Get the free Form 109

Show details

Este folleto contiene instrucciones para el Formulario 109, Declaración de Impuestos sobre Ingresos para Organizaciones Exentas en California. Incluye detalles sobre los cambios recientes en las

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 109

Edit your form 109 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 109 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 109 online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 109. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 109

How to fill out Form 109

01

Gather your income information, including any W-2s or 1099s you have received.

02

Obtain a copy of Form 109 from the IRS website or a tax professional.

03

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

04

Enter the income amounts in the appropriate boxes, ensuring that you include all necessary documentation.

05

If applicable, fill out information regarding withholding and credits.

06

Review the form for accuracy, making sure all calculations are correct.

07

Sign and date the form.

08

Keep a copy for your records and submit the form as required by the IRS.

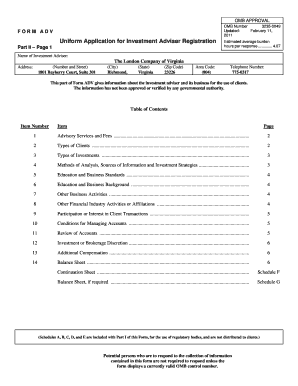

Who needs Form 109?

01

Anyone who has received certain types of income, such as freelance earnings, interest, dividends, or other miscellaneous income, may need to fill out Form 109.

02

Taxpayers who are self-employed or operate as a business may also need to complete Form 109 to report their income.

Fill

form

: Try Risk Free

People Also Ask about

What are Form 109 payments?

A tax-exempt organization that regularly carries on a trade or business that is not substantially related to its exempt purpose may be required to pay tax on the unrelated trade or business income that results from such activity. Use Form 109 to figure the tax on the unrelated business income of the organization.

What is a Form 1099-R used for?

Form 1099-R is the Internal Revenue Service form reporting a taxpayer's distributions from pensions, annuities, IRAs, insurance contracts, profit-sharing plans and/or retirement plans (including section 457 state and local government plans). The following information may be helpful in interpreting your Form 1099-R.

Do I have to file 109?

Payers who make Nonemployee Compensation payments below $600 are typically not required to file the 1099-NEC unless the payer withholds any amount of tax from the payments. However, they may do so if they wish. If you received less than $600 from a payer, you are still required to report the income on your tax return.

Does a 1099-R hurt your taxes?

Key takeaways. IRS Form 1099-R reports income received from IRAs, pensions, retirement plans, profit-sharing plans, insurance contracts, and annuities. Whether you're required to pay taxes on this income depends on the source. Distributions from a traditional 401(k), for example, are usually taxable.

What is a 109 form for?

Use Form 109, California Exempt Organization Business Income Tax Return, to figure the tax on the unrelated business income of the organization. Filing Form 109 does not replace the requirement to file Form 199, California Exempt Organization Annual Information Return, or FTB 199N.

What is a 109 form for?

Use Form 109, California Exempt Organization Business Income Tax Return, to figure the tax on the unrelated business income of the organization. Filing Form 109 does not replace the requirement to file Form 199, California Exempt Organization Annual Information Return, or FTB 199N.

Who would send me a 1099-R?

Form 1099-R is used to report distributions from annuities, profit-sharing plans, retirement plans, IRAs, insurance contracts, or pensions. Anyone who receives a distribution over $10 should receive a 1099-R form. The form is provided by the plan issuer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 109?

Form 109 is a tax form used in the United States to report various types of income, typically related to interest, dividends, or miscellaneous income.

Who is required to file Form 109?

Individuals or entities that have made certain types of payments such as dividends, interest, or royalties that meet or exceed specified thresholds are required to file Form 109.

How to fill out Form 109?

To fill out Form 109, you must provide details about the payer and payee, including names, addresses, and taxpayer identification numbers, as well as the amounts paid during the fiscal year.

What is the purpose of Form 109?

The purpose of Form 109 is to ensure that the IRS receives accurate information about income paid to individuals and entities, aiding in the correct assessment of tax obligations.

What information must be reported on Form 109?

Form 109 must report the payer's details, recipient's details, amounts paid, and the type of payment made, along with any relevant tax information.

Fill out your form 109 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 109 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.