Get the free SBA Form 2202 - safecu

Show details

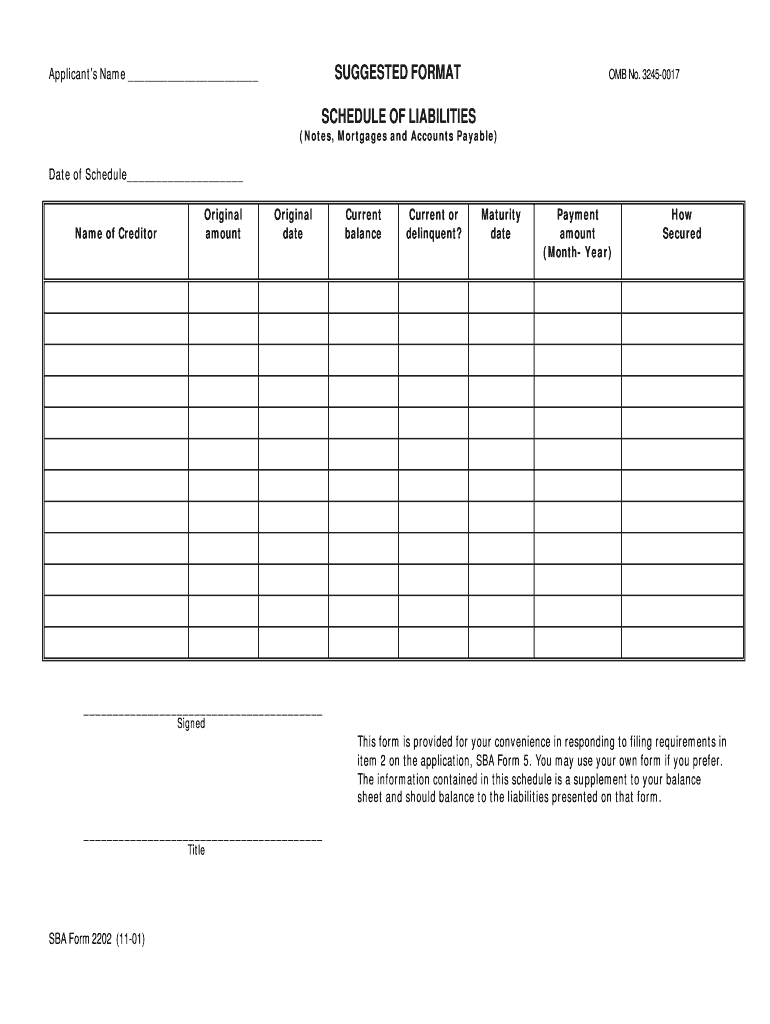

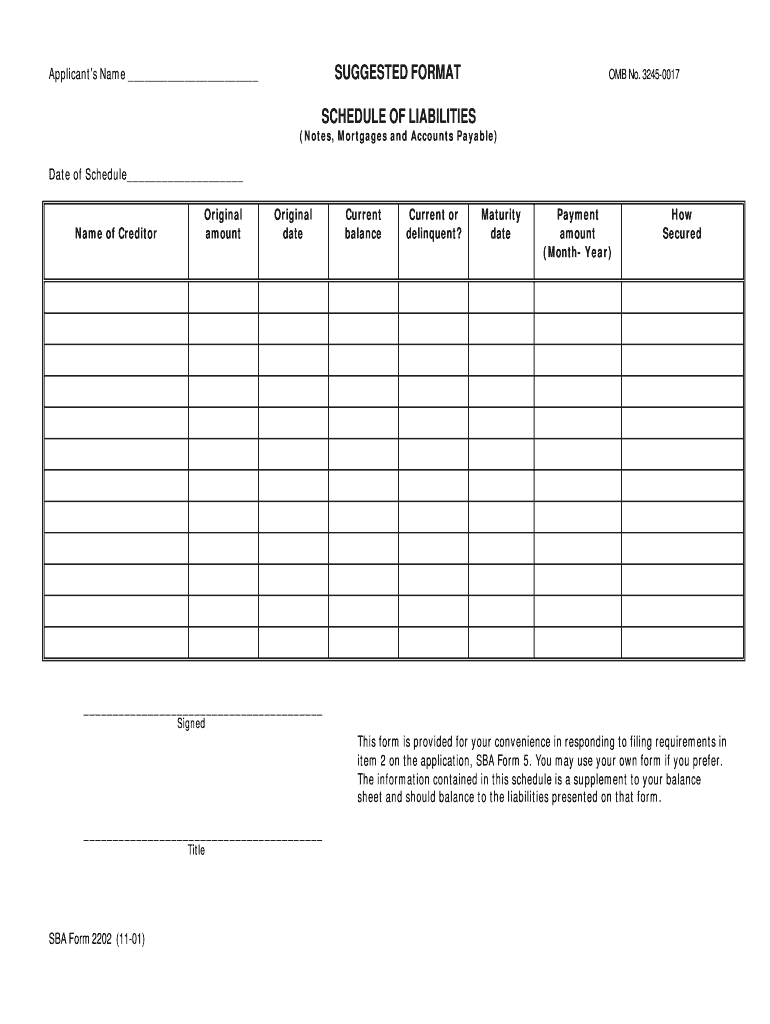

This form is provided for your convenience in responding to filing requirements in item 2 on the application, SBA Form 5. It is used to report the schedule of liabilities including notes, mortgages,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sba form 2202

Edit your sba form 2202 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba form 2202 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sba form 2202 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sba form 2202. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sba form 2202

How to fill out SBA Form 2202

01

Begin by downloading SBA Form 2202 from the official SBA website.

02

Enter your business name, address, and contact information in the designated sections.

03

Provide details about the loan amount you are applying for.

04

List all outstanding business debts including loans and financial obligations.

05

Fill in the terms of each debt and the name of the lender for clarity.

06

Ensure all amounts are accurate and match your financial records.

07

Review the form for completeness and accuracy.

08

Sign and date the form to certify the information provided.

Who needs SBA Form 2202?

01

Small business owners seeking assistance due to financial hardship.

02

Businesses applying for or seeking forgiveness for a Paycheck Protection Program (PPP) loan.

Fill

form

: Try Risk Free

People Also Ask about

Who needs to fill out SBA form 1919?

To receive a 7(a) loan, small businesses must fill out Form 1919. A copy of the form must be filled out by each principal stakeholder or owner who controls at least 20% of the business, trustors, and anyone hired to run the business' general operations.

Do credit cards go on the schedule of liabilities?

A business debt schedule, schedule of debt or schedule of liabilities is a list of all the debts your business currently owes, their current balance, original amount, monthly payments and other pertinent details. These debts can include: Small-business loans, including lines of credit and business credit cards.

What is SBA form 1919?

The purpose of this form is to collect identifying information about the Lender, the Small Business Applicant ("Applicant"), the loan guaranty request, sources and uses of funds, the proposed structure and compliance with SBA Loan Program Requirements, as defined in 13 CFR § 120.10.

What goes on schedule of liabilities?

