Get the free KNOX TOWNSHIP REGULAR AUDIT - auditor state oh

Show details

This document presents the financial audit of Knox Township in Columbiana County, detailing the combined statements of cash receipts, disbursements, and changes in fund cash balances for the years

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign knox township regular audit

Edit your knox township regular audit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your knox township regular audit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing knox township regular audit online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit knox township regular audit. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

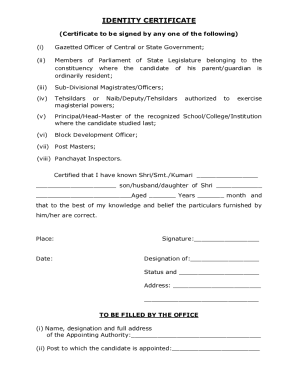

How to fill out knox township regular audit

How to fill out KNOX TOWNSHIP REGULAR AUDIT

01

Gather all necessary financial documents for the audit period.

02

Review the financial records, including income statements and balance sheets.

03

Ensure that all transactions are recorded accurately and are supported by appropriate documentation.

04

Complete the KNOX TOWNSHIP REGULAR AUDIT form with accurate figures.

05

Sign and date the audit form at the designated section.

06

Submit the completed audit form along with the supporting documents to the relevant authority.

Who needs KNOX TOWNSHIP REGULAR AUDIT?

01

Residents of Knox Township who are interested in understanding financial management.

02

Local government officials who require transparency in financial reporting.

03

Auditors and financial reviewers responsible for assessing the township's fiscal responsibility.

Fill

form

: Try Risk Free

People Also Ask about

Is company audit and statutory audit the same?

As a result, it is possible to say that statutory audits and tax audits serve entirely different purposes. A statutory audit has a broader scope than a tax audit. Furthermore, while statutory audits are required for all companies, tax audits are only required for companies subject to the Income-tax Act.

What is the purpose of a statutory audit?

A statutory audit is intended to determine if an organisation delivers an honest and accurate representation of its financial position by evaluating information, such as bank balances, financial transactions, and accounting records.

What is audit committee in simple words?

An audit committee is a group of board members responsible for overseeing an organization's financial reporting, risk management, and other internal controls. These board members ensure financial statements are accurate and audits are conducted independently.

What is a statutory audit in English?

Meaning of a Statutory Audit A statutory audit is a legally required check of the accuracy of the financial statements and records of a company or government.

What are the two main types of audits?

An audit may also be classified as internal or external, depending on the interrelationships among participants. Internal audits are performed by employees of your organization. External audits are performed by an outside agent.

Do audit committee members get paid?

As of Apr 2, 2025, the average annual pay for an Audit Committee in the United States is $138,997 a year. Just in case you need a simple salary calculator, that works out to be approximately $66.83 an hour.

What is the difference between statutory and non-statutory?

The difference between a statutory and non-statutory service is that a statutory service is required by legislation and non-statutory services is not.

What is the audit committee in English?

An audit committee is a group of board members responsible for overseeing an organization's financial reporting, risk management, and other internal controls. These board members ensure financial statements are accurate and audits are conducted independently.

What is the difference between a statutory audit and a regular audit?

A statutory audit is an audit that must be conducted in ance with relevant legislation. A non-statutory audit is generally an audit that is conducted at the request of the directors, Trustees or shareholders – although not required by legislation.

Who does the audit committee report to?

The audit committee should report to the board on an annual basis - or as needed - whether any complaints or concerns about financial improprieties have been raised by employees or others, and how those complaints/concerns were investigated, managed, and resolved.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is KNOX TOWNSHIP REGULAR AUDIT?

KNOX TOWNSHIP REGULAR AUDIT is a systematic examination and evaluation of the financial records and operations of Knox Township to ensure accuracy, compliance with laws and regulations, and to identify areas for improvement.

Who is required to file KNOX TOWNSHIP REGULAR AUDIT?

Entities operating within Knox Township that meet specific financial thresholds or are mandated by local laws to maintain transparency and accountability, typically including government agencies and certain non-profit organizations.

How to fill out KNOX TOWNSHIP REGULAR AUDIT?

To fill out the KNOX TOWNSHIP REGULAR AUDIT, gather all relevant financial documents, follow the prescribed format provided by the township, fill in necessary financial data, and ensure accuracy before submission.

What is the purpose of KNOX TOWNSHIP REGULAR AUDIT?

The purpose of KNOX TOWNSHIP REGULAR AUDIT is to provide assurance that financial statements are accurate, to promote accountability and transparency in financial practices, and to assess the effectiveness of operational procedures.

What information must be reported on KNOX TOWNSHIP REGULAR AUDIT?

The information that must be reported includes financial statements, revenue and expenditure details, compliance with laws, internal control assessments, and any findings or recommendations from the audit process.

Fill out your knox township regular audit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Knox Township Regular Audit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.