Get the free ACCOUNTING1 (90 Hours) - adultinstruction

Show details

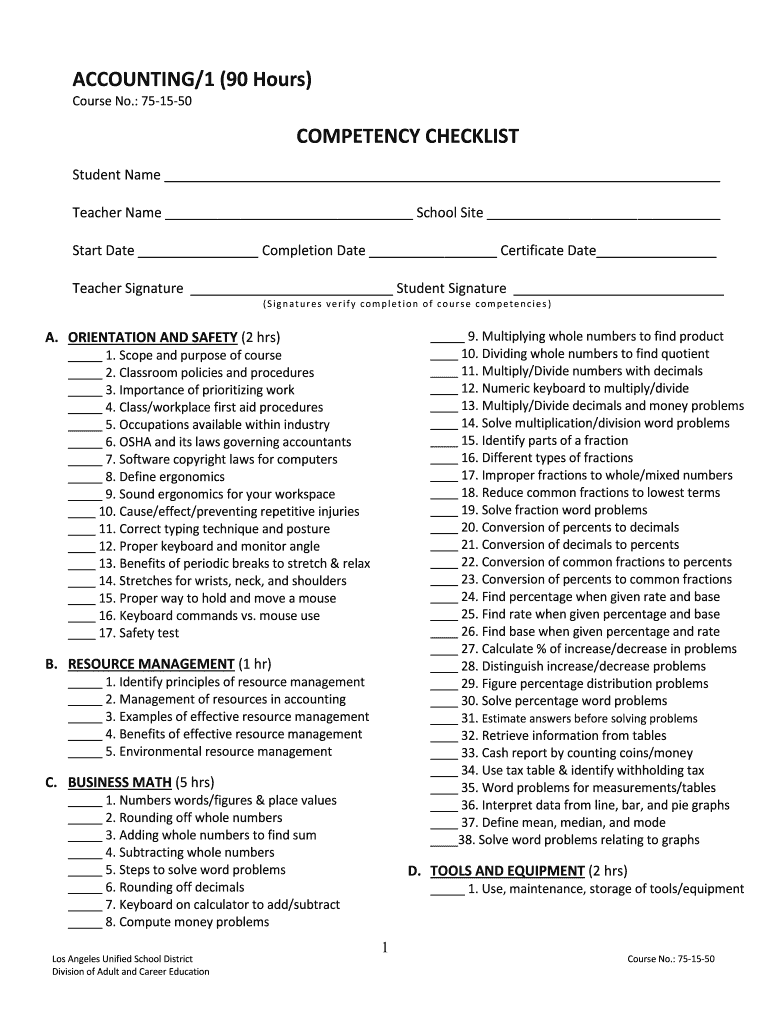

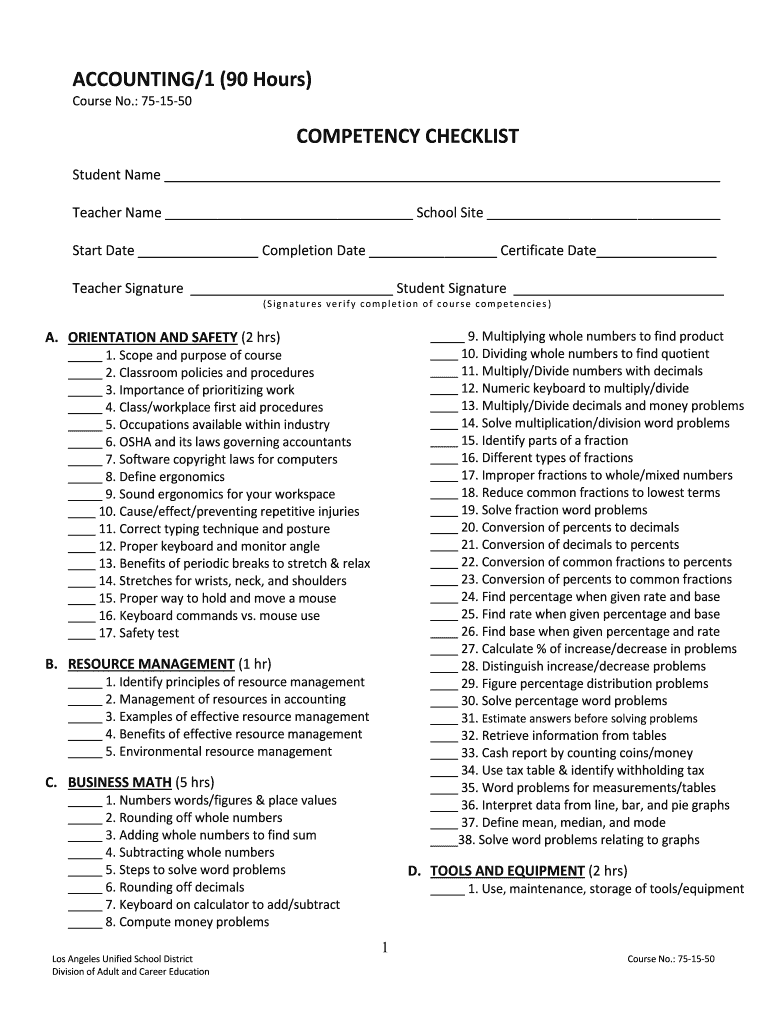

ACCOUNTING/1 (90 Hours) Course No.: 751550 COMPETENCY CHECKLIST Student Name Teacher Name School Site Start Date Completion Date Certificate Date Teacher Signature Student Signature (Signatures verify

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounting1 90 hours

Edit your accounting1 90 hours form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounting1 90 hours form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit accounting1 90 hours online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit accounting1 90 hours. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounting1 90 hours

How to fill out accounting1 90 hours?

01

Start by gathering all relevant financial documents, such as invoices, receipts, and bank statements.

02

Organize the documents into categories based on their type or purpose, such as income, expenses, or assets.

03

Use accounting software or spreadsheets to input the financial data from the documents. Ensure that all entries are accurate and include the necessary information such as date, description, and amount.

04

Reconcile bank statements with the corresponding entries in the accounting records to identify any discrepancies or errors.

05

Generate financial reports, such as profit and loss statements or balance sheets, based on the recorded data to assess the financial health of the business.

06

Review the completed accounting records to ensure they comply with relevant accounting principles and regulations.

07

Save and store all the financial documents and records in a secure and organized manner for future reference or audits.

Who needs accounting1 90 hours?

01

Business owners: Accounting1 90 hours is crucial for business owners as it helps them track and manage their finances effectively. It allows them to make informed decisions, evaluate profitability, and monitor cash flow.

02

Accountants: Accounting professionals need a thorough understanding of accounting1 90 hours to perform their job duties efficiently. They are responsible for maintaining accurate records, preparing financial reports, and providing financial advice to stakeholders.

03

