Get the free Low Income Property Tax Exemption Form 2018-19 with address #2

Show details

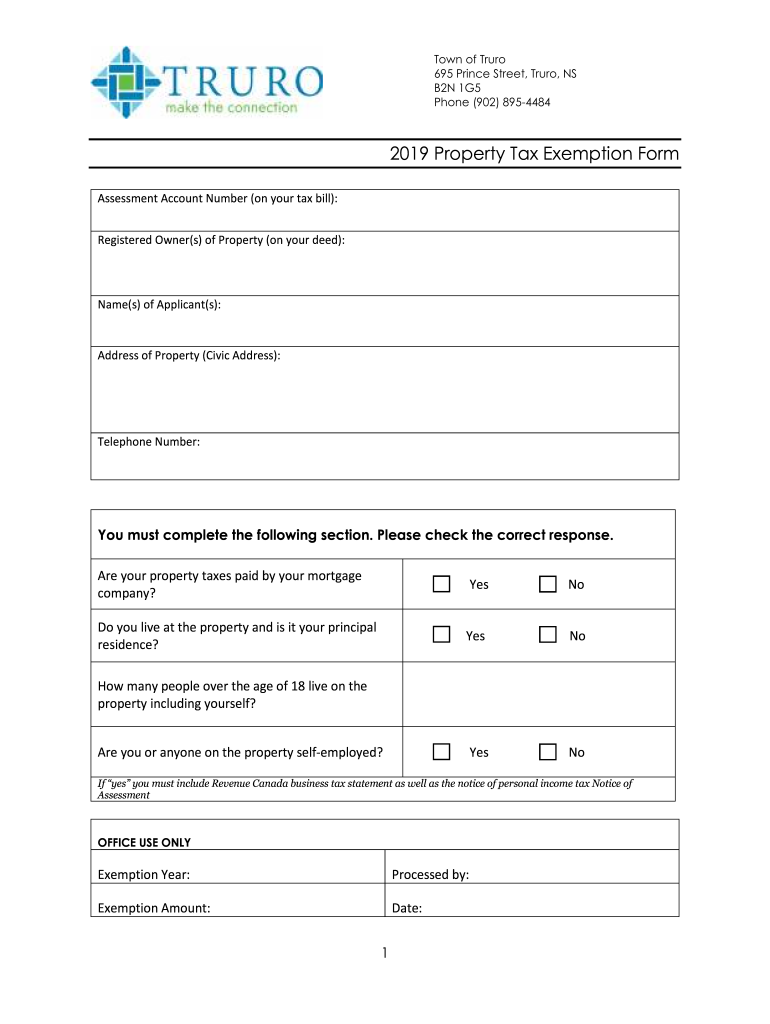

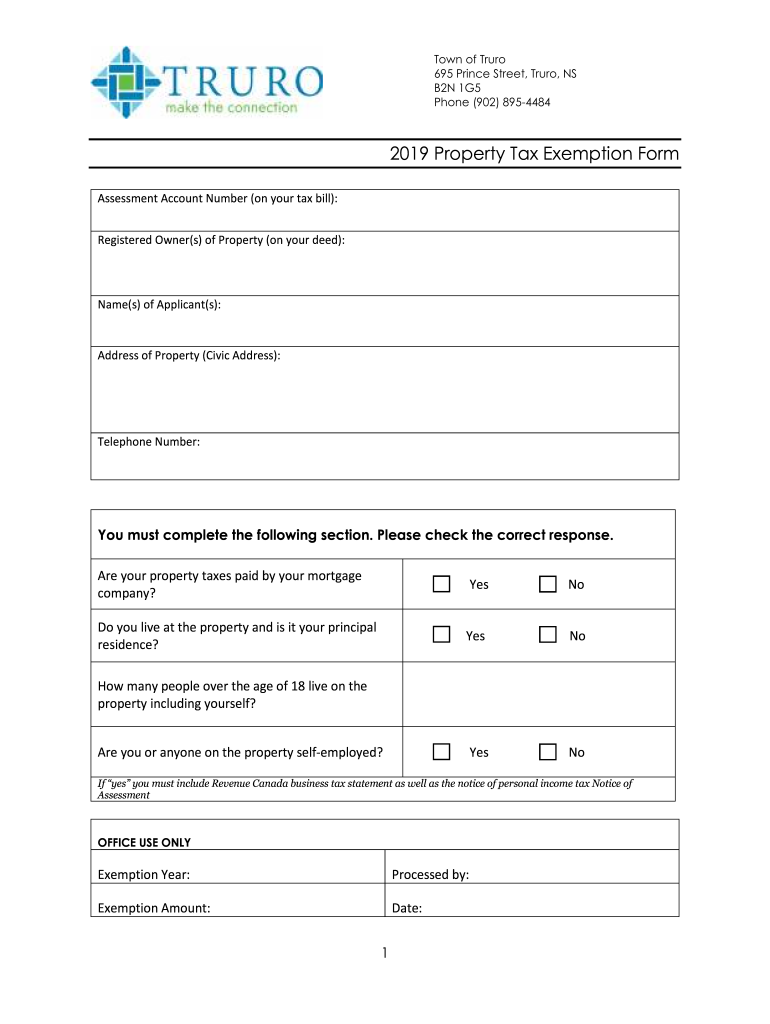

Town of Tour

695 Prince Street, Tour, NS

B2N 1G5

Phone (902) 89544842019 Property Tax Exemption Form

Assessment Account Number (on your tax bill):

Registered Owner(s) of Property (on your deed):Name(s)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign low income property tax

Edit your low income property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your low income property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing low income property tax online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit low income property tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out low income property tax

How to fill out low income property tax

01

Gather all necessary documents such as income statements, property information, and tax forms.

02

Determine if you meet the eligibility criteria for low income property tax. This may vary depending on your location.

03

Contact your local tax office or government agency responsible for property taxes to obtain the relevant application or forms for low income property tax.

04

Fill out the application or forms accurately and completely. Provide all required information and documentation as requested.

05

Double-check all the information provided to ensure accuracy and completeness.

06

Submit the filled-out application or forms to the appropriate tax office or government agency by the specified deadline.

07

Wait for the processing of your application. This may take some time, so be patient.

08

If approved, you may receive a reduction or exemption on your property tax based on your income level.

09

Keep records of your low income property tax application and any documentation submitted for future reference.

Who needs low income property tax?

01

Individuals and households with low income who own property may benefit from low income property tax programs.

02

These programs are designed to provide financial relief and assistance to those who may struggle to meet their property tax obligations due to limited income.

03

Low income property tax assistance aims to ensure that property ownership remains affordable for lower-income individuals and families.

