Get the free Business Credit Application ( ) ( ) ( ) - Garcia Roofing and Sheet Metal

Show details

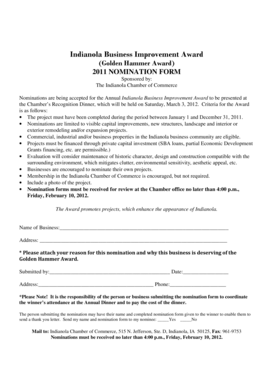

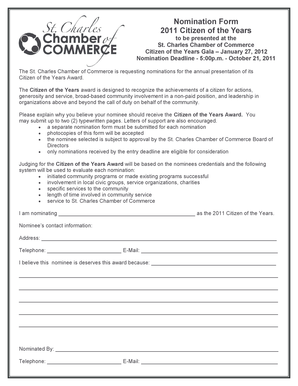

Garcia Roofing & Sheet Metal 18219 Swamp Road Prairieville, LA 70769 Phone: 225-756-3100 Fax: 225-677-7526 Business Credit Application Business Information Application Date Month / Day / Year Gross

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business credit application

Edit your business credit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business credit application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business credit application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business credit application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business credit application

How to fill out a business credit application:

01

Gather all the necessary information and documents. This may include the business's legal name, address, phone number, tax identification number (TIN), financial statements, and any other relevant financial or legal documents.

02

Review the application form thoroughly. Ensure that you understand each section and the information requested.

03

Begin by providing the basic information about the business, such as its legal name, address, and contact details.

04

Fill in the financial information section, which may include details about the business's revenue, expenses, assets, and liabilities.

05

Include information about the ownership and management of the business, such as the names, titles, and contact information of the owners or executives.

06

Provide a brief description of the business's operations, including its products or services, target market, and any unique selling points.

07

If applicable, disclose any existing credit relationships or loans the business has with other financial institutions.

08

Sign and date the application form, certifying that all the information provided is accurate and complete to the best of your knowledge.

09

Submit the completed application, along with any requested supporting documents, to the designated contact or department.

Who needs a business credit application:

01

Business owners or entrepreneurs looking to establish a line of credit or obtain financing for their business.

02

Companies seeking to expand their operations, purchase equipment, or invest in new projects.

03

Startups or small businesses looking to establish creditworthiness and build a solid credit profile.

04

Businesses that need working capital or funding to meet their day-to-day operational expenses.

05

Enterprises planning to apply for trade credit terms with suppliers or vendors.

06

Companies seeking to improve their overall financial stability and cash flow management.

Note: It is important to consult with a financial advisor or banker for specific guidance on filling out a business credit application as requirements may vary depending on the institution and type of credit being applied for.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business credit application to be eSigned by others?

When your business credit application is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make changes in business credit application?

The editing procedure is simple with pdfFiller. Open your business credit application in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I edit business credit application on an Android device?

With the pdfFiller Android app, you can edit, sign, and share business credit application on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is business credit application?

A business credit application is a document used by businesses to request credit from lenders or suppliers.

Who is required to file business credit application?

Any business that wishes to apply for credit from lenders or suppliers is required to file a business credit application.

How to fill out business credit application?

To fill out a business credit application, you need to provide information about your business, such as its name, address, financial history, and the amount of credit you are requesting.

What is the purpose of business credit application?

The purpose of a business credit application is to provide lenders or suppliers with the necessary information to assess the creditworthiness of a business and determine whether to extend credit.

What information must be reported on business credit application?

The information that must be reported on a business credit application typically includes the business's name, legal structure, address, contact information, financial statements, credit history, and references.

Fill out your business credit application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Credit Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.