Get the free Report of Independent Accountants - auditor state oh

Show details

This document presents the report of Independent Accountants evaluating the Ohio Democratic Party's compliance with financial reporting requirements for the year ended December 31, 2002. It details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign report of independent accountants

Edit your report of independent accountants form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your report of independent accountants form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing report of independent accountants online

Follow the steps down below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit report of independent accountants. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

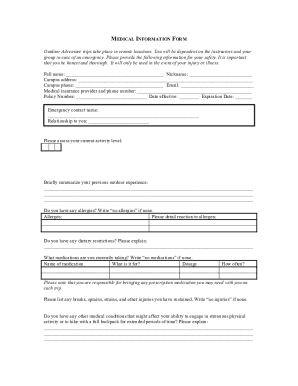

How to fill out report of independent accountants

How to fill out Report of Independent Accountants

01

Obtain the official Report of Independent Accountants form from the relevant authority or website.

02

Fill out the header section with your organization's name, address, and contact information.

03

Specify the period covered by the report, typically a fiscal year.

04

Include the name and qualifications of the independent accountant or firm.

05

Provide a description of the accounting services rendered and the scope of the audit.

06

State the financial statements that were audited or reviewed, including balance sheets and income statements.

07

Document compliance with relevant accounting principles and standards.

08

Indicate any findings, opinions, or recommendations made by the accountant.

09

Sign and date the report, and ensure it's printed on official letterhead if applicable.

10

Distribute the completed report to stakeholders as needed.

Who needs Report of Independent Accountants?

01

Businesses seeking to provide transparency to investors or stakeholders.

02

Organizations that require validation of financial statements for compliance purposes.

03

Nonprofits applying for grants or funding that require audited financials.

04

Companies undergoing mergers or acquisitions that need credible financial records.

05

Financial institutions assessing loan applications for risk evaluation.

Fill

form

: Try Risk Free

People Also Ask about

What is an independent accountant report?

An Independent Accountant's Report (also known as an IAR) is a documented review prepared for organisations receiving some sort of grant funding, or award.

Can a CPA issue an audit report?

In conclusion, a CPA can certify financial statements by preparing compilation, review, or audit reports.

What is an accountant's report?

Updated 4 March 2025. Accounting reports help small, medium or large businesses to keep up-to-date records of their business transactions. They help to determine the business's financial condition and steer decisions and activities towards success.

What is the difference between audit and accountancy?

Accounting is done with the purpose of reflecting the actual position, performance and profitability of the business or organisation. Auditing is done to verify the accuracy of records and statements presented by accounting. To determine the profit and loss or the financial position of an organisation for a period.

What is the difference between reporting accountant and auditor?

An accountant reports to the management of the business. He is responsible for providing performance reports and metrics, which help them to make informed decisions. An auditor, on the other hand, reports to the external stakeholders, such as regulatory bodies, shareholders, and sometimes management also.

What is an example of an accountant's report?

Examples include accountant's reports on government grants and loans, applications for other facilities and funding, charity street collections, service charge accounts, mortgage references, profit forecasts and the safeguarding of client monies – to name but a few.

What is the difference between an audit report and an accountant's report?

What is an accountant's report? Unlike a full audit, it doesn't involve an independent verification of your company's financial statements. Instead, it serves as a professional confirmation by a qualified accountant.

What is an independent accountant's review report?

A review includes primarily applying analytical procedures to management's financial data and making inquiries of company management. A review is substantially less in scope than an audit, the objective of which is the expression of an opinion regarding the financial statements as a whole.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Report of Independent Accountants?

A Report of Independent Accountants is an official document prepared by a licensed accountant that provides an independent evaluation of an organization's financial statements or compliance with specified regulations.

Who is required to file Report of Independent Accountants?

Entities that are subject to regulatory oversight, such as publicly traded companies and certain non-profit organizations, are typically required to file a Report of Independent Accountants as part of their financial reporting obligations.

How to fill out Report of Independent Accountants?

To fill out a Report of Independent Accountants, a qualified accountant must gather necessary financial data, perform an audit or review in accordance with relevant standards, and then document findings in the prescribed format, including signatures and accompanying notes.

What is the purpose of Report of Independent Accountants?

The purpose of the Report of Independent Accountants is to provide assurance to stakeholders regarding the reliability and accuracy of financial statements, thereby enhancing transparency and trust in the organization's financial reporting.

What information must be reported on Report of Independent Accountants?

The Report of Independent Accountants must include the accountant's opinion on the financial statements, any significant findings or issues discovered during the audit, comments on internal controls, and adherence to applicable accounting standards.

Fill out your report of independent accountants online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Report Of Independent Accountants is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.