04

Eligibility requirements may vary depending on the jurisdiction and program, but generally, individuals or households with income below a certain threshold may qualify.

05

It is advisable to contact the local tax office or government agency responsible for property taxes to determine the specific eligibility criteria and application process in your area.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my low income property tax in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your low income property tax and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send low income property tax to be eSigned by others?

low income property tax is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit low income property tax in Chrome?

Install the pdfFiller Google Chrome Extension to edit low income property tax and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

What is low income property tax?

Low income property tax refers to tax provisions that are intended to assist low-income individuals or families by providing tax relief or reductions on property taxes based on their income levels.

Who is required to file low income property tax?

Individuals or families who meet certain income thresholds and own property may be required to file for low income property tax relief or exemptions.

How to fill out low income property tax?

To fill out low income property tax, individuals must obtain the appropriate forms from their local tax authority, provide income documentation, and complete all required sections accurately before submitting by the deadline.

What is the purpose of low income property tax?

The purpose of low income property tax is to alleviate the financial burden of property taxes on low-income households, ensuring they can afford to keep their homes and promoting housing stability.

What information must be reported on low income property tax?

Information typically required includes the applicant's income, household size, property details, and any other relevant financial documentation that supports the claim for low income property tax relief.

Fill out your low income property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Low Income Property Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.