Get the free 8937 - Audax Credit BDC

Show details

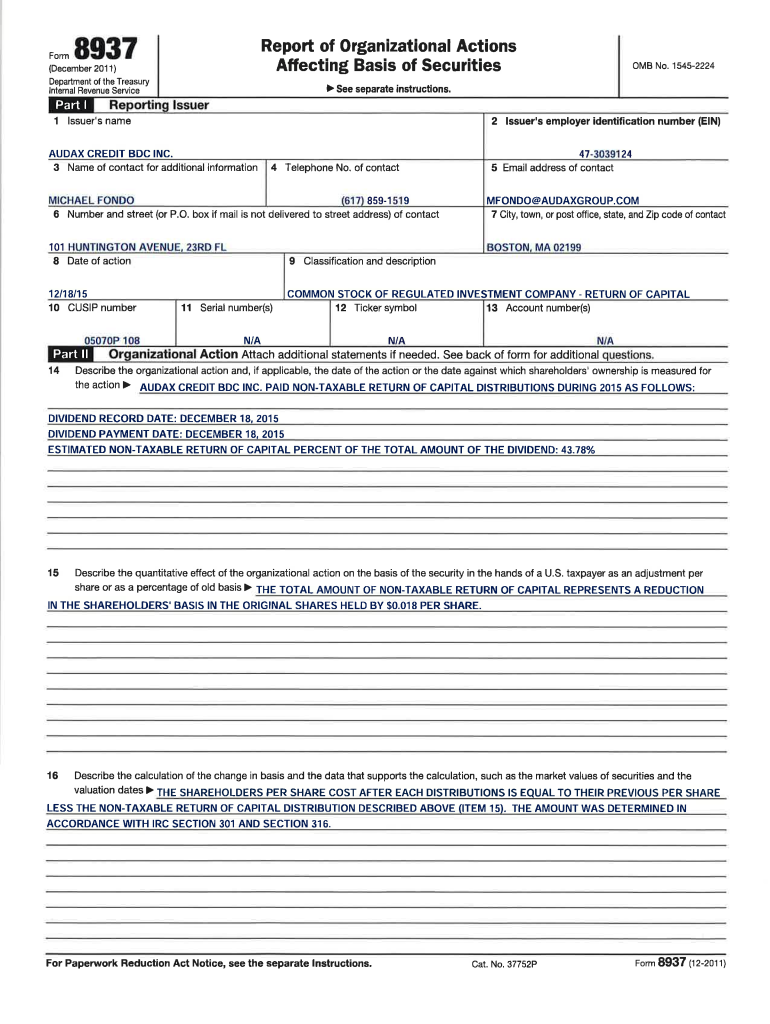

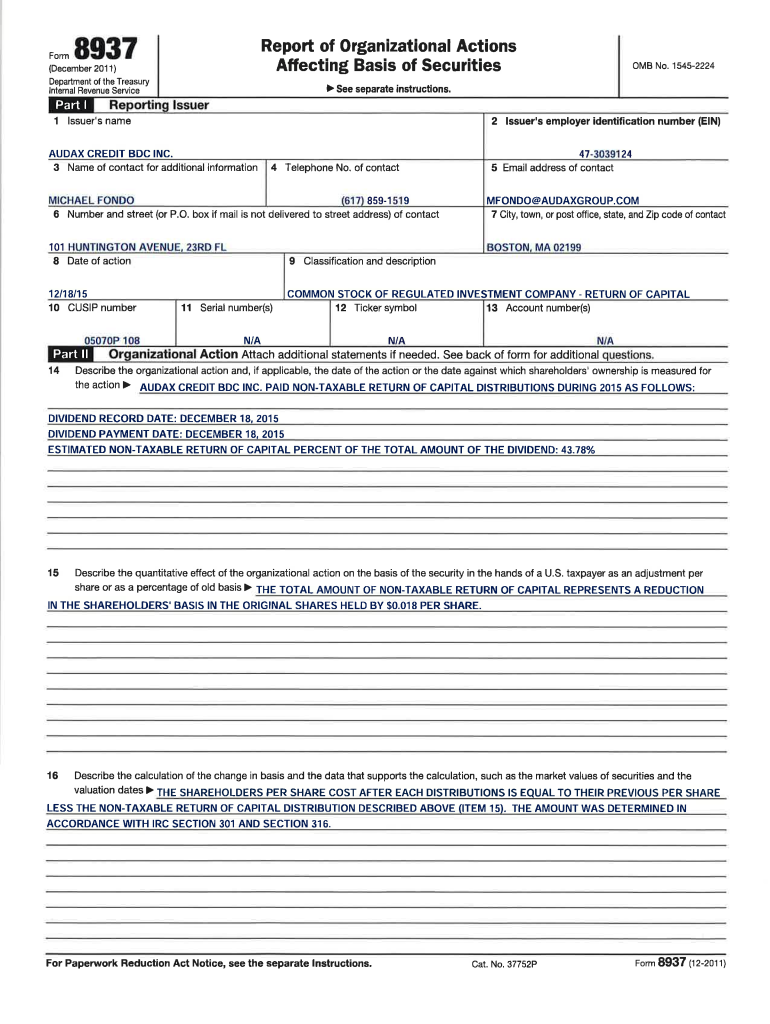

Report of Organizational Actions Affecting Basis of Securities, “,8937 (December 201 1) Department of the Treasury internal Revenue ServicePart1 See separate instructions, Issuer's nameAUDAX CREDIT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 8937 - audax credit

Edit your 8937 - audax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 8937 - audax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 8937 - audax credit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 8937 - audax credit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 8937 - audax credit

How to fill out 8937 - audax credit

01

To fill out Form 8937 - Audax Credit, follow these steps:

02

Begin by entering the name of the issuer of the underlying security or properties that are the subject of the transaction.

03

Next, provide the name of the issuer of the instrument, if different from step 1.

04

Specify the date of the transaction, including the month, day, and year.

05

Enter the CUSIP number of the instrument, if available.

06

Indicate the type of transaction being reported, such as an acquisition, disposition, change in tax status, or correction of a prior Form 8937.

07

Provide a brief description of the transaction and the nature of the underlying instrument.

08

For each applicable category, report the amount, type, and tax basis of the instrument that is subject to the transaction.

09

Attach any supporting documentation that provides additional details or evidence of the transaction.

10

11

Please note that this is a general overview. It is recommended to consult the official instructions provided by the IRS for Form 8937 - Audax Credit for detailed guidance on filling out the form.

Who needs 8937 - audax credit?

01

Form 8937 - Audax Credit is typically needed by issuers of financial instruments or securities who are required to report certain transactions to the Internal Revenue Service (IRS). This form is specifically used to report organizational actions that affect the tax basis of the instrument, such as acquisitions, dispositions, changes in tax status, or corrections of prior reports.

02

