Get the free PLAN 150 LIFE INSURANCE

Show details

TM1901 Las Vegas Blvd. So. Suite 107

Las Vegas, Nevada 891041309

(702) 7339938

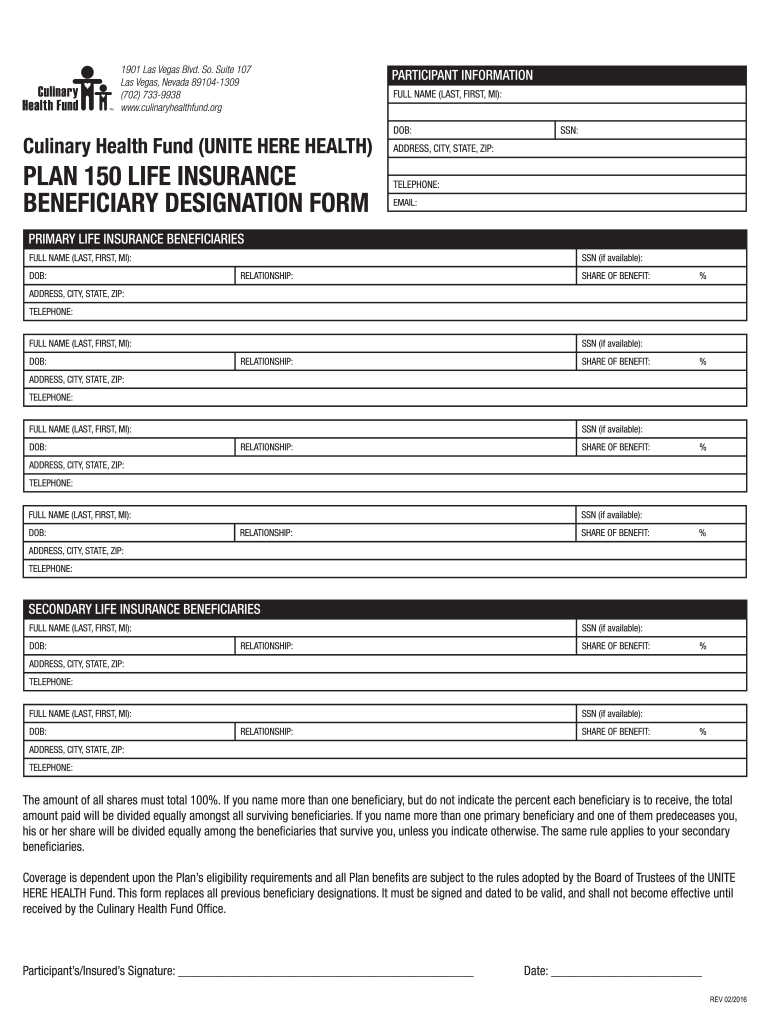

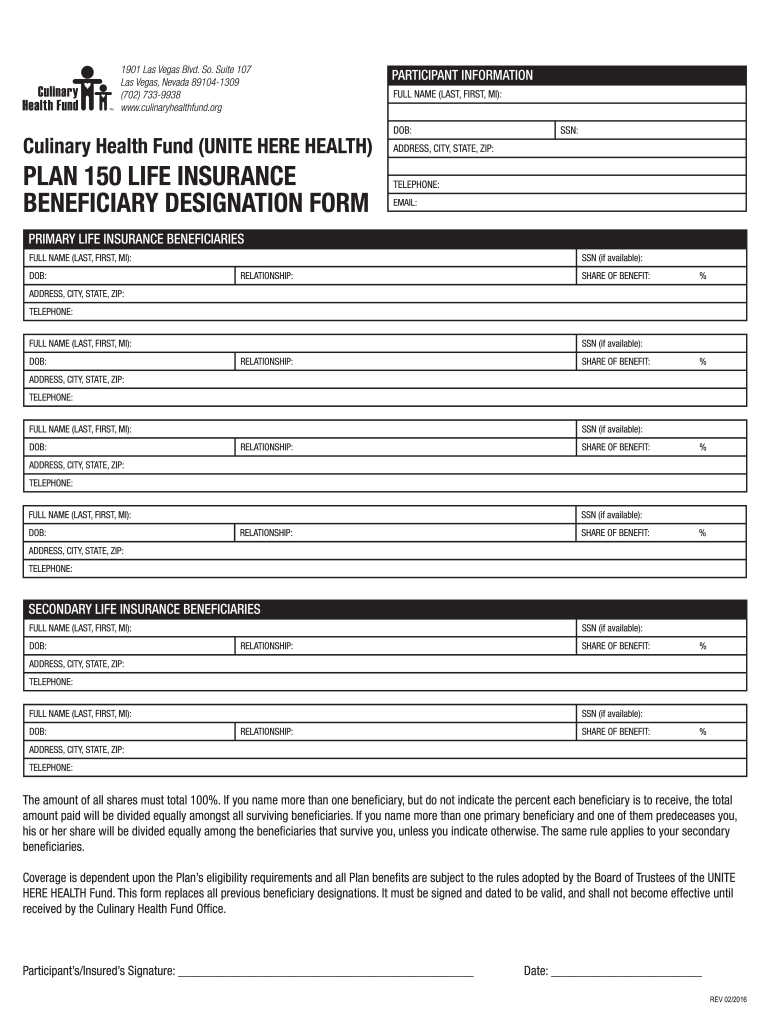

www.culinaryhealthfund.orgCulinary Health Fund (UNITE HERE HEALTH)PLAN 150 LIFE INSURANCE

BENEFICIARY DESIGNATION NONPARTICIPANT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign plan 150 life insurance

Edit your plan 150 life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your plan 150 life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

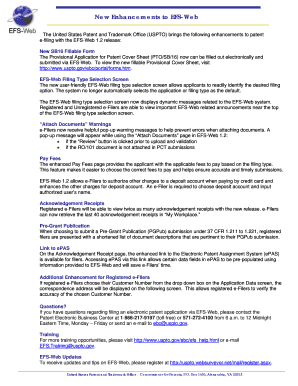

Editing plan 150 life insurance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit plan 150 life insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out plan 150 life insurance

How to fill out plan 150 life insurance

01

Gather all necessary information: To fill out plan 150 life insurance, you will need personal information such as your name, date of birth, address, and contact information. You may also need to provide details about your health, occupation, and financial situation.

02

Choose the policy: Select the plan 150 life insurance policy that suits your needs and budget. Consider factors such as coverage amount, premium payments, and any additional riders or benefits.

03

Fill out the application form: Complete the application form accurately and honestly. Provide all the required information, ensuring there are no mistakes or omissions.

04

Review and sign: Carefully review the filled-out application form to make sure all information is correct. Sign the form as required.

05

Submit the application: Send the completed application form along with any supporting documents to the insurance company. You may need to include a payment for the first premium.

06

Wait for approval: The insurance company will review your application and make a decision. They may request additional information or medical examinations if needed.

07

Receive the policy: If your application is approved, you will receive the plan 150 life insurance policy. Read it thoroughly and keep it in a safe place for future reference.

Who needs plan 150 life insurance?

01

Plan 150 life insurance is typically suitable for individuals who want a relatively low-cost life insurance option with a specific coverage amount. Here are some people who may benefit from this type of insurance:

02

- Young adults starting their careers and looking for basic life insurance coverage

03

