Get the free SBA Business Loan Application - City of Page

Show details

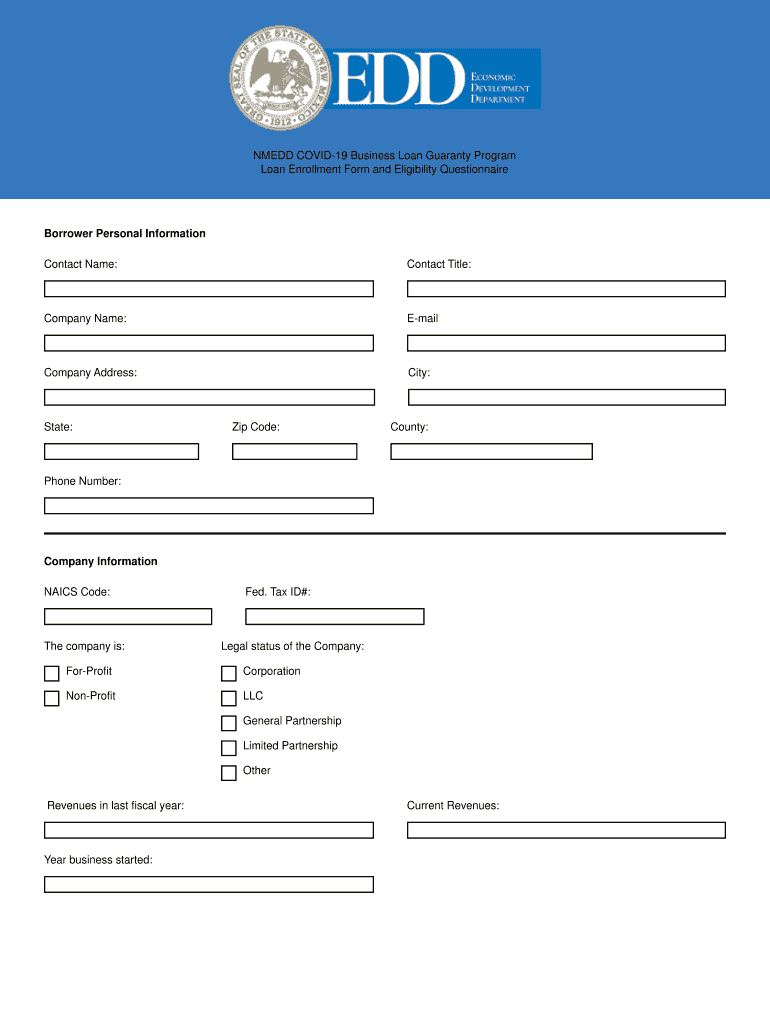

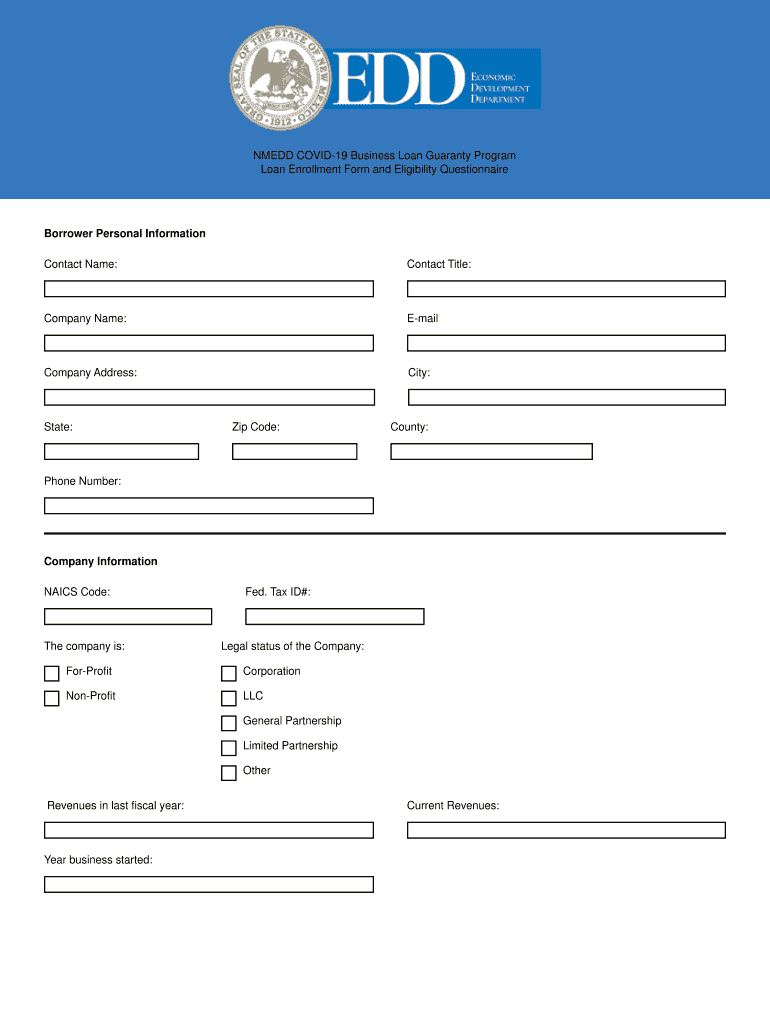

NM EDD COVID-19 Business Loan Guaranty Program

Loan Enrollment Form and Eligibility QuestionnaireBorrower Personal Information

Contact Name:Contact Title:Company Name:EmailCompany Address:City:State:Zip

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sba business loan application

Edit your sba business loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba business loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sba business loan application online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sba business loan application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sba business loan application

How to fill out sba business loan application

01

To fill out the SBA business loan application, follow these steps:

02

Gather all the necessary documents such as financial statements, tax returns, business plans, and other supporting information.

03

Go to the SBA's website and navigate to the application section.

04

Create an account or log in if you already have one.

05

Fill in the required personal and business information, including your social security number, business tax ID, and contact details.

06

Provide detailed information about your business, including its legal structure, industry, and number of employees.

07

Answer questions related to your financial history, such as past bankruptcy filings or outstanding loans.

08

Fill out the sections related to your loan request, including the desired loan amount, purpose of the loan, and collateral.

09

Review all the information you have provided and make any necessary corrections.

10

Submit the application online or follow the instructions to print and mail it to the appropriate SBA office.

11

Keep a copy of the application for your records and await further communication from the SBA regarding your loan.

Who needs sba business loan application?

01

Anyone who owns or operates a small business and requires financial assistance can benefit from the SBA business loan application.

02

This includes entrepreneurs, startups, and existing small businesses that need funding for various purposes such as expanding operations, purchasing equipment, refinancing debt, or covering working capital needs.

03

The SBA offers a range of loan programs specifically designed to support small businesses across different industries and stages of development.

