Get the free Was 2011 your final year of fishing

Show details

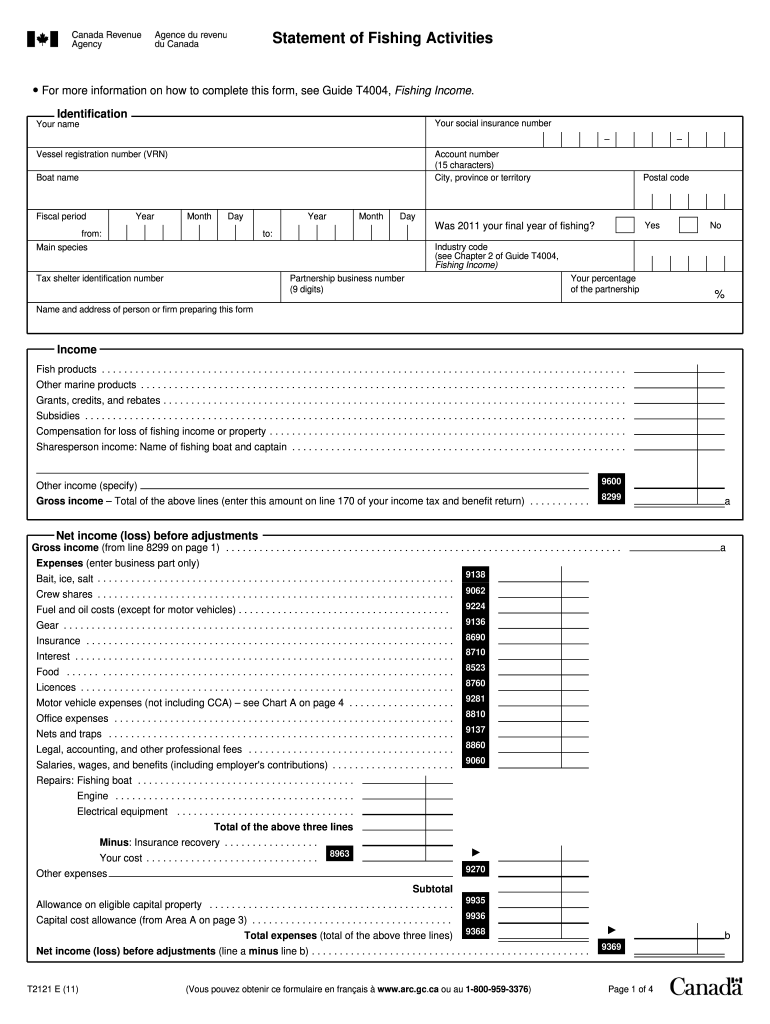

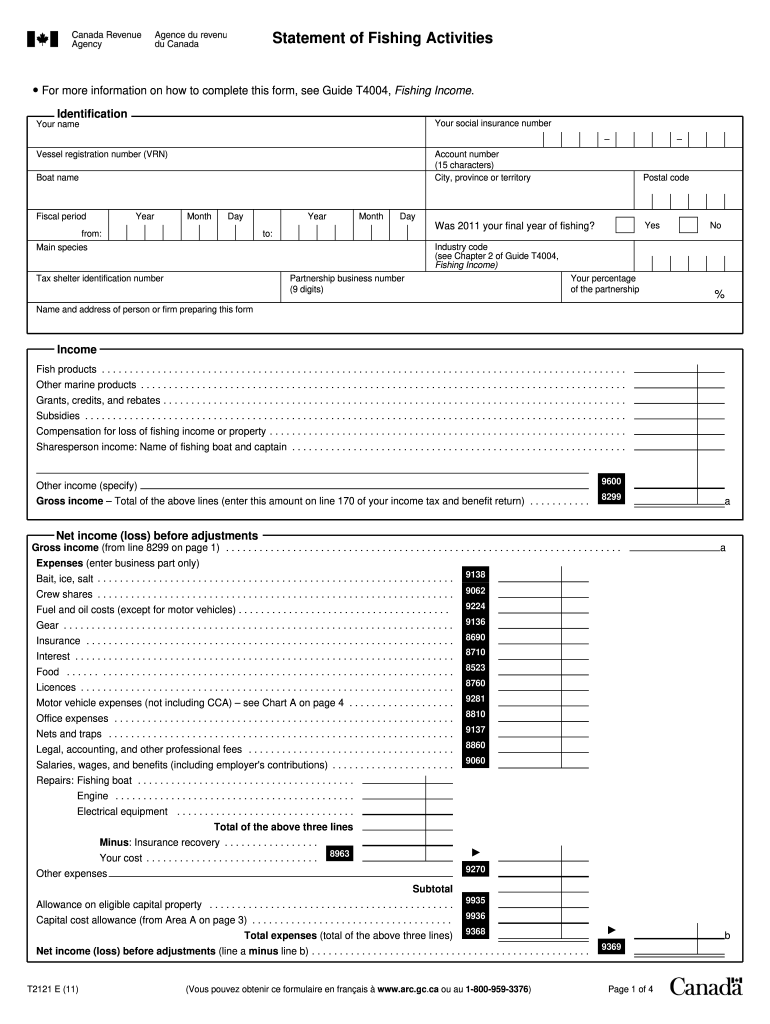

Statement of Fishing Activities For more information on how to complete this form, see Guide T4004, Fishing Income. Identification Your numerous social insurance numberless registration number (VAN)Account

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign was 2011 your final

Edit your was 2011 your final form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your was 2011 your final form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing was 2011 your final online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit was 2011 your final. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out was 2011 your final

How to fill out was 2011 your final

01

To fill out was 2011 your final, follow these steps:

02

Begin by gathering all relevant information for the year 2011, including financial records, tax documents, and any other necessary paperwork.

03

Identify the appropriate form to fill out. In most cases, this would be Form 1040 for individual taxpayers.

04

Ensure you have the latest version of the form, which can be obtained from the IRS website or through other reliable sources.

05

Begin filling out the form by providing your personal information, including your name, address, and social security number.

06

Enter your income for the year 2011, including wages, salaries, self-employment income, and any other sources of income.

07

Deduct any eligible expenses and adjustments to arrive at your adjusted gross income.

08

Complete the applicable sections for credits, deductions, and exemptions based on your specific circumstances.

09

Calculate your tax liability using the appropriate tax tables or tax software.

10

Determine if you are eligible for any refund or if you owe additional taxes.

11

Sign and date the form, and include any required attachments such as W-2 forms or additional schedules.

12

13

It is recommended to consult with a tax professional or refer to the official IRS instructions for more detailed guidance on filling out was 2011 your final.

Who needs was 2011 your final?

01

Various individuals and entities may need to fill out was 2011 your final, including:

02

