Get the free Life Insurance Benefits Application

Show details

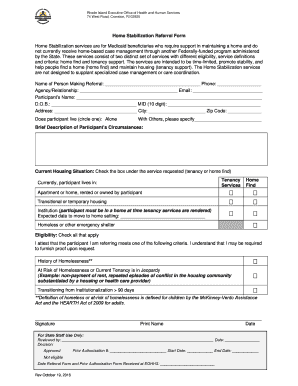

Reset New Mexico Public Schools Insurance Authority Life Insurance Bene ts Application Instructions Standard Insurance Company Life Bene ts Department PO Box 2800 Portland OR 97208 888. 609. 9763 Tel Please select your school from the lists below before printing School Alpha Listing School Name and District No* CHOOSE ONE PLEASE READ CAREFULLY The application for life insurance bene ts consists of the forms included in this packet as well as the additional information noted under item 1...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance benefits application

Edit your life insurance benefits application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance benefits application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit life insurance benefits application online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit life insurance benefits application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance benefits application

How to fill out Life Insurance Benefits Application

01

Obtain the Life Insurance Benefits Application form from the insurance provider or their website.

02

Read the instructions carefully before filling out the form.

03

Provide the insured person's information including their full name, date of birth, and Social Security number.

04

Fill in the details of the policy, such as the policy number and the name of the insurance company.

05

Specify the cause of death or the reason for the claim, along with any necessary documentation such as a death certificate.

06

Complete the beneficiary information, including their full names and relationship to the insured.

07

Sign and date the application form to attest that the information provided is accurate.

08

Submit the application via the insurance provider's preferred submission method, whether by mail or online.

Who needs Life Insurance Benefits Application?

01

Individuals who have life insurance policies and are beneficiaries of the policy.

02

Family members or dependents of the insured seeking to claim benefits after the insured's death.

03

Financial representatives or advisors managing the insurance claims process for a client.

Fill

form

: Try Risk Free

People Also Ask about

What conditions make you uninsurable for life insurance?

What medical conditions prevent you from getting life insurance? Anxiety and depression. Asthma. Diabetes. Heart disease. High blood pressure. High cholesterol. HIV. Obesity.

What are 3 reasons you may be denied from having life insurance?

Reasons You May Have Been Denied Life Insurance Some chronic illnesses such as diabetes, heart disease, or high blood pressure can raise red flags for insurers. Even well-managed conditions can sometimes lead to a denial.

How to fill out a life insurance claim form?

When a loved one dies, a beneficiary may have options for how to receive the death benefit. One option is a single settlement check. Another option may be a Retained Asset Account, which is like a checking account maintained with the life insurance company.

What disqualifies you from a life insurance policy?

If you have had a history of suicidal actions, insurance companies will likely deny coverage due to the high risk. People who suffer from posttraumatic stress disorder (PTSD) may also be denied coverage. Another disqualifying condition would be self-medicating with drugs and alcohol to treat your depression.

What should you not say when applying for life insurance?

1:03 2:42 Based on your correct. Age missing information is also a big no. No.MoreBased on your correct. Age missing information is also a big no. No.

What not to say when applying for life insurance?

Documents needed for life insurance If you first seek an insurance quote online, you may only have to give a few pieces of information, such as your age, weight, height, gender, and a few facts about your lifestyle and medical history, like previous surgeries and whether or not you smoke.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Life Insurance Benefits Application?

The Life Insurance Benefits Application is a formal request submitted to an insurance company by the beneficiary or claimant to receive the benefits of a life insurance policy following the insured person's death.

Who is required to file Life Insurance Benefits Application?

Typically, the beneficiary named in the life insurance policy is required to file the Life Insurance Benefits Application. In some cases, a legal representative of the deceased may also file the application.

How to fill out Life Insurance Benefits Application?

To fill out the Life Insurance Benefits Application, gather required documents such as the death certificate, policy number, and personal identification. Complete the application form with accurate information, sign it, and submit it to the insurance company.

What is the purpose of Life Insurance Benefits Application?

The purpose of the Life Insurance Benefits Application is to formally notify the insurance company of the insured's death and initiate the process of releasing the death benefit to the designated beneficiary.

What information must be reported on Life Insurance Benefits Application?

The information that must be reported on the Life Insurance Benefits Application includes the insured person's name, date of birth, policy number, date of death, a copy of the death certificate, and the contact information of the beneficiary.

Fill out your life insurance benefits application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance Benefits Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.