Get the free International Fuel Tax Agreement (IFTA) - CDTFA - CA.gov

Show details

BOE-400-IFT (S2F) REV. 3 (11-99) P.O. BOX 942879 SACRAMENTO, CA 94279-0065 (916) 322-9669 STATE OF CALIFORNIA BOARD OF EQUALIZATION APPLICATION FOR IFTA LICENSE AND DECALS BOARD USE ONLY REG FOR RR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign international fuel tax agreement

Edit your international fuel tax agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your international fuel tax agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit international fuel tax agreement online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit international fuel tax agreement. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out international fuel tax agreement

How to fill out the International Fuel Tax Agreement (IFTA):

01

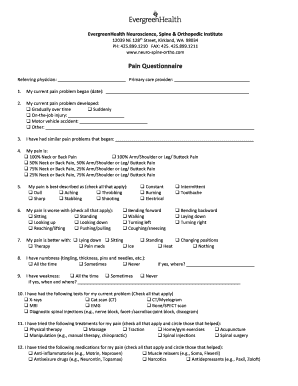

Gather all required information: Before filling out the IFTA, make sure you have the necessary documents and information ready. This includes your company's name, addresses, International Registration Plan (IRP) account number, fleet details such as the number of vehicles and their registration numbers, and fuel purchase records.

02

Verify eligibility: The IFTA is applicable to motor carriers that transport goods across jurisdictional lines. Ensure that your business falls under this category and is eligible to participate in the IFTA program. If you are unsure, consult with your local transportation authority or IFTA representative.

03

Obtain the IFTA tax return form: Contact your jurisdiction's transportation authority or visit their website to obtain the IFTA tax return form. This form is usually available online and can be downloaded easily.

04

Fill out the basic information: Start by filling out the basic information requested on the tax return form. This includes your company's name, address, account number, vehicle information, and reporting period.

05

Calculate the total distance traveled: Record the total distance traveled by each vehicle in each jurisdiction during the reporting period. This includes both taxable and nontaxable miles. You may need to refer to your vehicle's trip sheets or electronic tracking systems to accurately determine the distance traveled.

06

Determine fuel usage: Record the total amount of fuel purchased and consumed by each vehicle in each jurisdiction during the reporting period. This information is generally available from fuel purchase receipts or fleet management systems.

07

Calculate fuel tax liability: Use the mileage and fuel consumption information to calculate your fuel tax liability for each jurisdiction. Follow the specific calculation method outlined by your jurisdiction. This may involve converting distances to taxable miles, multiplying by the applicable fuel tax rate, and determining any necessary adjustments or exemptions.

08

Complete and submit the tax return: Once you have calculated your fuel tax liability for each jurisdiction, complete the remaining sections of the IFTA tax return form. Make sure to accurately report all the required information and double-check for any errors or missing details. Sign and date the form before submitting it to the appropriate jurisdiction's transportation authority by the due date.

Who needs the International Fuel Tax Agreement (IFTA)?

The IFTA is required for motor carriers that operate in multiple jurisdictions. This includes both private and for-hire carriers involved in transporting goods across state, provincial, or international boundaries. Participation in the IFTA program simplifies the reporting and payment of fuel taxes, as carriers only need to file a single quarterly tax return instead of multiple separate filings for each jurisdiction. It benefits carriers who frequently travel across different jurisdictions, making it easier to track and manage fuel tax reporting obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit international fuel tax agreement from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like international fuel tax agreement, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make changes in international fuel tax agreement?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your international fuel tax agreement to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I make edits in international fuel tax agreement without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing international fuel tax agreement and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Fill out your international fuel tax agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

International Fuel Tax Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.