Get the free IF Accounting method (

Show details

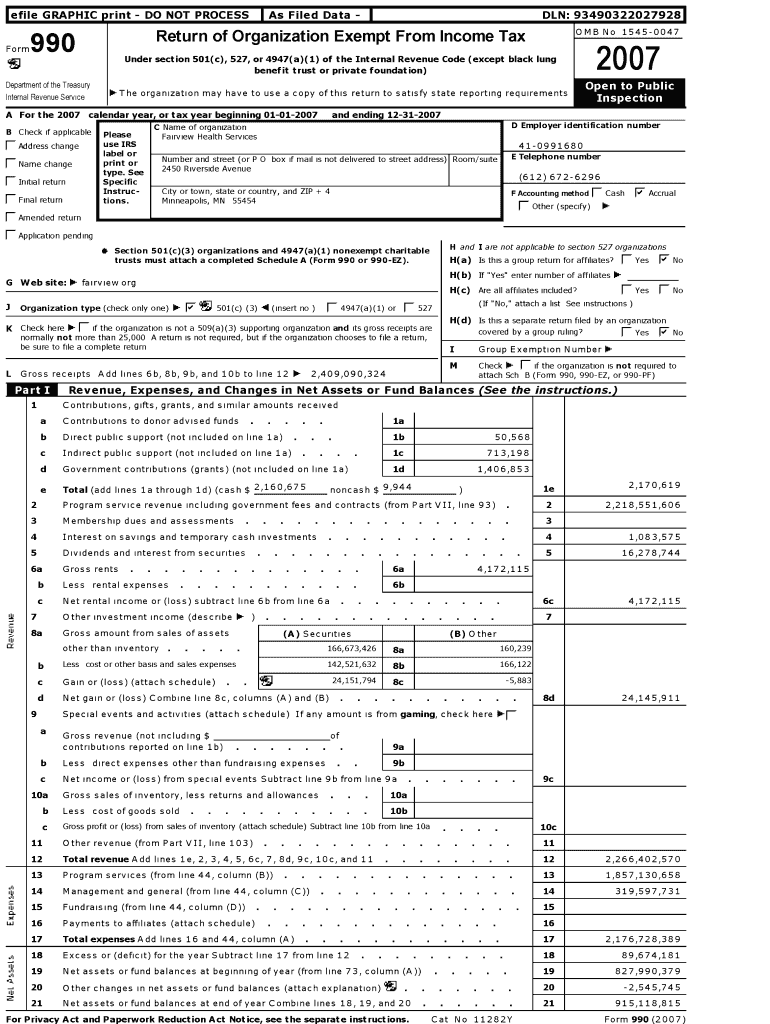

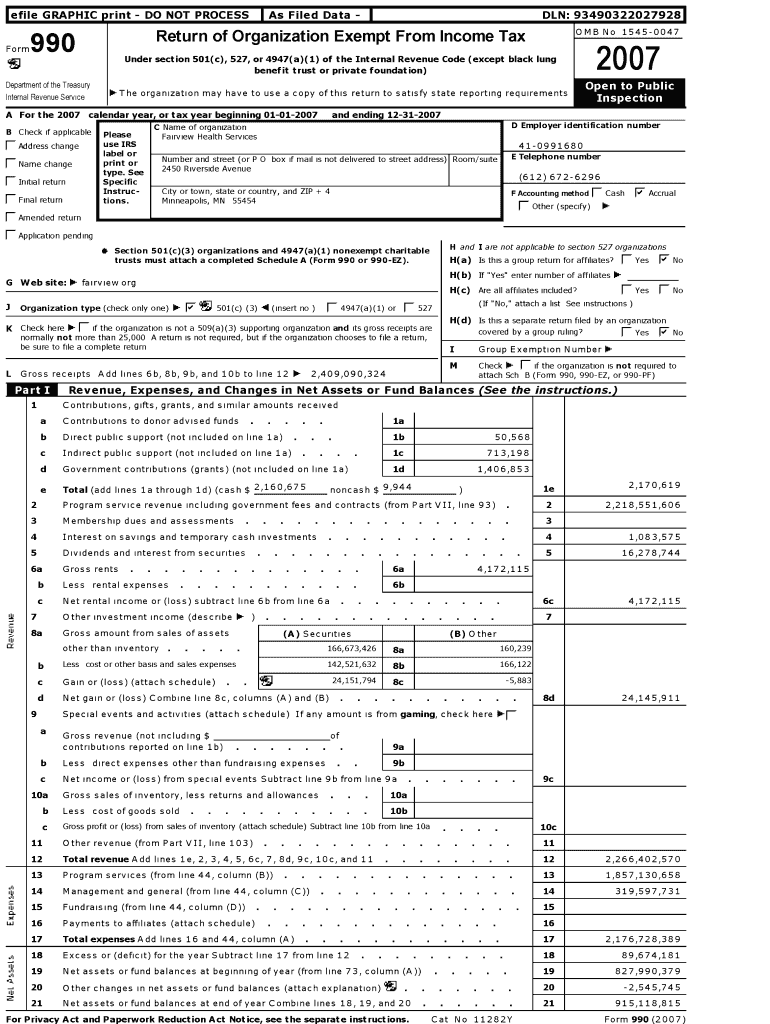

Le file FormGRAPHICp print DO NOT Process Filed Data DAN: 93490322027928 OMB Return of Organization Exempt From Income Tax99015450047Under section 501 (c), 527, or4947(a)(1) of the Internal Revenue

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign if accounting method

Edit your if accounting method form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your if accounting method form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing if accounting method online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit if accounting method. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out if accounting method

How to fill out if accounting method

01

To fill out the if accounting method, follow these steps:

02

Gather all relevant financial records and documents, such as income statements, balance sheets, and cash flow statements.

03

Determine the accounting period for which you want to calculate the if accounting method.

04

Review and classify all financial transactions based on their nature and purpose.

05

Calculate the net income or loss for the accounting period by subtracting expenses from revenues.

06

Determine the opening and closing balances of all relevant accounts.

07

Adjust the opening balances of accounts based on any necessary accruals or deferrals.

08

Apply any applicable accounting principles or standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

09

Prepare the financial statements, including the income statement, balance sheet, and cash flow statement.

10

Review and verify the accuracy of the filled out if accounting method package to ensure compliance with accounting principles and regulations.

11

Submit the if accounting method package to the relevant stakeholders, such as tax authorities, investors, or regulatory bodies.

Who needs if accounting method?

01

The if accounting method is needed by various stakeholders, including:

02

- Businesses and corporations: They need the if accounting method to accurately record and report their financial transactions, calculate their net income or loss, and prepare financial statements.

03

- Financial analysts and investors: They rely on the if accounting method to analyze a company's financial performance, assess its profitability and growth potential, and make investment decisions.

