Get the free Self directed ira adoption agreement - Vector Asset Management

Show details

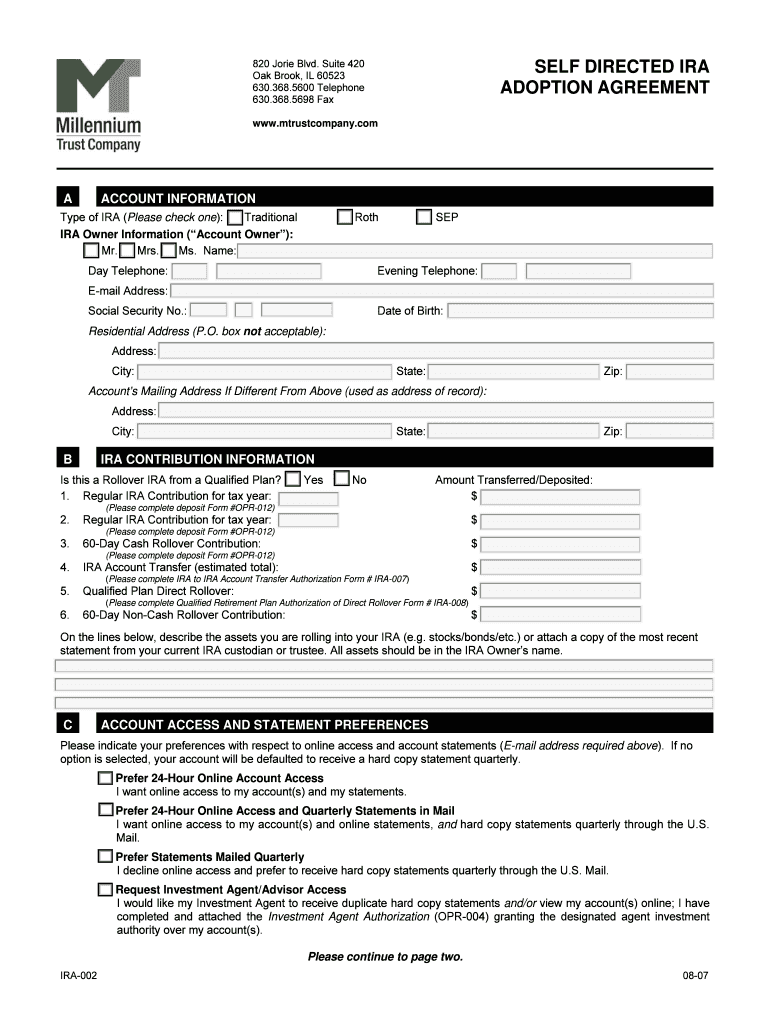

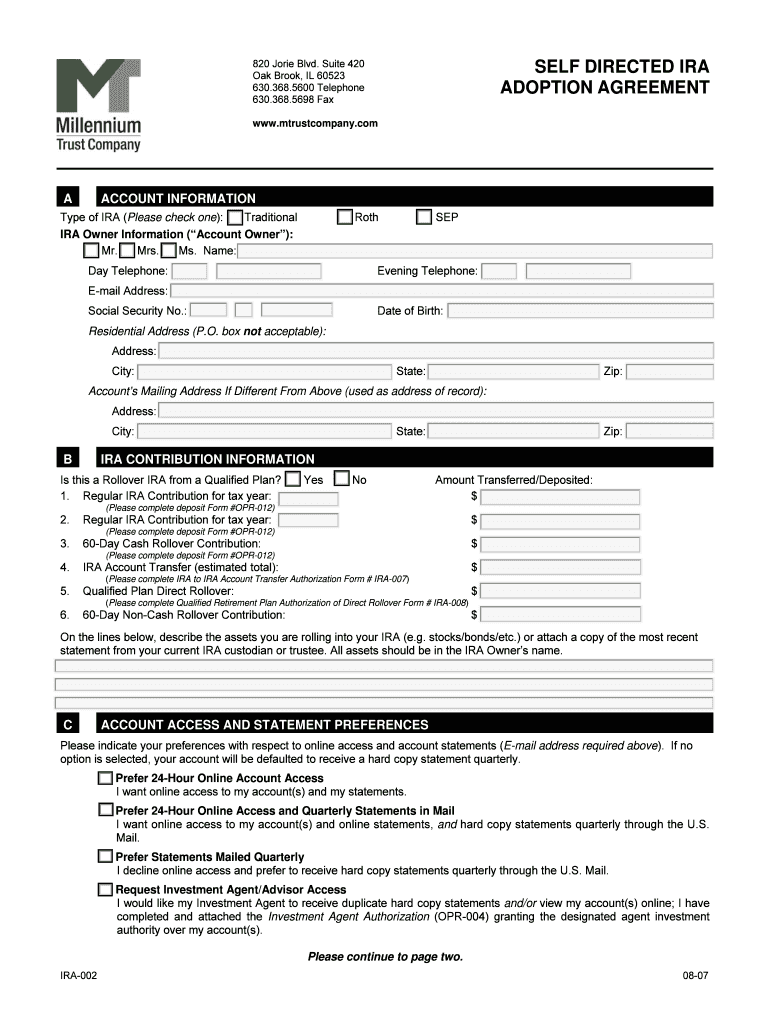

820 Jorge Blvd. Suite 420 Oak Brook, IL 60523 630.368.5600 Telephone 630.368.5698 Fax SELF DIRECTED IRA ADOPTION AGREEMENT www.mtrustcompany.com A ACCOUNT INFORMATION Type of IRA (Please check one):

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self directed ira adoption

Edit your self directed ira adoption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self directed ira adoption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self directed ira adoption online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit self directed ira adoption. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self directed ira adoption

How to fill out self directed ira adoption:

01

Research and choose a self-directed IRA custodian or administrator. This is the company that will hold and manage your self-directed IRA funds. Make sure to review their fees, customer reviews, and reputation.

02

Contact the chosen custodian or administrator and request the necessary paperwork to open a self-directed IRA. This may include an application form, account agreement, beneficiary designation form, and any required supporting documentation.

03

Carefully review and complete all the required paperwork. Provide accurate and up-to-date information to avoid any delays or errors in the adoption process. If you have any doubts or questions, don't hesitate to contact the custodian or administrator for assistance.

04

Consider consulting with a financial advisor or tax professional to ensure you understand the implications and potential tax benefits of adopting a self-directed IRA. They can provide valuable guidance on investment options, contribution limits, and any tax strategies that may be applicable to your situation.

05

Once you have completed the paperwork, submit it to the self-directed IRA custodian or administrator as instructed. Ensure that you include any necessary supporting documentation, such as identification documents or proof of income if required.

06

Wait for confirmation from the custodian or administrator regarding the successful adoption of your self-directed IRA. This may involve receiving an account number, login credentials, or other relevant information. Keep this information in a safe place for future reference.

Who needs self-directed IRA adoption?

01

Individuals who want more control over their retirement investments. With a self-directed IRA, you have the flexibility to invest in a wide range of assets such as real estate, private equity, cryptocurrency, precious metals, and more.

02

Investors who are comfortable conducting independent research and due diligence. Self-directed IRA adoption requires investors to take an active role in managing their investments, as they will be responsible for evaluating and selecting suitable assets.

03