- Individual taxpayers who were required to file a tax return for the year 2011.

03

- Business owners or self-employed individuals who need to report their income and expenses for that year.

04

- Executors or administrators of estates that had financial activity in 2011.

05

- Individuals who need to claim credits or deductions for the year 2011.

06

- Anyone who has received a request or notification from the IRS to provide information or file a tax return for that specific year.

07

08

It is important to note that tax requirements can vary based on individual circumstances and it is recommended to consult with a tax professional or refer to the official IRS guidelines to determine if you need to fill out was 2011 your final.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send was 2011 your final for eSignature?

Once your was 2011 your final is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in was 2011 your final?

With pdfFiller, it's easy to make changes. Open your was 2011 your final in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an electronic signature for the was 2011 your final in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is was your final year?

The term 'final year' typically refers to the last year of an academic program or the closing year of a reporting period for taxes or financial statements.

Who is required to file was your final year?

Individuals or organizations that are concluding their financial year or completing an academic program are required to file the final year paperwork or reports.

How to fill out was your final year?

To fill out the final year documents, gather all relevant financial or academic information, follow the prescribed format, and ensure all entries are accurate.

What is the purpose of was your final year?

The purpose of the final year filing is to summarize and report financial results or academic achievements, providing a clear overview of the preceding period.

What information must be reported on was your final year?

The final year report typically includes income, expenses, balances, and significant achievements or grades attained during the period.

Fill out your was 2011 your final online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Was 2011 Your Final is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.