04

- Tax authorities and regulatory bodies: They require businesses to use the if accounting method for tax purposes and to ensure compliance with accounting regulations and standards.

05

- Creditors and lenders: They use the if accounting method to evaluate a company's creditworthiness and financial stability before providing loans or credit.

06

- Government agencies and policymakers: They depend on the if accounting method to gather financial data, monitor the economy, and formulate economic policies and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute if accounting method online?

pdfFiller has made filling out and eSigning if accounting method easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I sign the if accounting method electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your if accounting method in seconds.

How do I complete if accounting method on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your if accounting method. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is if accounting method?

The if accounting method, or income forecast accounting method, is a method used to report income based on estimated future earnings rather than actual earnings, focusing on future cash flows and profitability.

Who is required to file if accounting method?

Businesses and entities that project their earnings based on expected income and cash flow patterns are typically required to file using the if accounting method.

How to fill out if accounting method?

To fill out the if accounting method, one needs to provide estimates of future income, detailed projections of expected cash flows, and supporting data that justifies the forecasts made.

What is the purpose of if accounting method?

The purpose of the if accounting method is to provide a more accurate representation of an entity's future financial performance, allowing stakeholders to make informed decisions based on expected income rather than just historical data.

What information must be reported on if accounting method?

The information that must be reported includes projected income statements, cash flow projections, the assumptions made for forecasts, and any relevant data used to derive these estimates.

Fill out your if accounting method online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

If Accounting Method is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.