Get the free RETIREMENT PLAN AND TRUST FOR THE GENERAL EMPLOYEES

Show details

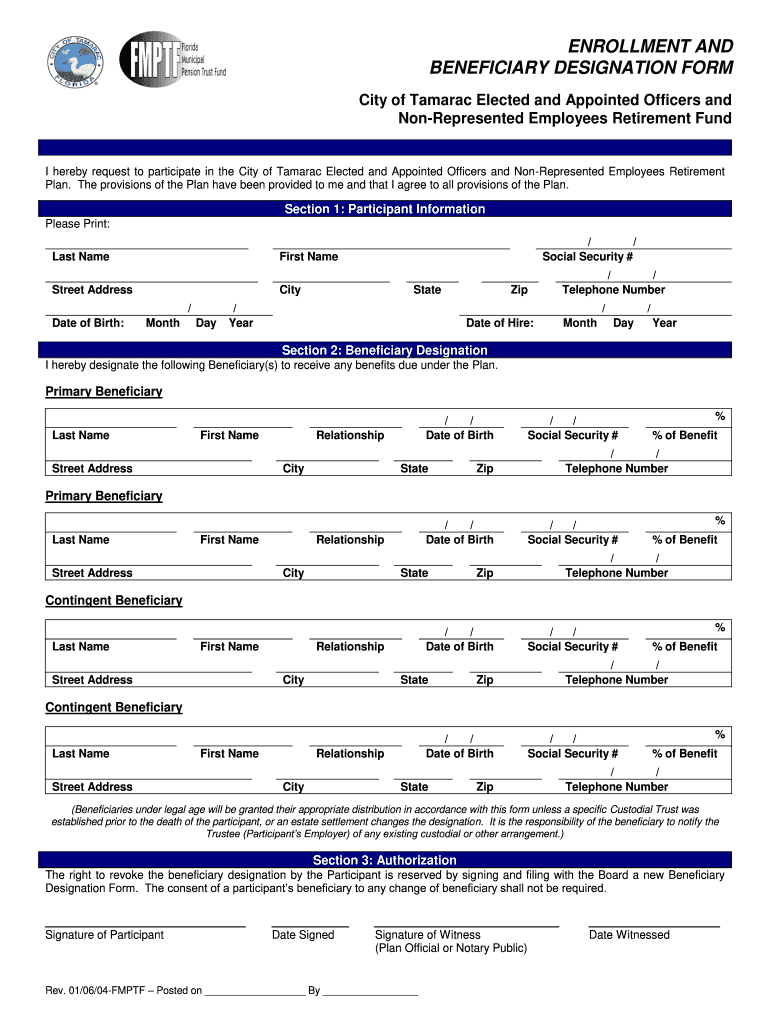

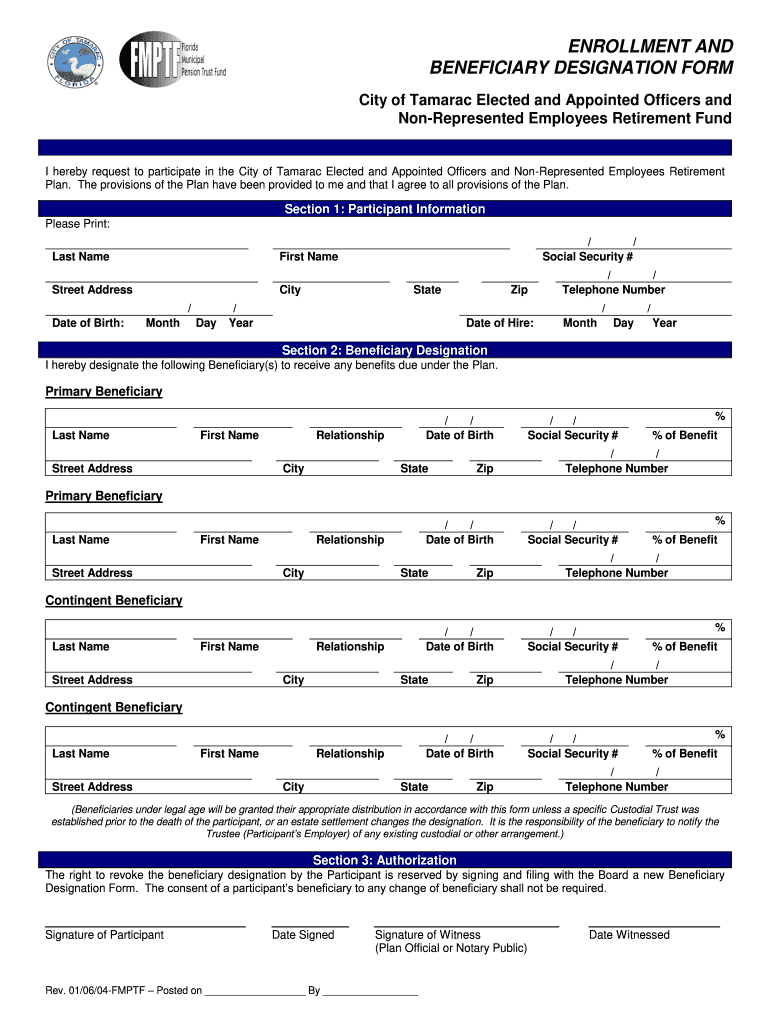

ENROLLMENT AND

BENEFICIARY DESIGNATION FORM

City of Tamarac Elected and Appointed Officers and

Unrepresented Employees Retirement Funds hereby request to participate in the City of Tamarac Elected

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retirement plan and trust

Edit your retirement plan and trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retirement plan and trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing retirement plan and trust online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit retirement plan and trust. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retirement plan and trust

How to fill out retirement plan and trust

01

To fill out a retirement plan, follow these steps:

02

Gather all relevant financial information such as income, expenses, assets, and liabilities.

03

Determine your retirement goals and how much money you will need to achieve them.

04

Research the different types of retirement plans available, such as traditional IRAs, Roth IRAs, 401(k)s, or pension plans.

05

Choose the most suitable retirement plan based on your financial situation, employment status, and eligibility.

06

Fill out the necessary paperwork or online forms provided by the retirement plan provider.

07

Provide accurate information about your personal details, employment history, and financial information.

08

Determine the contribution amount you will make towards your retirement plan and set up automatic contributions if possible.

09

Review and understand the terms and conditions of the retirement plan, including any fees or penalties for early withdrawals.

10

Seek professional advice from a financial advisor or retirement planning specialist if needed.

11

Submit the completed retirement plan application or forms to the appropriate retirement plan provider.

12

To fill out a trust, follow these steps:

13

Determine the type of trust you want to create, such as a revocable living trust or an irrevocable trust.

14

Decide on the beneficiaries of the trust and the assets or properties you want to include in the trust.

15

Consult with an attorney or estate planner to draft the trust agreement.

16

Provide details about the trust creator, beneficiaries, trustees, and successor trustees.

17

Specify the terms and conditions of the trust, including when and how the assets will be distributed to the beneficiaries.

18

Review and revise the trust agreement as necessary to ensure it meets your goals and intentions.

19

Sign the trust agreement in the presence of witnesses and have it notarized if required by your jurisdiction.

20

Fund the trust by transferring ownership of assets or properties into the trust.

21

Keep copies of the trust agreement and important documents in a safe place.

22

Periodically review and update the trust to reflect any changes in your circumstances or wishes.