- Individuals with limited financial resources who still want to protect their loved ones with a reasonable death benefit

04

- Those who have dependents or financial obligations and want to ensure their family's financial stability in case of their untimely demise

05

- People who cannot afford higher premium payments but still want some level of life insurance protection

06

- Individuals who are generally healthy and do not require extensive medical underwriting for coverage

07

It's important to review the terms and conditions of plan 150 life insurance and compare it with other insurance options to determine if it meets your specific needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my plan 150 life insurance in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your plan 150 life insurance and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I execute plan 150 life insurance online?

Filling out and eSigning plan 150 life insurance is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I edit plan 150 life insurance on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute plan 150 life insurance from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is plan 150 life insurance?

Plan 150 life insurance is a specific type of life insurance policy designed to provide financial security for the insured's beneficiaries, typically with a focus on affordable premiums and tailored coverage options.

Who is required to file plan 150 life insurance?

Individuals or businesses that have opted for Plan 150 life insurance coverage and need to report their policy details to the relevant regulatory authority are required to file.

How to fill out plan 150 life insurance?

To fill out Plan 150 life insurance, individuals need to gather personal information, details about their beneficiaries, and specific policy terms, then complete the appropriate forms provided by the insurance company.

What is the purpose of plan 150 life insurance?

The purpose of Plan 150 life insurance is to provide financial protection to beneficiaries in the event of the insured's death, ensuring that their financial needs are met.

What information must be reported on plan 150 life insurance?

The information that must be reported includes the policyholder's details, the coverage amount, names of beneficiaries, and any relevant health information.

Fill out your plan 150 life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Plan 150 Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.