Get the free SUPPLEMENTARY KNOW YOUR CLIENT (KYC), FATCA & CRS - SELF ...

Show details

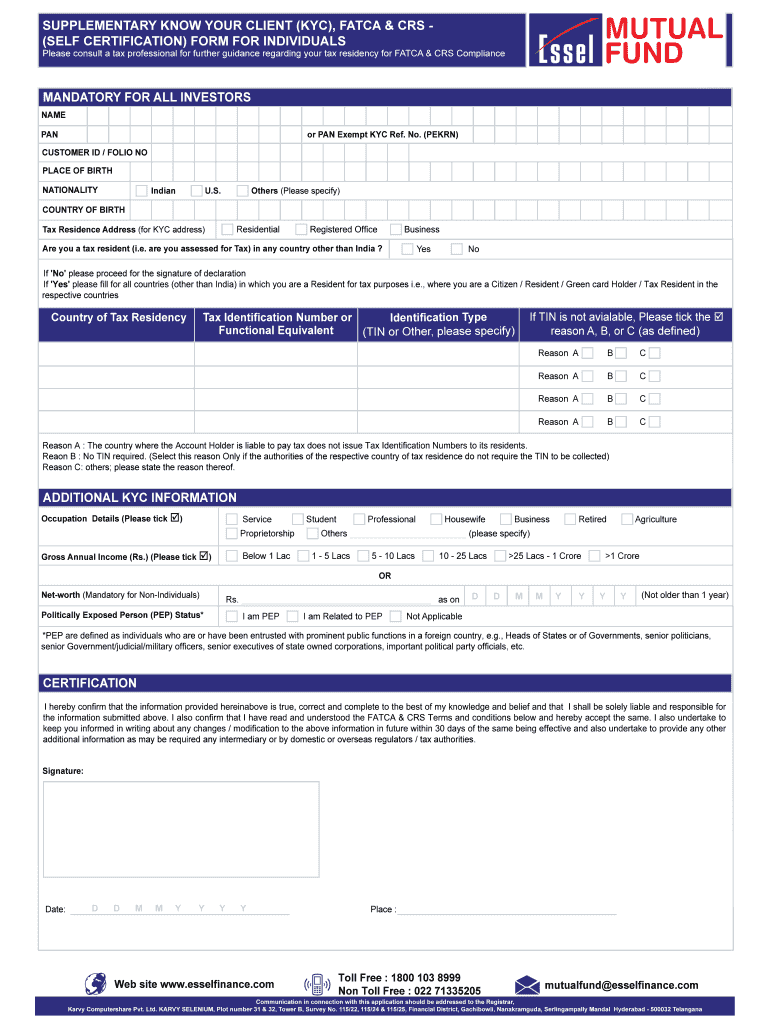

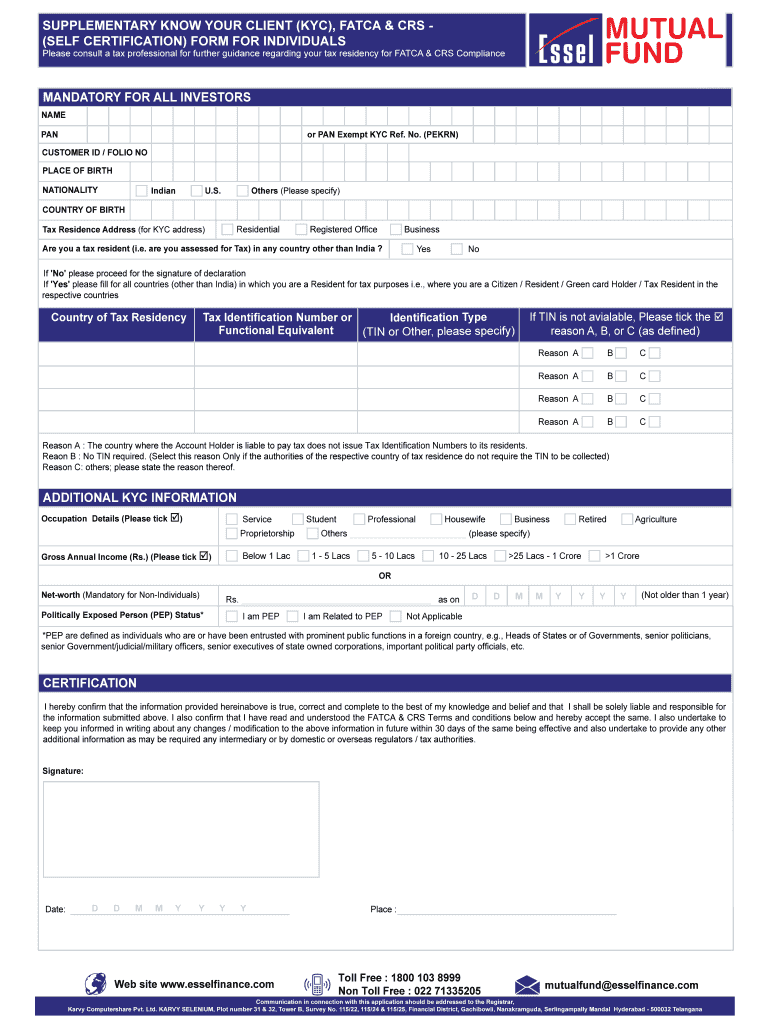

SUPPLEMENTARY KNOW YOUR CLIENT (KYC), FATWA & CRS (SELF CERTIFICATION) FORM FOR INDIVIDUALSPlease consult a tax professional for further guidance regarding your tax residency for FATWA & CRS ComplianceMANDATORY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign supplementary know your client

Edit your supplementary know your client form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supplementary know your client form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing supplementary know your client online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit supplementary know your client. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out supplementary know your client

How to fill out supplementary know your client

01

First, collect all the necessary documents and information required to fill out the supplementary Know Your Client form.

02

Start by entering your basic personal details such as your name, address, contact information, and date of birth.

03

Provide information about your employment status, current occupation, and employer details.

04

Fill in details about your financial situation, including information about your income, assets, and liabilities.

05

Answer the questions related to your investment knowledge and experience.

06

Specify your investment objectives and risk tolerance.

07

If applicable, provide information about any other beneficial owners or account holders.

08

Review the completed form for any errors or missing information.

09

Sign and date the form to certify the accuracy of the provided information.

10

Submit the completed supplementary Know Your Client form to the respective organization or institution.

Who needs supplementary know your client?

01

Supplementary Know Your Client (KYC) forms are required by financial institutions, investment firms, and other organizations that offer financial services.

02

Individuals who are opening new accounts, applying for loans, or engaging in investment activities may be asked to fill out supplementary KYC forms.

03

Existing customers may also be requested to complete these forms periodically to ensure that the organization has up-to-date information about their clients.

04