Those looking to diversify their retirement portfolio. By investing in alternative assets through a self-directed IRA, individuals can potentially reduce their exposure to traditional stocks and bonds, thus spreading risk across different asset classes.

04

Investors who are willing to put in the time and effort to educate themselves about the rules and regulations surrounding self-directed IRAs. It's crucial to fully understand the IRS guidelines and any restrictions on certain types of investments to avoid penalties or disqualifying transactions.

In conclusion, filling out a self-directed IRA adoption involves researching and selecting a custodian, completing the necessary paperwork, seeking professional advice if needed, and submitting the completed forms to the custodian. Self-directed IRA adoption is suitable for individuals who seek more control and flexibility over their retirement investments, are willing to conduct independent research, want to diversify their portfolio, and are willing to educate themselves about the rules and regulations involved.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit self directed ira adoption from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your self directed ira adoption into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send self directed ira adoption to be eSigned by others?

When your self directed ira adoption is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for signing my self directed ira adoption in Gmail?

Create your eSignature using pdfFiller and then eSign your self directed ira adoption immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is self directed ira adoption?

Self directed IRA adoption refers to the process of establishing and funding a self-directed Individual Retirement Account (IRA), where the account owner has more control and flexibility in choosing investments.

Who is required to file self directed ira adoption?

Any individual who wants to open a self-directed IRA and take advantage of the benefits it offers is required to file self directed IRA adoption.

How to fill out self directed ira adoption?

To fill out self directed IRA adoption, individuals need to contact a financial institution that offers self-directed IRAs, complete the necessary paperwork, and fund the account with eligible contributions.

What is the purpose of self directed ira adoption?

The purpose of self directed IRA adoption is to provide individuals with the opportunity to invest their retirement savings in alternative assets beyond traditional stocks, bonds, and mutual funds.

What information must be reported on self directed ira adoption?

The self directed IRA adoption form typically requires information such as the account owner's personal details, the chosen investments, contribution amounts, and beneficiary information.

Fill out your self directed ira adoption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self Directed Ira Adoption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.