Students: Accounting1 90 hours is a fundamental subject in accounting education. It equips students with the necessary knowledge and skills to pursue careers in finance, auditing, or taxation.

04

Individuals managing personal finances: Even individuals who are not involved in business can benefit from understanding accounting1 90 hours. It helps them make informed financial decisions, create budgets, and track their expenses to achieve financial stability.

05

Investors and stakeholders: Investors and stakeholders rely on accounting1 90 hours to assess the financial performance and stability of companies before making investment decisions. It provides them with insights into a company's profitability, liquidity, and overall financial health.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit accounting1 90 hours online?

The editing procedure is simple with pdfFiller. Open your accounting1 90 hours in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I sign the accounting1 90 hours electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your accounting1 90 hours and you'll be done in minutes.

Can I edit accounting1 90 hours on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as accounting1 90 hours. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is accounting1 90 hours?

Accounting 90 hours refers to the total number of hours spent on accounting activities or tasks within a specific period of time.

Who is required to file accounting1 90 hours?

Anyone who is responsible for maintaining accurate accounting records or performing accounting duties may be required to file accounting 90 hours.

How to fill out accounting1 90 hours?

To fill out accounting 90 hours, you need to track and record the amount of time spent on various accounting tasks or activities within a specific timeframe.

What is the purpose of accounting1 90 hours?

The purpose of tracking accounting 90 hours is to monitor and evaluate the time spent on accounting tasks, assess productivity, and make informed decisions regarding resource allocation.

What information must be reported on accounting1 90 hours?

The information reported on accounting 90 hours may include the type of accounting tasks performed, the duration of time spent on each task, and any relevant details or notes.

Fill out your accounting1 90 hours online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

accounting1 90 Hours is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.