Issuers who have experienced such transactions may need to fill out Form 8937 - Audax Credit to comply with IRS regulations and provide documentation and details regarding the transaction. It helps ensure accurate reporting of the tax basis and aids in determining any potential tax liabilities or benefits associated with the transaction.

03

Ultimately, issuers who have undergone relevant organizational actions are the ones who typically need to complete Form 8937 - Audax Credit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 8937 - audax credit online?

The editing procedure is simple with pdfFiller. Open your 8937 - audax credit in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit 8937 - audax credit in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing 8937 - audax credit and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit 8937 - audax credit on an Android device?

The pdfFiller app for Android allows you to edit PDF files like 8937 - audax credit. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is 8937 - audax credit?

Form 8937, the 'Status of Certain Financial Transactions,' is used to report the failure to satisfy the conditions of a qualified payment under the Internal Revenue Code, specifically associated with the audax credit.

Who is required to file 8937 - audax credit?

Entities that have made certain financial transactions or had corporate actions affecting tax liabilities must file Form 8937 to report the relevant information.

How to fill out 8937 - audax credit?

To fill out Form 8937, taxpayers need to provide comprehensive information regarding the nature of the transaction, the affected parties, the amount involved, and any relevant dates.

What is the purpose of 8937 - audax credit?

The purpose of Form 8937 is to disclose information to the IRS and affected shareholders about certain financial transactions or corporate actions that affect tax responsibilities.

What information must be reported on 8937 - audax credit?

Form 8937 requires details such as the date of the transaction, type of transaction, amount invested or paid, and any adjustments to basis related to the audax credit.

Fill out your 8937 - audax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

8937 - Audax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.