protection in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your consumer financial protection in seconds.

How do I edit consumer financial protection straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing consumer financial protection.

How do I fill out consumer financial protection on an Android device?

Use the pdfFiller Android app to finish your consumer financial protection and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your consumer financial protection online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Financial Protection is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.