04

Whether you are a sole proprietor, partnership, or corporation, and regardless of the size of your business, the SBA business loan application can be a valuable resource for accessing affordable financing options.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sba business loan application directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your sba business loan application and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Where do I find sba business loan application?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific sba business loan application and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How can I edit sba business loan application on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing sba business loan application, you need to install and log in to the app.

What is sba business loan application?

The SBA business loan application is a formal request made by small business owners seeking financial assistance from the U.S. Small Business Administration (SBA) to help fund their business operations, expansions, or acquisitions.

Who is required to file sba business loan application?

Small business owners who need funding for their business activities, such as purchasing equipment, working capital, or real estate, are required to file an SBA business loan application.

How to fill out sba business loan application?

To fill out the SBA business loan application, applicants must gather necessary financial documents, complete the application forms detailing business information, financial statements, and a business plan, then submit it to an approved lender with additional required documentation.

What is the purpose of sba business loan application?

The purpose of the SBA business loan application is to provide small businesses with access to financing that may not be available through traditional lending sources, thereby fostering growth and encouraging job creation.

What information must be reported on sba business loan application?

The information that must be reported includes business financial statements, business plan details, ownership structures, personal and business credit histories, and specific details about the proposed use of the loan funds.

Fill out your sba business loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sba Business Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.