Get the free Senior Parent Form - samohi smmusd

Show details

This form is designed for parents or guardians of students at Santa Monica High School to provide insights and information that will assist in writing a 'Letter of Recommendation' for their child.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign senior parent form

Edit your senior parent form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your senior parent form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing senior parent form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit senior parent form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out senior parent form

How to fill out Senior Parent Form

01

Gather necessary personal information including your name, address, and contact details.

02

Collect information about your senior student, including their name, school ID, and grade level.

03

Fill in the details regarding parental consent and emergency contact information.

04

Provide any relevant medical information or special considerations for your student.

05

Review all entries for accuracy before submission.

06

Submit the completed form by the designated deadline, either online or in person.

Who needs Senior Parent Form?

01

Parents or guardians of high school seniors who need to provide information and consent for school-related activities and documentation.

Fill

form

: Try Risk Free

People Also Ask about

At what age do seniors stop paying property taxes in Illinois?

Senior Citizen Homestead Exemption – Homeowners age 65 or older and living in their own home could be entitled to an additional homestead exemption. The homeowner should sign up for this exemption during the year in which he or she will turn 65. You will receive a renewal every year around January 1st.

How much is the senior tax exemption in Illinois?

Senior Citizens Homestead Exemption The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook County or $5,000 in all other counties.

When can I apply for senior freeze in Cook County?

You must file each year in order to continue to receive the Senior Freeze Exemption and the requirements must be met each year. First-time applicants are encouraged to contact us to ensure eligibility, and if eligible, to apply between January and April.

What exemptions do you get on your property when you turn 65 in Illinois?

The Senior Exemption reduces the Equalized Assessed Value (EAV) of a property by $8,000. EAV is the partial value of a property used to calculate tax bills. It is important to note that the exemption amount is not the dollar amount by which a tax bill is lowered.

How do I apply for senior tax freeze in Illinois?

Obtain an application for the exemption at the Chief County Assessors Office, from your Township Assessors, or download the application (PDF). If you need assistance in filling out your income information, view the Senior Citizen Assessment Freeze Conversion Guide for IRS 1040 (PDF).

How do you qualify for senior freeze in Illinois?

Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2023 calendar year. A "Senior Freeze" Exemption provides property tax savings by freezing the equalized assessed value (EAV) of an eligible property.

What is the senior tax deferral program in Illinois?

APPLICATIONS ARE TAKEN: January through the cut-off date of March 1st each year the program is offered by the State of Illinois. The Senior Citizens' Real Estate Tax Deferral program provides tax relief for qualified senior citizens by allowing them to defer $7,500 of their property tax on their principal residence.

Who qualifies for senior freeze exemption in Cook County?

Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2023 calendar year. A "Senior Freeze" Exemption provides property tax savings by freezing the equalized assessed value (EAV) of an eligible property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

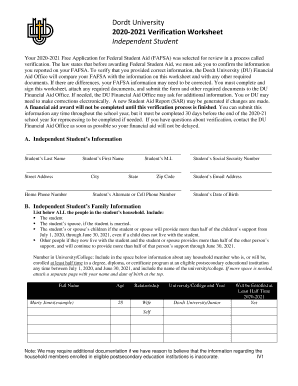

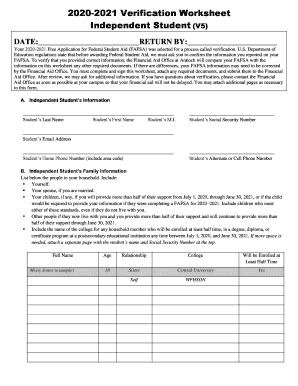

What is Senior Parent Form?

The Senior Parent Form is a document used by certain educational institutions to collect information about the parents or guardians of senior students, usually for college applications and planning.

Who is required to file Senior Parent Form?

Typically, the Senior Parent Form must be completed by the parents or guardians of students who are in their final year of high school and applying for college.

How to fill out Senior Parent Form?

To fill out the Senior Parent Form, parents should gather necessary details such as financial information, student information, and any additional required documentation, then complete the form by providing accurate responses and submitting it as directed by the school.

What is the purpose of Senior Parent Form?

The purpose of the Senior Parent Form is to collect important information that helps schools and colleges understand the financial situation and background of students, which can be vital for admissions and financial aid processes.

What information must be reported on Senior Parent Form?

The Senior Parent Form generally requires information such as parent names, contact details, financial details including income and assets, and any relevant educational history that may influence the student's college application.

Fill out your senior parent form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Senior Parent Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.