The purpose of these forms is to facilitate proper due diligence, risk assessment, and compliance with legal and regulatory requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my supplementary know your client directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your supplementary know your client and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I edit supplementary know your client from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including supplementary know your client, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make changes in supplementary know your client?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your supplementary know your client and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

What is supplementary know your client?

Supplementary Know Your Client (KYC) refers to additional information that financial institutions are required to collect and verify from their clients to ensure compliance with regulatory standards and to assess the risk of money laundering or other financial crimes.

Who is required to file supplementary know your client?

Financial institutions, such as banks, investment firms, and insurance companies, are required to file supplementary Know Your Client information for their clients as part of their compliance obligations.

How to fill out supplementary know your client?

To fill out supplementary know your client, clients need to provide personal identification details, financial information, sources of income, and any other relevant data requested by the financial institution. This information is typically submitted through a designated form or online portal.

What is the purpose of supplementary know your client?

The purpose of supplementary Know Your Client is to enhance the understanding of the client's financial profile, verify their identity, assess potential risks, and ensure compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

What information must be reported on supplementary know your client?

Information that must be reported includes personal identification details (name, date of birth, address), financial status (income, assets, employment details), and other relevant information related to the client's financial activities and source of funds.

Fill out your supplementary know your client online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supplementary Know Your Client is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.