Get the free LICENSING AND TAXATION OF BUSINESSES

Show details

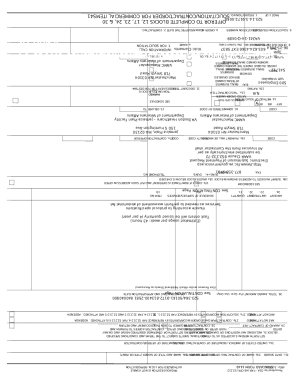

CHAPTER 40. GENERAL REQUIREMENTS FOR

LICENSING AND TAXATION OF BUSINESSES

Article I. Issuance of License; Payment of Taxes

Section 40.010. Taxes and Fees to Be Paid Before Issuance of Licenses. No

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign licensing and taxation of

Edit your licensing and taxation of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your licensing and taxation of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing licensing and taxation of online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit licensing and taxation of. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out licensing and taxation of

How to fill out licensing and taxation of

01

Gather all necessary documents such as business registration papers, identification documents, and financial records.

02

Determine the specific type of license or permits required for your business based on its nature and location.

03

Research and understand the tax regulations applicable to your business sector.

04

Consult with a qualified tax professional or attorney to ensure compliance with all licensing and taxation requirements.

05

Fill out the licensing and tax forms accurately and thoroughly, providing all required information and supporting documentation.

06

Submit the completed forms along with any required fees to the appropriate government agency.

07

Keep copies of all submitted forms and receipts for future reference and verification.

08

Stay updated with any changes or updates in licensing and taxation regulations that may affect your business.

09

Renew or update your licenses and tax registrations as required by law and maintain accurate records for auditing purposes.

Who needs licensing and taxation of?

01

Any individual or organization engaged in business activities that generate income or involve the provision of goods and services can be required to obtain licenses and fulfill tax obligations.

02

This can include businesses of all sizes, ranging from sole proprietorships to large corporations.

03

Different industries and professions may have specific licensing requirements, such as healthcare providers, food establishments, financial institutions, construction companies, and more.

04

Taxation is applicable to all individuals and businesses earning taxable income, regardless of their nature or size.

05

Ultimately, anyone who wants to operate legally and compliantly should consider licensing and taxation as an essential part of their business operations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get licensing and taxation of?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific licensing and taxation of and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit licensing and taxation of in Chrome?

licensing and taxation of can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an eSignature for the licensing and taxation of in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your licensing and taxation of and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is licensing and taxation of?

Licensing and taxation refers to the regulatory and financial obligations that individuals or businesses must comply with to legally operate within a jurisdiction. This includes obtaining necessary licenses and permits as well as fulfilling tax obligations.

Who is required to file licensing and taxation of?

Individuals or businesses engaged in activities that require licenses, such as operating a business or selling goods and services, are typically required to file licensing and taxation forms. This may include self-employed individuals, corporations, and partnerships.

How to fill out licensing and taxation of?

To fill out licensing and taxation forms, one should gather all necessary information, complete the required fields accurately, attach any necessary documentation, and submit the form by the specified deadline, either online or via mail.

What is the purpose of licensing and taxation of?

The purpose of licensing and taxation is to regulate the activities of individuals and businesses, ensure compliance with local laws and ordinances, collect revenue for government services, and maintain public safety and order.

What information must be reported on licensing and taxation of?

Information typically required may include business name, owner’s information, type of business activity, revenue, or income, and details about previous licensing or tax filings, among other specifics depending on the jurisdiction.

Fill out your licensing and taxation of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Licensing And Taxation Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.