Who needs retirement plan and trust?

01

A retirement plan and trust are beneficial for individuals who:

02

- Want to save and invest money for retirement to ensure financial security in their later years.

03

- Desire tax advantages or preferential treatment for their retirement savings.

04

- Have specific retirement goals and need a structured investment strategy to achieve them.

05

- Wish to protect their assets and properties for estate planning purposes.

06

- Want to determine how their wealth will be distributed and managed after their death.

07

- Have dependents or beneficiaries who may need financial support or protection in the future.

08

- Seek to avoid probate and ensure a smoother transfer of assets to their heirs.

09

- Want to provide for their loved ones, charities, or organizations even after they are gone.

10

- Need to plan for long-term care or special financial needs of their dependents or disabled family members.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find retirement plan and trust?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the retirement plan and trust in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make changes in retirement plan and trust?

With pdfFiller, the editing process is straightforward. Open your retirement plan and trust in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I edit retirement plan and trust on an Android device?

You can edit, sign, and distribute retirement plan and trust on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is retirement plan and trust?

A retirement plan is a financial arrangement designed to provide individuals with income after they retire from work. A trust associated with a retirement plan is a legal entity that holds and manages the assets of the plan for the benefit of the plan participants.

Who is required to file retirement plan and trust?

Generally, employers who offer retirement plans, such as 401(k) plans or pension plans, are required to file certain documents and reports for those plans, including trusts, with the IRS and other regulatory bodies.

How to fill out retirement plan and trust?

Filling out a retirement plan and trust typically involves completing IRS forms such as Form 5500, which requires information on plan assets, liabilities, and participant demographics. It is advisable to consult a financial advisor or tax professional for specific guidance.

What is the purpose of retirement plan and trust?

The purpose of a retirement plan and trust is to accumulate savings and investments to provide income after retirement, ensuring that individuals are financially secure in their later years.

What information must be reported on retirement plan and trust?

Information that must be reported includes plan assets, benefits paid out, administrative expenses, and details about plan participants such as contributions and distributions.

Fill out your retirement plan and trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retirement Plan And Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.