Liabilities include everything owed. The liabilities schedule lists existing loans, both farm-related and non-farm, and provides for all calculations needed to make the loan-related entries in the balance sheet, cash flow statement, and income statement.

What goes on a debt schedule?

They are current liabilities, long-term liabilities and contingent liabilities. Current and long-term liabilities are going to be the most common ones that you see in your business. Current liabilities can include things like accounts payable, accrued expenses and unearned revenue.

What is SBA form 5?

The form is used by business owners to apply for assistance to repair or replace disaster-damaged real estate or business property.

Is the SBA form 1920 no longer required?

SBA Form 1920 has been retired as of August 1, 2023. This form remains posted for reference only.

What are the changes to the SBA form 1919?

The new SBA Form 1919 removed questions about past criminal history and replaced them with a question on whether the Applicant or any Associate of the Applicant is presently incarcerated, on probation, on parole or presently subject to an indictment for a felony or any crime involving financial misconduct or false

What goes on a schedule of liabilities?

Liabilities include everything owed. The liabilities schedule lists existing loans, both farm-related and non-farm, and provides for all calculations needed to make the loan-related entries in the balance sheet, cash flow statement, and income statement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SBA Form 2202?

SBA Form 2202 is a document used by the Small Business Administration (SBA) to collect information about a borrower's business debts as part of the loan application process.

Who is required to file SBA Form 2202?

Borrowers seeking financial assistance and loans through the SBA are required to file SBA Form 2202.

How to fill out SBA Form 2202?

To fill out SBA Form 2202, borrowers need to provide detailed information about their outstanding debts, including creditor names, amounts owed, and account numbers, as well as sign and date the form.

What is the purpose of SBA Form 2202?

The purpose of SBA Form 2202 is to gather comprehensive data regarding a borrower's existing financial obligations to assess creditworthiness and the ability to repay an SBA loan.

What information must be reported on SBA Form 2202?

Information that must be reported on SBA Form 2202 includes the names of creditors, current balances, payment amounts, account numbers, and any related loan details.

Fill out your sba form 2202 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sba Form 2202 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.